Decades Of Life Left In North Dakota Bakken Crude Oil Shale, Petroleum Producer President Says

The president of top U.S. petroleum liquids producer Continental Resources, Inc. (NYSE: CLR), Rick Bott, insisted that there are decades of life remaining in North Dakota’s Bakken shale oil formation alone.

“There is a steep decline” in the Bakken, Bott said Tuesday at the IHS CERA Week energy summit in Houston, “but then there is a very, very long tail. You get flush production, but it’s the tail you really count on.”

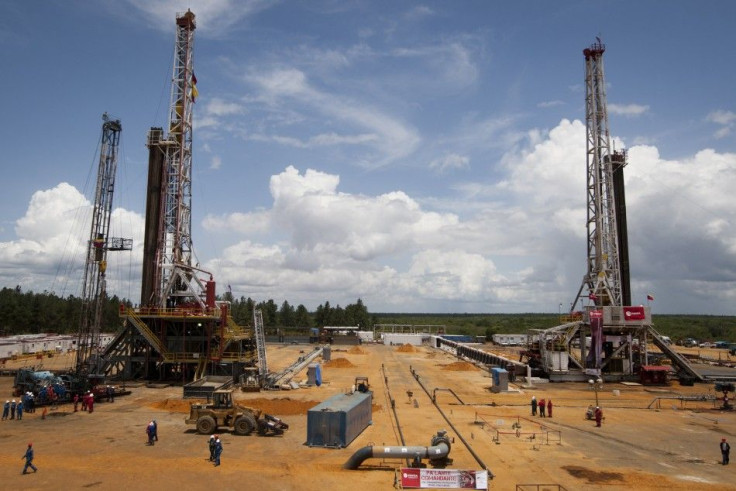

The hydraulically-fractured wells in the Bakken oil fields have had outsize production in their first year but now face steep drop-offs.

Bott said that the industry can expect to extract about 32 billion barrels more, or three decades of growth, even at the current 3.5 percent recovery rate.

Continental Resources, which is based in Oklahoma City, grew its production to 49.6 million barrels last year, largely from North Dakota’s Bakken, the largest domestic oil find since Prudhoe Bay in the 1960s and where the company is the No. 1 leaseholder. That’s a production increase of 35 percent.

The company is on track to triple its oil production from its 2012 levels by 2017.

© Copyright IBTimes 2025. All rights reserved.