Chinese Money In Africa Directed Away From Oil, Toward Other Sectors

When Chinese Premier Li Keqiang visited Africa earlier this month, he stopped in four countries. Oil-rich Angola and Nigeria were first on the list, which makes sense as that’s where China has some of its biggest holdings. But he also stopped in Kenya and Ethiopia, countries not known for massive crude deposits, but appealing to China nonetheless as it switches investment focus from natural resources to manufacturing and services.

“The countries he [visited] are not only interesting for him because of natural resources, but because of the dramatic infrastructure development going on in these countries in which Chinese companies are actively involved in,” said Anna Rosenberg, sub-Saharan Africa analyst at consulting firm Frontier Strategy Group.

“It is a common misunderstanding that the Chinese are primarily in Africa for natural resources; investment is in fact primarily channeled into manufacturing, transport, real estate and construction,” she said, adding that Chinese companies are hoping to benefit from a rising consumer class in sub-Saharan Africa.

Initially, Chinese investments were mainly in natural resources like minerals and oil. Data from the Heritage Institute’s China Global Investment Tracker, which logs Chinese investments and contracts worldwide, shows that investments in the energy sector peaked in 2010 but have been diminishing since, in favor of sectors such as agriculture and transportation.

"Between 2003 and 2010, over half of China's foreign direct investment in Africa was in the oil sector," according to a 2013 report from the United States International Trade Organization. The biggest investors were Sinopec, China National Petroleum Group, China State Construction Engineering Corporation and China Metallurgical Group Corporation, which formed partnerships with state oil companies in Nigeria, Angola, Sudan, Egypt, Chad and Niger.

“China’s investments in Africa have become diversified in recent years. While oil and mining remain an important focus, Chinese foreign direct investment (FDI) has flooded into everything from shoe manufacturing to food processing,” wrote Harry Broadman, chief economist at PwC in a 2013 report.

Indeed, all eyes are on an upcoming $2 billion investment from the Huajian Group and other Chinese investors in a shoe manufacturing project that should employ more than 100,000 local workers in Ethiopia over the next 10 years.

During his Africa tour, Premier Li announced grand plans for Chinese-backed railroad projects in Kenya, adding to an already substantial investment from China-based firms in that sector as well.

“Chinese firms have also made major investments in African infrastructure, targeting key sectors such as telecommunications, transport construction, power plants, waste disposal and port refurbishment. Given the scale of Africa’s infrastructure deficit, these investments represent a vital contribution to the continent’s development,” wrote Harry Broadman, chief economist at PwC in a 2013 report,”

Broadman also cited a $600 million Chinese hydroelectric project in Zambia, hotels in South Africa and Botswana, and $400 million worth of cell phone service contracts for Chinese telecom giant Huawei in Kenya, Zimbabwe and Nigeria as examples of diversified Chinese investment.

The sub-Saharan economy as a whole is set for average economic growth of roughly 5 percent, with a growing middle class and educated youth population, which makes for an incredible investment opportunity.

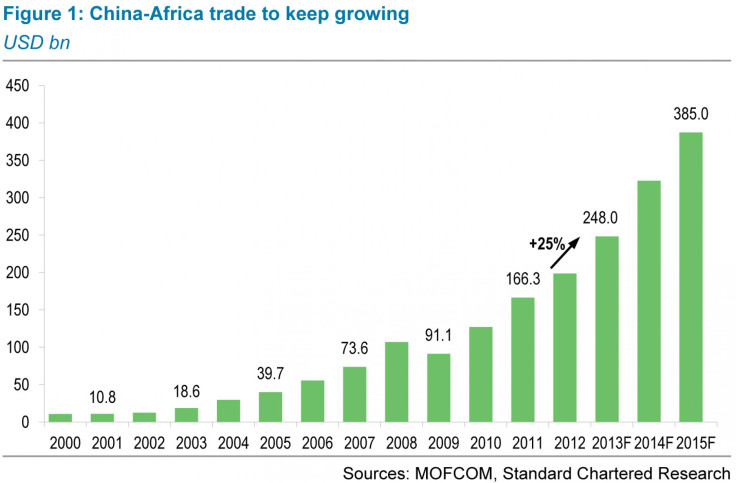

"It is fair to say with the long-term engagement expected between China and Africa, we are seeing more sectors engaging in trade as the relations strengthen,” said Ravinder Sikand, director at Deloitte in Nairobi.

© Copyright IBTimes 2025. All rights reserved.