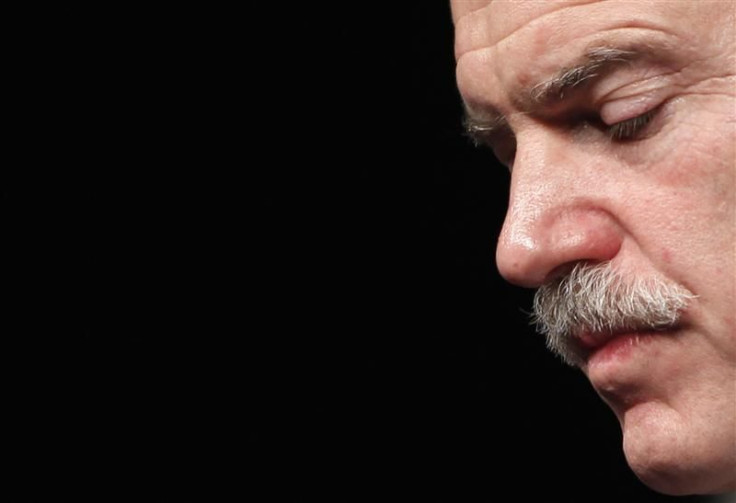

Former PM Papandreou Warns Of 'Catastrophe' If Greece Leaves Euro

As Greeks cast ballots in the country’s crucial elections on Sunday, the country’s former leader warned that a departure from the euro zone would have disastrous results.

George Papandreou, former Socialist prime minister who was ousted from power over the unpopularity of his administration’s acceptance of harsh bailout terms from the European Union, told BBC that a break-up of the currency bloc would be a major catastrophe.”

Papandreou’s fears may come to be realized given that the only two pro-bailout parties – the conservative New Democracy and his own Pasok Socialists – are not expected to amass a majority of support in the next parliament.

The vehemently anti-bailout far-left Syriza, which is running neck-and-neck with ND, came under withering criticism from Papandreou. He warned that Syriza could not have their cake and eat it,” suggesting that rejecting the bailout and fostering economic growth are impossible to engineer concurrently.

In contrast, Papandreou believes that given enough time, the Greeks would be able to adhere to bailout terms.

The euro is keeping us stable,” he said. “Leaving would mean a bank run, higher inflation, deep wage cuts and a fall in GDP of more than 20 percent -- it would be a major catastrophe.”

The former prime minister further asserted that Greece itself is not really the problem – rather, Athens’ issues are manifestations of deeper structural woes within the euro zone itself, citing that the continent has no unified banking system, no common fiscal policy, and different labor laws and pension systems.

“The market is telling Europe, not Greece: We are not confident today in the European structures as they are in the euro zone,” Papandreou said.

“We are in a make-or-break point in Europe. Greece has its problems, and we take on our responsibility for our problems and our own mistakes, for our past, for our bad governance and that is what we are trying to change. However, the structures in Europe need to be modernized.”

Other prominent voices are also warning Greece not to turn its back on austerity.

Robert Zoellick, the outgoing president of the World Bank, declared that Europe is facing a moment as cataclysmic as the 2008 collapse of U.S. investment bank Lehman Brothers, which led to a global financial crisis.

He told the UK newspaper, the Observer: Europe may be able to muddle through, but the risk is rising. This could be a Lehman's moment if things are not properly handled.

© Copyright IBTimes 2024. All rights reserved.