Crude Oil Price Skid Isn’t Lubricated By Supply And Demand, Bank for International Settlements Says

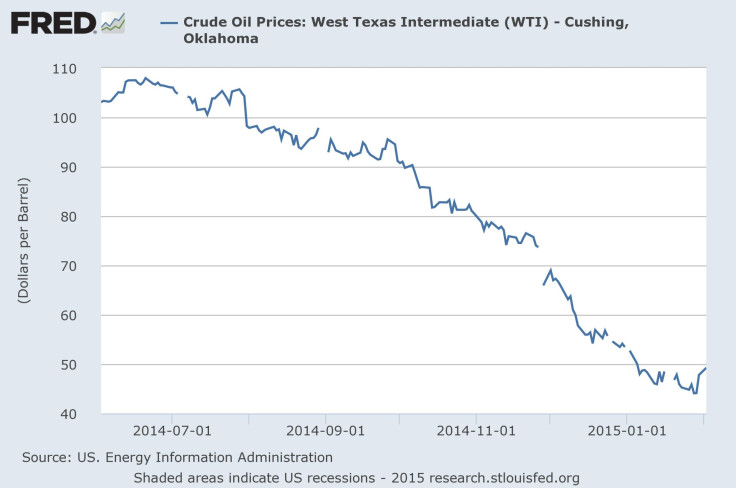

A big boost in debt in the crude-oil industry may be a more important factor than supply-and-demand issues are in the collapse of the commodity’s pricing during the past eight months, the Bank for International Settlements, or BIS, indicated in a report Saturday. U.S. benchmark crude’s price per barrel was $107.95 June 20, according to Federal Reserve Economic Data, or FRED. And its comparable price was $51.69 Friday, based on the March 2015 futures settlement at the CME Group. To put these figures in their proper perspective, the price has plummeted -$56.26, or -52.12 percent.

“Changes in production and consumption seem to fall short of a fully satisfactory explanation of the abrupt collapse in oil prices,” the BIS reported. “The last two episodes of comparable oil price declines (1996 and 2008) were associated with sizable reductions of oil consumption and, in 1996, with a significant expansion of production. This seems to be in stark contrast to developments since mid-2014, during which time oil production has been close to prior expectations and oil consumption has been only a little weaker than forecast.”

Called a central bank for central banks, the BIS has company in its assessment that commodity crude-oil prices have not plunged simply because of changes in the balance between supply and demand. Abdullah al-Badri, the secretary general of the Organization of the Petroleum Exporting Countries, or OPEC, said in December, “The fundamentals should not lead to this dramatic reduction [in prices].”

“[T]he steepness of the price decline and very large day-to-day price changes are reminiscent of a financial asset,” the BIS reported. “As with other financial assets, movements in the price of oil are driven by changes in expectations about future market conditions. In this respect, the recent OPEC decision not to cut production has been key to the fall in the oil price.”

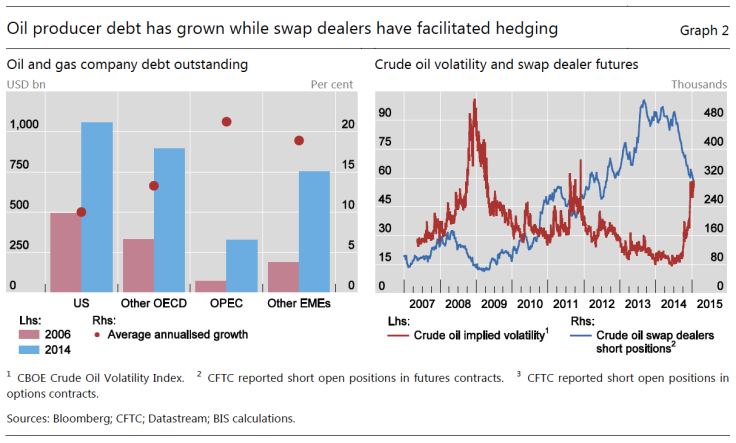

However, the BIS suggested the OPEC decision has not been the only driver of crude prices since the middle of 2014: “One important new element is the substantial increase in debt borne by the oil sector in recent years. The greater willingness of investors to lend against oil reserves and revenue has enabled oil firms to borrow large amounts in a period when debt levels have increased more broadly.”

As a result, the BIS said: “The greater debt burden of the oil sector may have influenced the recent dynamics of the oil market by exposing producers to solvency and liquidity risks. Lower prices tend to reduce the value of oil assets that back the debt. Indeed, spreads on energy high-yield bonds widened from a low of 330 basis points in June 2014 to over 800 basis points in January.”

The crude-oil industry debt explosion between 2006 and 2014 was documented by the BIS in its report, as shown by the above chart. “Against this background of high debt, a fall in the price of oil weakens the balance sheets of producers and tightens credit conditions, potentially exacerbating the price drop as a result of sales of oil assets (for example, more production is sold forward),” the organization reported.

The BIS also mentioned currency-exchange rates collectively as a driver of the major price move made in what is still mostly a U.S. dollar-denominated commodity: “An additional factor that may amplify the oil price decline is that many oil firms located outside the United States have nevertheless borrowed in U.S. dollars.”

Meanwhile, the BIS reported: “[O]il firms in emerging market economies (EMEs) have seen the steepest increases in debt. If a stronger dollar were to be accompanied by more stringent financial conditions, then EME oil firms, which have increased borrowing significantly, could be particularly adversely affected.”

Based on the BIS analysis and OPEC’s stance on maintaining its output, there appears to be little reason to believe crude prices will fall a great deal more or rise a great deal more, at least in the short term.

© Copyright IBTimes 2025. All rights reserved.