FOMC Meeting, Fed Chairman Ben Bernanke Press Conference - Live Blog

Hello and welcome to our live coverage of the Federal Reserve's interest rate decision and the press conference that Ben Bernanke, the Fed's chief, will give a bit later in Washington D.C.

The Federal Reserve's powerful rate-setting committee concludes its second meeting of the year today.

Instead of a long gap between the official statement and Fed Chairman Ben Bernanke’s press conference, the statement -- along with the updated survey of economic projections from FOMC participants -- will come out at the revised time of 2 p.m. EDT Wednesday, followed by Bernanke’s press conference at 2:30 p.m.

***

4:00 | Until Next Time

The key things we've learnt are:

* The Fed would continue with its purchases until the outlook for the labor market improved "substantially.”

* However, Bernanke was as vague as ever in the press conference on what exactly would qualify as a substantial improvement.

* Nevertheless, Bernanke was quick to add that the FOMC was ready to adjust the rate of flow of its purchases on a meeting-to-meeting basis.

* Taken together with Bernanke's comments, that suggests Fed officials are warming to the idea of slowing the rate of asset purchases in the second half of this year.

That's a wrap. Thanks for tuning in.

3:58 | Reaching Into My Inbox

Our friend at Societe Generale sent over this note:

“It seems that Bernanke would be in favor of giving a numerical guidance on asset purchases, which in his words ‘would be more effective,’” said Aneta Markowska, senior U.S. economist at Societe Generale.

Markowska now assume that the Fed will begin to taper asset purchases some time during the third quarter (late summer/early fall) and fully end them in December.

3:28 | Bernanke Leaves The Stage

That's all from Bernanke. His next post-FOMC press conference will take place on June 19.

3:20 | Spring Slump

There has been a trend in the last couple of years where the economy jumped out of the gate in the first part of the year, only to kind of falter. Why does this keep happening?

One possible explanation is that the seasonal adjustments were distorted by the severity of the recession in 2007 to 2009. While many statistical experts deny it, Bernanke says the change in seasonality may have resulted in exaggerated job creation and GDP figures earlier in the year.

3:15 | Lower Even Further The Unemployment Rate Target?

Bernanke says that at least one member of the FOMC committee has suggested that the Fed “could lower even further the unemployment rate number” – the 6.5 percent unemployment threshold to start raising rates -- but indicates right now, they find the thresholds currently in place to be sufficient.

2:59 p.m. | Unemployment

A reporter with the New York Times asked Bernanke when was the last time he talked to someone who was unemployed.

"Pretty recently," Bernanke says. "I have a relative who is unemployed. I come from a small town in South Carolina that has taken a big hit from the recession."

Bernanke used the opportunity to stress that “it's very, very important that we act to address unemployment,” and he thinks the Fed has been fairly active in that regard.

2:54 p.m. | Succession

Reporter: Do you think eight years is the right amount of time for a central bank leader? And what about you?

Bernanke: I'll certainly be informing the Wall Street Journal and other publications if I come to some decision or developments on that front.

2:47 p.m. | Cyprus

"It's a difficult situation in Cyprus," Bernanke says. “There are a lot of uncertainties and difficulties.”

While admitting the situation in Cyprus does have some consequence, the Fed chief quickly adds that he doesn’t think the impact has been “enormous.”

“At this point, we are not seeing a major risk to the U.S. financial system or the U.S. economy,” Bernanke says.

2:40 p.m. | Bernanke Has Begun Taking Questions

First question, as expected: (From Washington Post) We have seen some of your colleagues giving more specific criteria, give color around what they are looking for before they consider exiting QE. 1) Can you tell us what you are looking for in terms of substantial improvement in the labor market? 2) Does the fact there aren't thresholds associated with QE say anything about the level of disagreement among the committee members over what the exit should look like?

"We'll be looking for sustained improvement in a range of key labor-market indicators," Bernanke says, citing payrolls, unemployment, hiring rates and more. The Fed also will look at growth to look past short-term shocks.

Bernanke notes, as he has before, the Fed "may adjust the purchases month to month" in its bond-buying to "appropriately accommodate" the Fed's support for the economy.

2:32 p.m. | The Economy Needs More Support

Bernanke: High unemployment in combination with relatively low inflation underscores the need for policies that will support progress towards maximum employment, in a context of price stability.

2:30 p.m. | Bernanke Taking A Seat

Here we go.

2: 25 p.m. | Hold Your Breath

Bernanke is on in less than 5.

