Droughts In Brazil, West Africa And The US Are Hurting Commodities, But Experts Say It’s Only Temporary

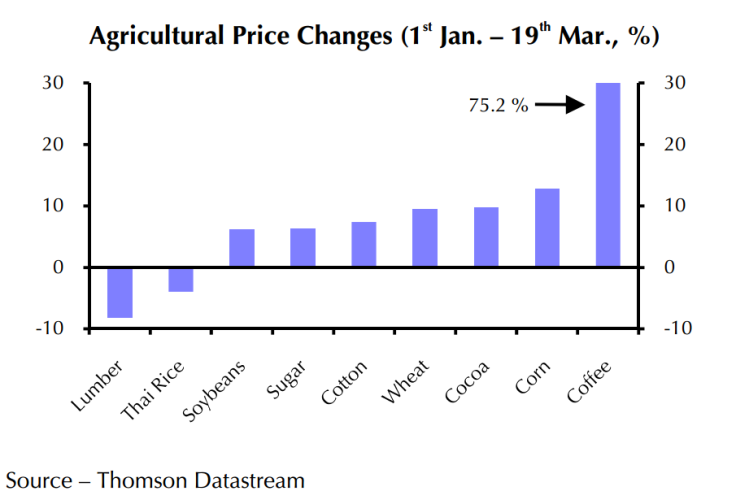

Agricultural commodities prices have been on the rise in 2014 thanks to droughts, disease and distress due to the conflict in Ukraine.

Brazilian coffee, American wheat and West African cocoa rates have reached strikingly high levels -- but economists say the situation isn’t permanent.

“We think that the sharp rise in agricultural prices since the beginning of the year is likely to be a spike rather the start of an upward trend,” Thomas Pugh, a commodities economist at Capital Economics, wrote in a note this morning.

“Past experience suggests that the market tends to factor in worst-case scenarios for bad weather, so there may well be some fall back in prices if the damage isn’t as bad as first feared,” Pugh said, citing recent rains in Brazil that could offset damage from January and December floods, which raised concerns about crop yields and sent coffee prices spiking.

For instance, the price of Arabica coffee is up more than 70 percent since the end of 2013. Brazil produces 35 percent of the global crop, which has been plagued by bad weather and disease.

Droughts in December and January have raised fears of low crop yields this year, which has brought up prices. Plus, a type of fungus called coffee rust has damaged more than 20 percent of the global supply, according to the Costa Rican Coffee Institute.

It’s even affecting the country’s economy.

“The drought in Brazil is pushing some food prices up, and some argue that weather effects have been behind the recent increase of 2014 inflation expectations to 6.11 percent from 6.01 previously,” analysts from Merrill Lynch Global Research wrote in a note.

Although Brazilian coffee has weathered worse storms before, “these pressures are likely to be much more muted than in 2007/2008 in our view, as slack is building in many economies,” they added.

In the U.S., a devastating drought continues to decimate western states, sparking fears of low crop yields.

California is hit the hardest, and it will record its third-driest winter on record, and its warmest winter ever, too, according to the U.S. Department of Agriculture's weekly weather and crop bulletin.

Yesterday, wheat futures jumped to a ten-month high on speculation about continued dry weather. Soybeans and corn prices also jumped.

“Soybeans prices have staged a recovery over the past week on strong demand alongside concerns about tight US supplies,” analysts at Deutsche Bank wrote in a note.

However, the weather is likely to change soon, which should quell the fears and bring prices back toward normal rates.

“We expect the surge in wheat prices may start to ease in response to favorable weather in the U.S. plains and as fears over a disruption in grain exports from the Ukraine moderate,” the note read.

Meanwhile, increased demand for from emerging markets coupled with a drought in West Africa sent the cocoa price up more than 11 percent since January.

“We are looking at a situation where elevated cocoa prices are going to be much more the norm,” Sterling Smith, a Citigroup futures specialist told the Wall Street Journal. “You can’t ramp up cocoa production like you can ramp up corn production."

West Africa, including Ghana and Ivory Coast, accounts for nearly 70 percent of the world’s cocoa-bean production.

However, it’s likely that growing prices will also stem demand, which is expected to moderate in the coming months.

© Copyright IBTimes 2024. All rights reserved.