December FOMC Minutes Show Support For QE Tapering, But Stress Further Reduction ‘Not On A Preset Course’

The minutes from the Dec. 17-18 meeting of the U.S. Federal Open Market Committee, after which the central bank announced its plan to reduce monthly asset purchases by $10 billion to $75 billion, showed that many members wanted to “proceed cautiously” in the first cut to QE and that further reductions should be undertaken in “measured steps.”

“Most participants saw a reduction in the pace of purchases as appropriate at this meeting," the minutes said. But some of the 10 voting policymakers “expressed concern about the potential for an unintended tightening of financial conditions if a reduction in the pace of asset purchases was misinterpreted as signaling that the committee was likely to withdraw policy accommodation more quickly than had been anticipated.”

The meeting minutes included the results of a survey of officials about the costs and benefits of the QE program. The survey found that “a majority of participants judged that the marginal efficacy of purchases was likely declining as purchases continue.”

Policymakers also wanted to stress to the public that further reductions were "not on a preset course" and would depend on progress in the labor market and on inflation, as well as on how well the program was judged to work in the months ahead.

“If the Fed’s and our outlook for the U.S. economy is realized, the FOMC will gradually reduce asset purchases further at upcoming meetings and begin preparations for the eventual interest rate tightening cycle,” two Barclays analysts said in a note published Wednesday.

They expect the Fed to reduce the pace of purchases by $10 billion per meeting through September, split equally between Treasuries and mortgage-backed securities, and to take a final $15 billion step down at the October meeting.

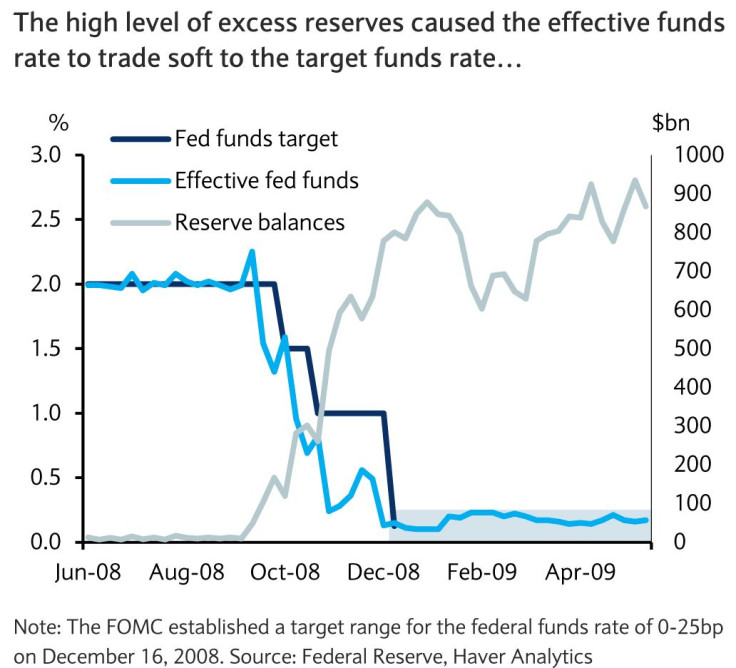

Since late 2008, the increase in the level of excess reserves has distorted activity in short-term interest rate markets and probably impaired the Fed’s ability to control interest rates as precisely as it would desire, according to Barclays. By the time QE3 is completed, there will be an estimated $3 trillion in excess reserves.

The Fed will likely have to drain $2 trillion in excess reserves in an effort to stabilize short-term interest rates when it decides to tighten monetary policy, according to Barclays economist Michael Gapen and short-term market strategist Joseph Abate. They projected each $100 billion drop in excess reserves will raise the rates in the federal funds and repurchase agreement markets by 1 basis point.

“Altogether, we estimate that the Fed will need to absorb more than $2.0 trillion in bank reserves to remove softness in the fed funds and repo rates, as well as improve connectivity between short-term rates,” Gapen and Abate said.

The overnight fed funds rate ended Tuesday at 0.07 percent, while the overnight repo rate closed at 0.04 percent. The Fed's target range on the fed fund rates has been zero to 0.25 percent since December 2008.

Yellen’s Fed

The U.S. Senate on Monday voted 56 to 26 to approve Janet Yellen as the next Fed chair, after Ben Bernanke finishes his second term at the end of this month. Yellen, 67, has been the Fed's second-in-command since 2010. She is the first woman to lead the Fed in its 100-year history.

As Bernanke’s successor, Yellen will face challenges including managing the process of ending quantitative easing, as well as deciding when and how to ease off short-term interest rates.

Her first meeting as chair is scheduled for March 18-19.

© Copyright IBTimes 2024. All rights reserved.