EADS-BAE Merger Would Create Very Diverse Aerospace Company - Here's What It Would Produce

Two European aerospace giants are once again talking of a possible merger that if realized would create a $45 billion company with more than 200,000 employees. And it seems like nobody buying and selling stocks in either company thinks it's a good idea.

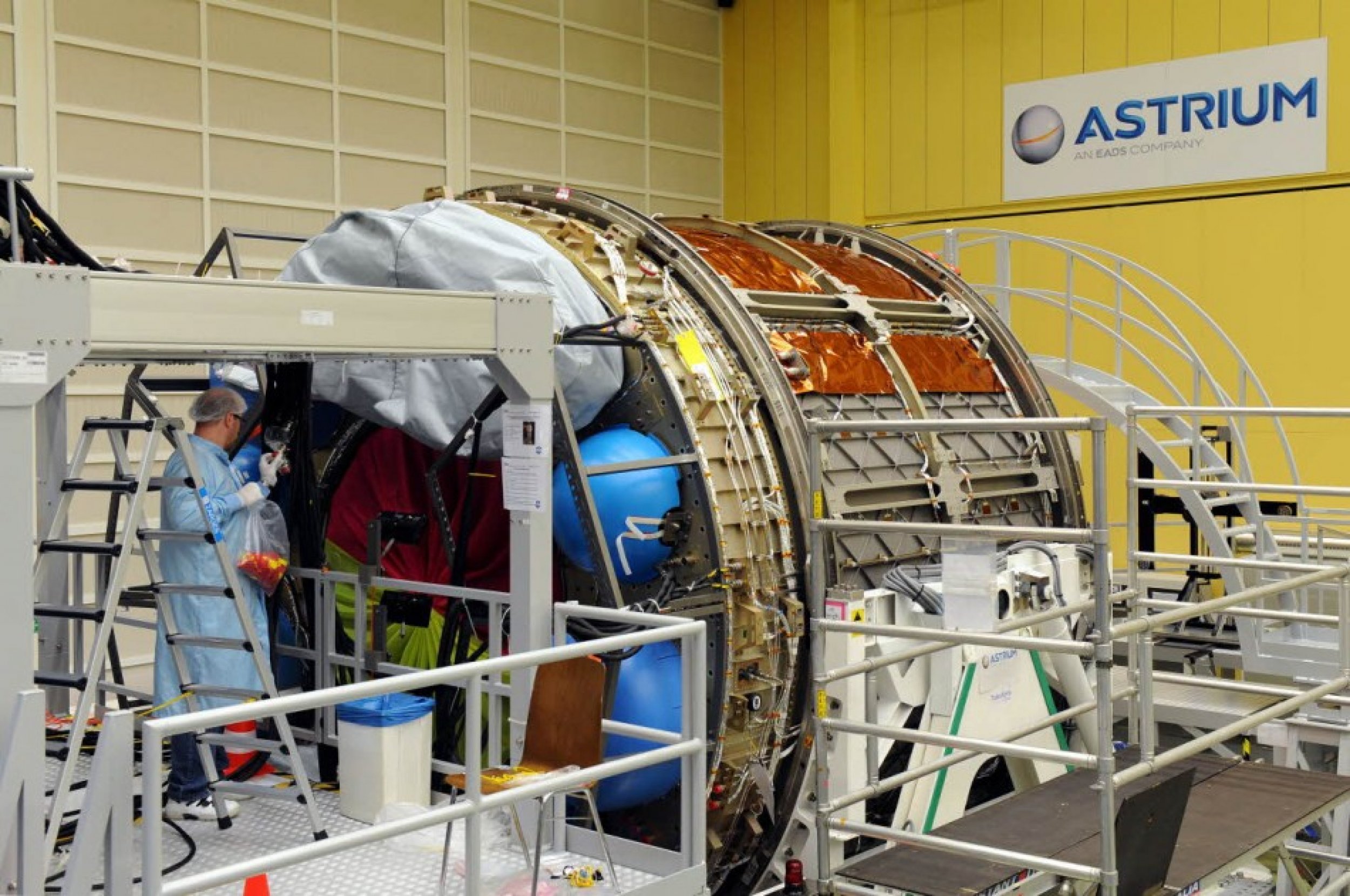

Leiden, Netherlands-based European Aeronautic, Defence & Space Co., better known as EADS (EPA: EAD), is the more diverse of the two companies. It's involved in commercial and military aircraft and is the parent of Airbus, which shares pretty much all of the world's market for large jetliners with U.S.-based Boeing (NYSE: BA). It also provides civilian and military space systems support. The company's stock price closed down 10.2 percent to €25.16 ($32.53) on Thursday, its lowest price since mid-January.

London-based BAE Systems Plc (LON:BA) is focused primarily on defense as one of the world's top military contractors. It builds military aircraft, munitions, naval vessels and armored vehicles, including the Bradley that has been used by the U.S. since 1981. The company closed down 7.32 percent to €337, higher than prior to Thursday's afternoon's announcement that initially pumped up the stock price of both.

Analysts say the company that would come out such a merger would be very difficult to manage.

"This will be a very complex organization, and there is a risk of synergies coming only much later," Yan Derocles, an analyst at Oddo Securities in Paris, told Bloomberg.

© Copyright IBTimes 2025. All rights reserved.