Eurozone Q1 2016 GDP Growth Doubles, But Inflation Turns Negative

The 19-nation eurozone grew at its fastest pace in a year in the first quarter of 2016, as the gross domestic product growth in the three-month period beat forecasts and came in at 0.6 percent, compared with the 0.3 percent in previous quarter. On a year-over-year basis, GDP rose by 1.6 percent — the same rate as the first quarter of 2015.

Growth in the eurozone was driven by better-than-expected recovery in France and Spain, both of which reported their GDP figures earlier Friday. France, which grew 0.3 percent in the three-month period between October and December, registered GDP growth of 0.5 percent in Q1 2016, while in Spain, the figure held steady at 0.8 percent.

Eurostat — the bloc’s statistics agency — did not provide a country-by-country breakdown of GDP figures.

The eurozone unemployment rate also fell to its lowest level since August 2011 in March, driven by a strong labor market in Germany. The unemployment rate dropped to 10.2 percent, down from 10.4 percent in the previous month and 11.2 percent in March 2015. Across the wider European Union, unemployment rate dropped to a seven-year low of 8.8 percent, down from 8.9 percent in February and 9.7 percent in March 2015.

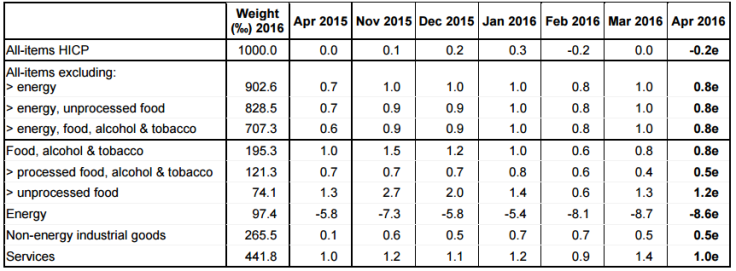

However, inflation figures for the bloc, also released Friday, are, to a certain extent, likely to overshadow the positive impact of the improving economic growth and decline in unemployment. In April, the annual inflation rate in the euro area is estimated at minus 0.2 percent, down from zero in March, primarily due to the drop in global oil prices.

Excluding volatile food and energy prices, consumer prices rose 0.8 percent year-on-year in April, down from 1 percent in March, according to Eurostat estimates.

Eurozone has been struggling with perilously low levels of inflation, and the latest figures would add further pressure on the European Central Bank to dive deeper into the negative rate territory. The ECB, which has already embarked on a massive bond-buying program and introduced record-low deposit rates, aims to bring core inflation in the bloc to 2 percent over the medium term.

© Copyright IBTimes 2024. All rights reserved.