Cypherpunk Economics: What Monero Reveals About The Equifax Breach

Most cryptocurrency prices temporarily plummeted this week after JPMorgan Chase CEO Jamie Dimon called bitcoin a fraudulent bubble as rumors of regulatory crackdown circulated in China. As of Friday, bitcoins are selling for a little over $3,000 a pop, according to CoinMarketCap, which is roughly $1,500 less than last week’s price. Most experts don’t worry about these media-fueled fluctuations. The cryptocurrency market overall continues taking two giant leaps forward, then one small step back from time to time. Meanwhile, at least one leading cryptocurrency is having a particularly good month: The privacy centric token monero.

Bloomberg reported the San Francisco-based hedge fund MetaStable Capital has seen 100-fold returns since it recently invested in monero. Monero currently has a global market cap over $1.2 billion. There are other cryptocurrencies with a likeminded focus on anonymity and security, such as zcash and dash. Dash, in particular, is working on several developments to make it easier for average folks to use cryptocurrency, such as a cryptocurrency debit card connected to a user-friendly mobile wallet app. However, monero’s technology and ethos are both fundamentally different from its competitors. It offers one of the market’s clearest examples of cypherpunk philosophy in action.

Want to know what decentralized economics looks like in the real world? Meet monero.

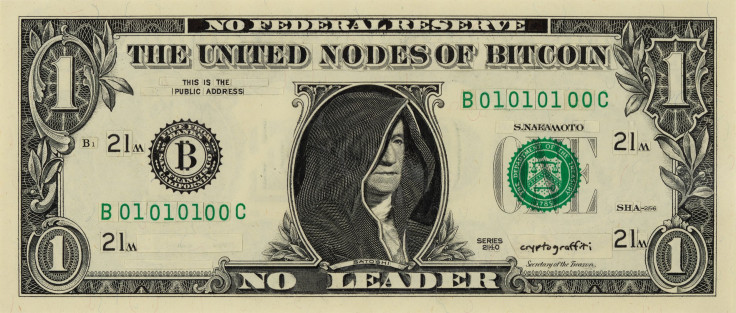

Once upon a time, there was an anonymous internet sleuth who wondered if blockchain currencies, like bitcoin, could create universal trust without sacrificing individual privacy. Much like bitcoin’s elusive creator, Satoshi Nakamoto, we still don’t really know who invented monero’s underlying concept and launched the preliminary bitmonero in 2014. It was open source and quickly became a community project, another similarity it shares with bitcoin.

Riccardo 'Fluffypony' Spagni, monero’s South African co-founder, stumbled across bitmonero through a friend who loves alternative coins and immediately started mining it when bitmonero first launched. At the time, Spagni was a pretty typical bitcoin enthusiast and cryptocurrency miner. There was no master plan. He was just making a little money on the side.

Within a few weeks, bitmonero’s anonymous creator divulged plans to merge bitmonero with another cryptocurrency. The budding bitmonero community rejected this plan and revolted. Miners voted among themselves. Debates raged across forums. It was a historic real-world test for the blockchain community’s cypherpunk philosophy. It showed how diverse people can build lucrative technology together and make decisions without any organizational body or sense of exclusive ownership.

“This is the first time anyone like this, in any [crypto] community, sort of ignored what the community wants and decided to do their own thing. So myself and six others decided we were going to fork the project from him,” Spagni told International Business Times. “And the community followed us...the seven of us ended up as stewards of an altcoin.”

The new lead developers didn’t know each other. They lived in different countries. They had no plans to get rich together or promote their careers in any traditional sense. Unlike zcash or Ethereum, there is no nonprofit foundation to guide monero as it grows. This is as grassroots as it gets, a blockchain network run by independent volunteers and donations. Monero users rely on organizations like the Software Freedom Law Center and the new academic Monero Research Lab when the faceless group needs official representation.

Sometimes, it’s easy to dismiss bullish claims about the future of cryptocurrency as naively idealist. Compared to the current system, ruled by governments and corporations, it’s hard to imagine the nitty-gritty of economics beyond capitalism. Then along came Monero, the masked cowboy of the blockchain ecosystem’s Wild West. The technological differences between monero and competitors like zcash show there are many, many ways to make a reliable cryptocurrency.

Monero’s stealth addresses and shielded transactions are a work of cryptographic art. Instead of giving someone an address, like bitcoin, monero offers gateway public keys. “You do something called a key exchange, with their keys and your keys, and get these shared secrets,” Spagni explained. “You take the shared secrets and create this cool little piece of cryptography by attaching it to a random value, so only they can decrypt it.”

Imagine this kind of like a treasure map or secret message written in invisible ink on the back of a closed locker. First, you need the keys just to get the locker open. To a random observer, the locker would look empty. But your shared secret acts like a special blacklight flashlight, revealing invisible markings in a language only you know. All of this still doesn’t show you the other person’s accounts or identity. It only creates a private drop off point for encrypted messages.

“To an observer, looking at the blockchain, it only looks like it’s going to random destinations,” Spagni said. Unlike bitcoin and Ethereum, there’s no transparency about the total amount of money sent or where it goes. And this is only the start.

In addition to hiding transaction values, monero also uses ring signatures. “Stealth addresses prevent someone from seeing where transactions are going to. Ring signatures hide where transactions are coming from,” Spagni said. Monero scatters transactions as if the network grabbed a handful of rice and threw it in the air. An observer could hardly identify which transaction belongs to a particular account.

Scaling is still a huge issue for most blockchain networks, and monero is no exception. Spagni told IBT monero is preparing for the Lightning Network, a well-tested scaling solution already used by litecoin, in addition to subaddresses for increased privacy while converting to other digital currencies on platforms like ShapeShift. At the same time, monero co-founder Francisco Cabañas, a retired mathematician in Canada with a PhD in physics, spends his time researching the cryptographic mechanics fueling monero’s network.

Cabañas believes monero avoided the bulk of bitcoin’s scaling issues with something called a permanent block reward. “Now you always have an incentive for miners to mind the blocks,” Cabañas told IBT. “We can make the block size scale as long as people are willing to pay for it...you don’t have to restrict the block size in order to secure the coin.”

In short, monero's community ethos shows how a decentralized currency works with minimal organization and official governance. It turns out, there's no need to sacrifice privacy on the altar of trust. There are plenty of reasons why someone might want a transparent transaction via bitcoin, Ethereum or even just an old school credit card. But it's now clear there are also other possibilities.

In the future, cryptocurrency could eliminate the risk of security problems like the Equifax data breach. Since cryptocurrencies are decentralized, there's no single pool of sensitive information. As for individual credit, blockchain networks automatically do all the verifications currently done by accident-prone third parties. There's no need for an external credit report.

Looking forward, monero's founders want it to become an epicenter for online privacy and cypherpunk experiments. The community already crowdfunds monero to support developers and research projects. “My long term vision for the space is for monero to become a privacy hub,” Spagni said. “We’ll provide them with a home, a support system, legal assistance, funding and resources.”

Currency is only as powerful as the people behind it, regardless of figureheads and organizational clout. Shifting trust from credit reports to blockchain networks may be as simple as showing people the sheer diversity of unlocked doors.

© Copyright IBTimes 2024. All rights reserved.