Fed's weak employment outlook dampens Q3 GDP data

Pessimistic outlook about unemployment from the U.S. Federal Reserve overshadowed reports stating the economy grew faster in the third quarter.

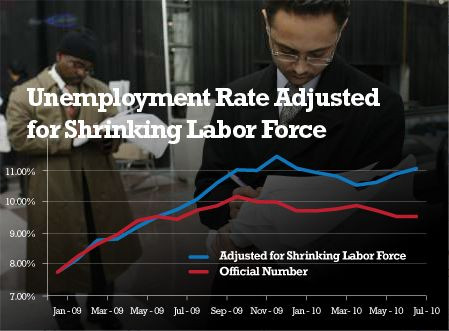

The Fed expects unemployment to remain high over the next couple of years, hovering around 8.9 percent to 9.1 percent next year. It had previously forecast unemployment rate between 8.3 percent and 8.7 percent.

The increase in the long-term unemployment rate forecast (from 5.0 percent to 5.3 percent to 5.0 percent to 6.0 percent) acknowledges that structural, as well as cyclical, factors are keeping unemployment high, Paul Dales, an economist at Capital Economics, said.

Eric Rosenbaum had defended the QE2 earlier this month, stating that it would help add 700,000 jobs to the economy by 2012, reducing the unemployment rate by half a percentage point.

However, the recent comments seem to indicate that people will struggle to find jobs in the faltering economic recovery. As unemployment remains uncertain and weak, consumer spending, which forms an important part of GDP growth, will also remain muted.

Somewhat strangely, just as core Consumer Price Index (CPI) inflation has fallen to a record low, the Fed nudged up its core PCE deflator forecast, to 0.9 percent to 1.6 percent, Dales added.

Core CPI, which is an important measure of inflation, rose only 0.6 percent in October, the smallest rise on record.

Low inflation was one of the main reasons behind the second round of quantitative easing of $600 billion announced earlier in November.

Minutes of the last FOMC policy meeting, which took place in early November, was released on Tuesday evening, indicating that the decision to launch the QE2 was not as controversial as initially perceived.

That said, Fed officials disagreed on the likely effects, and the recent backlash against QE2 may mean the Fed will find it hard to take further action if, as we expect, it is needed, Dales said.

The GDP growth won't amount to much more than 2 percent next year and the unemployment will remain above 9 percent, he added.

In such a situation, the Fed will have to consider more asset purchases, but given the backlash against QE2, any such near-term activity is unlikely, Dales said.

Job creation is the most important point on the current administration's agenda. Nearly 15 million people still do not have a job in the U.S. The economy needs to add over 200,000 jobs a month to reach the pre-recession levels of employment and financial security.

Though temporary employment has improved, rising about 23 percent in October, the situation still remains uncertain. Temporary employment does not inspire financial security, thereby lead to consumer spending, both of which are crucial to GDP growth.

Capital Economics' Dales expects the Fed to give more attention to other measures, such as setting an explicit inflation target, more attention given the criticism of the QE2.

But these are unlikely to be enough. If the unemployment rate remains above 9 percent and core CPI inflation falls below zero, more will be needed and we don't expect Bernanke and Co. to stand by and watch, he added.

© Copyright IBTimes 2024. All rights reserved.