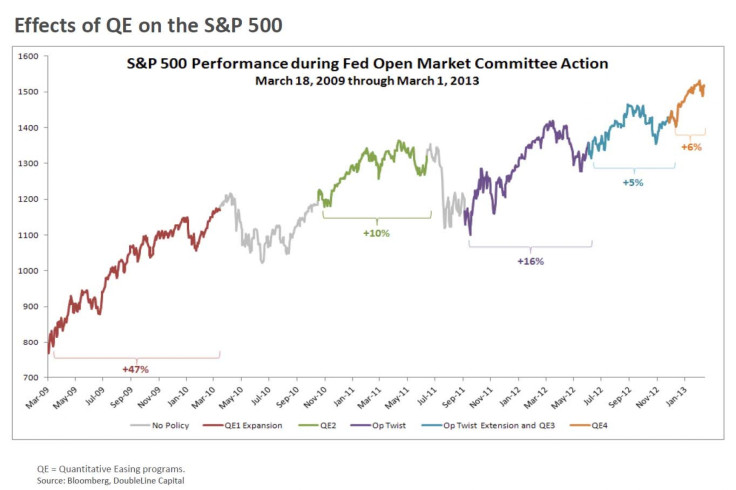

2:22 p.m. | S&P 500 Peak Performances During Each Fed Action

Bernanke has been a true friend of the stock market since the 2008-09 financial crisis. His easy-money policies have been a big driver of stock prices the past four years.

Proof.

(Source: Doubleline Capital, via Zero Hedge)

However, the Fed chief probably will not stand for a third term at the central bank. His current term ends Jan. 31, 2014.

(Read more: Fed vs. ECB: 20 Charts On How Central Bank Policy Impacts Asset Prices)

2:09 p.m. | Market Reactions

Quick update on the markets. The S&P 500 is now up 10.02 points, or 0.65 percent, to 1,558.36. Gold and silver lost more ground.

2:02 p.m. | Updated Economic Projections

The Fed has also released updated economic projections:

The central bank sees the unemployment rate falling faster than previously expected in 2013 and 2014. It now forecasts a range of 7.3 percent to 7.5 percent for this year and 6.7 percent to 7 percent the following year.

Meanwhile, the U.S. economy is expected to expand by 2.3 percent to 2.8 percent this year, and by 2.9 percent to 3.4 percent in 2014. Those forecasts were revised slightly lower compared to projections prepared in December.

For the full breakdown see here.

2 p.m. | The Fed Statement Arrives

The Fed used better language to describe the economy. Policymakers see a return to “moderate economic growth following a pause late last year.” But the central bank said it expects to continue holding interest rates at historic lows until the unemployment rate falls below 6.5 percent. It will also continue buying assets at its current pace of $85 billion per month, and weigh the costs and benefits of this aggressive monetary policy.

Read the full-text here.

1:50 p.m. | Fun Facts

Question: How much do you know about 1935?

While we wait for the big announcement, the Chicago Fed offered a good way to kill time. Read the Chicago Fed’s annual report of 1935 here.

1:42 p.m. | Countdown

The statement will be released in less than 20 minutes.

Gold is down nearly $5 ahead of Fed and floor session close. The S&P 500 index added 8.19 points, or 0.5 percent, to 1,556.53. The Nasdaq Composite Index is up 17.98 points, or 0.5 percent, to 3,247.07.

1:35 p.m. | Fed’s $4 Trillion Question

How does the Fed plan to get rid of all the government debt it has bought in an effort to boost the economy?

Minutes of the Fed's Jan. 29-30 policy meeting showed “many participants” felt the potential risks posed by the bond purchases could warrant tapering off or ending them before hiring picks up. However, several others argued there was a danger in halting them prematurely.

Bernanke appeared to be in the latter camp. "To this point, we do not see the potential costs of the increased risk-taking in some financial markets as outweighing the benefits of promoting a stronger economic recovery and more rapid job creation,” he said in his recent semi-annual monetary policy testimony to Congress.

Market-watchers will be sifting through Bernanke’s words for clues about the Fed's "exit strategy."

1:21 p.m. | U.S. Jobs Market

1:11 p.m. | What To Expect

The statement may be revised modestly to reflect two offsetting changes since the last FOMC meeting.

The better U.S. data of late should convince the Fed that the economy has resumed growing after the temporary pause noted in January. Conversely, several of the downside risks feared by Fed officials have intensified: The sequester was not averted, news from Europe has been disconcerting (Italian elections and Cyprus bailout), and Chinese data have softened.

The net effect is likely to be no change in either the quantitative easing purchase pace or the forward guidance.

In other words, the FOMC committee is widely expected to stick with their easy-money policies and vote to continue buying $85 billion in U.S. Treasury debt and mortgage-backed securities per month. The central bank has also promised to keep interest rates low until unemployment falls to 6.5 percent or inflation rises to 2.5 percent. Both thresholds seem far off.

(Read more on what to expect from the Fed.)

1:02 p.m. | Where to Watch It Live

The news conference will be broadcast live on the Federal Reserve's UStream channel.

© Copyright IBTimes 2024. All rights reserved.