Donald Trump's Tax Plan: When Will It Be Released And What Will It Look Like?

In the 24 hours since President Donald Trump sent tax preparation service H&R Block’s (HRB) shares tumbling with an offhand comment on his tax plan, Republicans on Capitol Hill and Trump himself showed signs of a delay in the proposal's rollout until at least the spring.

The president predicted his reform of the nation’s tax code would begin in early March, Guardian reporter Ben Jacobs pointed out during a press conference Trump held Thursday afternoon.

Trump now says tax reform is coming in early March

— Ben Jacobs (@Bencjacobs) February 16, 2017

But Politico cited “Republicans” speaking “behind the scenes” as saying they’d prefer Trump stall the release of his tax plan since a premature piece of legislation might get rejected and rewritten multiple times before it is approved, and Americans shouldn't expect to see the transformation until summer.

In a Wednesday interview on MSNBC’s “Morning Joe,” House Speaker Paul Ryan, R-Wis., said Republicans were “actually on schedule” with plans to repeal the Affordable Care Act and streamline corporate, income and other taxes. But that schedule appeared to run a bit behind Trump's.

“We have to do Obamacare first,” Ryan said. “Spring and summer is tax reform. Winter and spring is Obamacare.”

In a Wednesday meeting with retail company chief executives, including Jo-Ann Stores Inc. CEO Jill Soltau and Best Buy Co. CEO Hubert Joly, Trump hinted at what his tax proposal might look like, sending H&R Block’s share price down in the process.

“We’re going to provide tax relief for families,” Trump said, according to a White House transcript. “We're going to simplify very greatly the tax code — it's too complicated. We're going to bring down the number of alternatives, and I think it's going to be just a much, much simpler tax code. In fact, H&R Block probably won't be too happy — that's one business that might not be happy with what we're doing. Other than H&R Block, I think people are going to love it.”

The tax service's shares fell nearly 60 cents, or more than 2.7 percent, to a low of $20.53 from $21.11, following the comment.

The new administration, Trump continued, would “lower the rates very, very substantially for virtually everybody in every category, including personal and business,” and make the tax code “good and simpler.”

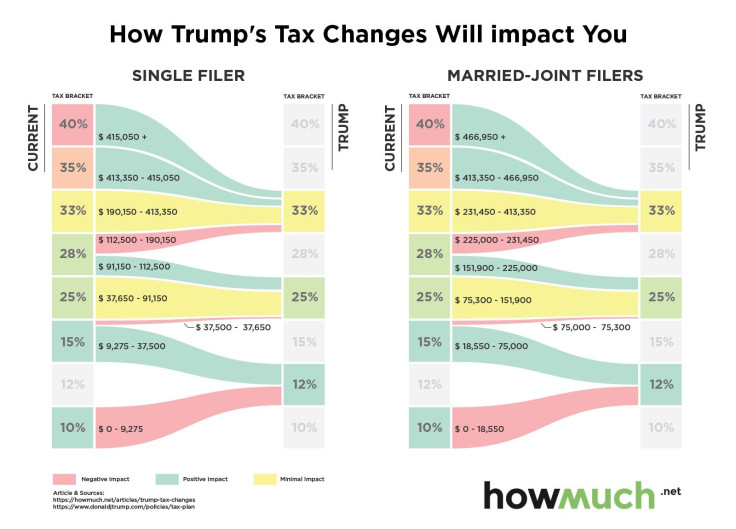

Vague notions aside, Trump campaigned on plans to lower the corporate tax rate to 15 percent from 35 percent, reduce the number of income brackets from seven to three — likely hurting low-income Americans in the process — and eliminate the estate tax, which gobbles up as much as 40 percent of an inheritance greater than $5.45 million for individuals and $10.9 million for couples.

© Copyright IBTimes 2024. All rights reserved.