The Federal Reserve will not Spoil the Party

Tom Sowanick is Co-President and Chief Investment Officer of OmnivestGroup in Princeton, N.J.

This week’s Federal Open Market Committee (FOMC) meeting should not interrupt the recent positive performance of the US financial markets.

The FOMC will very likely elect to maintain its current monetary stance and continue with QE2. Consequently, risk assets and lower quality fixed income assets should continue to lead the financial markets higher.

While all of this is good, at least for those that are invested, we all know that there is no free lunch. The cost of maintaining QE2 and keeping nominal Fed Fund rates at close to 0 percent and real Fed Fund rates well below 0 percent will continue to pressure

the US dollar.

On the surface, a weaker US dollar should promote trade, with exports gaining relative to imports. However, the US dollar is perilously close to setting a new all-time secular low, at a time when geopolitical frictions are high and global economic imbalances are very fragile.

Regardless, a weaker US dollar seems to be the trend that is most predictable.

Treasury Secretary [Timothy] Geithner reaffirmed the U.S. commitment to a “strong US dollar” and said that the US monetary policy is not geared towards forcing a weakening currency to gain an advantage over its trading partners.”

Well, if the US is not weakening the US dollar deliberately, then who should Mr. Geithner blame? It is quite careless to claim a commitment to a strong US dollar if there is no visible effort to arrest its decline. When tracking the US dollar on Bloomberg, it is only stronger against 2 out of 16 major currencies; the Japanese yen and the South African rand. With the US dollar measurably weak against 87.5 percent of the world’s major currencies, it is difficult not to laugh when Mr. Geithner professes an ongoing “commitment to a strong US dollar”.

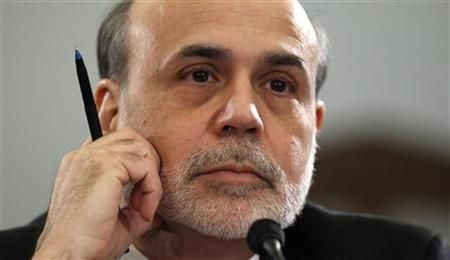

Mr. [Ben] Bernanke and the rest of the Federal Reserve clearly understand the relationship between currency movement and interest rate differentials and therefore implicitly are supporting a weak US dollar policy. This week’s FOMC decisions will only add further downward pressure on the beleaguered US dollar. In addition,

S&P’s recent rating warning on US Treasury debt takes another shot at an already weakening US dollar.

It should be no surprise that gold and other precious metals are soaring to new all-time nominal highs, as the US dollar suffers from benign neglect. While it can be argued that manufacturing will gain from a weak US dollar, it cannot be ignored that the standard of living in the US is materially weakened from this condition.

Our imports are becoming increasingly expensive and traveling abroad is becoming a luxury for only the rich.

As long as the Fed maintains its current monetary stance, investors should seek investments that have some hope of future appreciation. To this end, equities look very attractive in absolute terms and relative to debt instruments. Next on the list

would be lower quality fixed income assets. Finally, exposure to non-US dollar assets, such as emerging equities should prove to be the best of all asset classes.

© Copyright IBTimes 2025. All rights reserved.