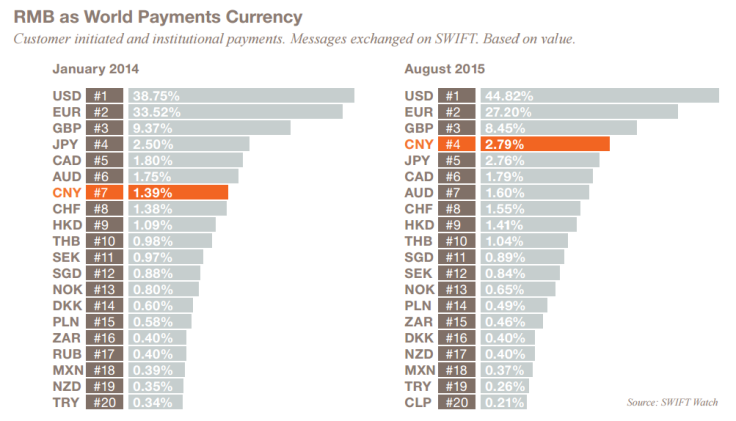

Chinese Yuan Is Now Fourth Most Common Global Payment Currency, Behind US Dollar, Euro, British Pound

The yuan has now surpassed the Japanese yen to become the fourth most used currency after the U.S. dollar, euro and British pound, the global transaction services organization SWIFT said on Tuesday. The move represents a step forward in Beijing’s aim to make the yuan a dominant global currency.

The world’s payments are still largely made in the U.S. dollar and the euro, but the yuan’s rapid ascent has seen it surpass the Hong Kong dollar, the Canadian dollar, the Australian dollar and four other currencies since 2012.

SWIFT said the yuan represented a record high 2.79 percent of all global payments, up from 0.6 percent at the start of 2013. Ten countries used the yuan for more than 90 percent of yuan-denominated global transactions in August. Singapore and the United Kingdom processed 46 percent of all yuan-denominated global payments.

More than about 1,700 financial institutions processed yuan payments in August, 14 percent more than in August 2014. Yuan-based foreign exchange transactions increased 20 percent in August compared with July after Beijing devalued its currency by nearly 2 percent to boost export activity.

The yuan may fall further as China seeks to spur economic activity. David Woo, Bank of America’s head of global rates and currencies research, told Bloomberg News on Monday that the yuan could lose as much as 10 percent of its value.

“Letting the currency go is going to be part of a package of monetary easing, let’s call it Chinese quantitative easing,” said Woo, referring to the unconventional policy where a central bank buys financial assets to release more of its currency into the economy, thus devaluing it.

© Copyright IBTimes 2024. All rights reserved.