Chipmaker Intel's Revenue Beats Wall Street Expectations

Intel Corp (INTC.O) reported better-than-expected quarterly profit and revenue as strong performance in its data center and Internet-of-Things businesses more than made up for continued weak demand for its chips used in personal computers.

Shares of the world's largest chipmaker rose marginally in after-market trading on Tuesday. The company also cut its 2015 capital expenditure for the third time to $7.3 billion, plus or minus $500 million.

Intel had previously forecast capital expenditure of $7.7 billion, plus or minus $500 million. The company said it expected fourth-quarter revenue of $14.8 billion, plus or minus $500 million. The midpoint of the range is a marginal increase from a year earlier.

Analysts on average were expecting revenue of $14.83 billion, according to Thomson Reuters I/B/E/S.

Revenue from the data center business, its second largest, jumped nearly 12 percent to $4.14 billion in the third quarter, as increased adoption of cloud services spurred demand for the company's chips.

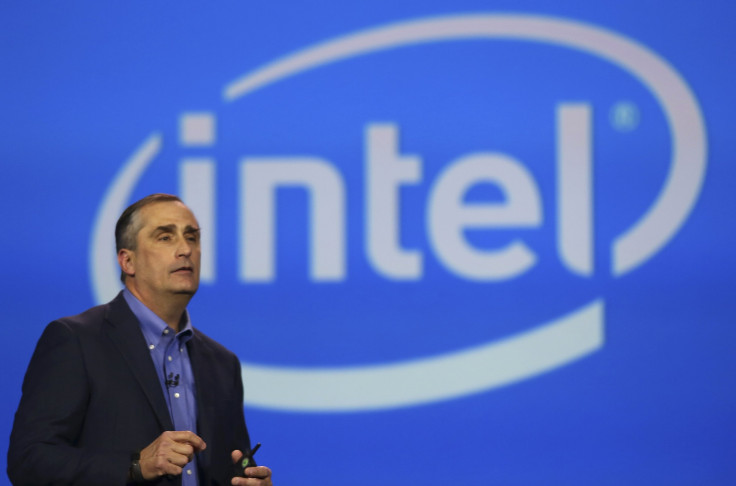

Under Chief Executive Brian Krzanich, Intel has been expanding beyond chips for PCs, the company's mainstay. The company agreed in June to acquire Altera Corp (ALTR.O) for $16.7 billion to expand its line-up of higher-margin chips used in data centers.

Intel said revenue from its PC business, its largest, fell 7.5 percent to $8.51 billion in the third quarter ended Sept. 26.

Worldwide shipments of personal computers fell 7.7 percent to 73.7 million units in the third quarter, according to research firm Gartner.

Intel's net income fell to $3.11 billion, or 64 cents per share, from $3.32 billion, or 66 cents per share, a year earlier.

Analysts on average had expected a profit of 59 cents per share.

Net revenue declined to $14.47 billion from $14.55 billion, but beat analysts' estimate of $14.22 billion.

The company's shares closed at $32.04 on the Nasdaq on Tuesday.

(Reporting by Anya George Tharakan in Bengaluru; Editing by Sriraj Kalluvila)

© Copyright Thomson Reuters 2024. All rights reserved.