Four Problems with the Payroll Tax Holiday Extension

The Senate has followed the House of Representatives in passing a bill to extend the payroll tax holiday first instituted in 2011.

Although the House was widely expected to pass the bill, some lawmakers had voiced concerns over possible resistance in the Senate. Now the bill is on President Obama's desk, ready to be signed when he returns from a fundraising trip on the West Coast.

The measure, officially referred to as the Middle Class Tax Relief and Job Creation Act of 2012, was passed well before deadline. Lawmakers on both sides of the aisle realized that a relatively smooth passage of the populist measure would be useful for their public image. In the end, good PR--especially valuable during the lead-up to a big election--trumped the concerns of most objectors.

But there were some issues that stood in the way, and four major groups have their own objections to the measure.

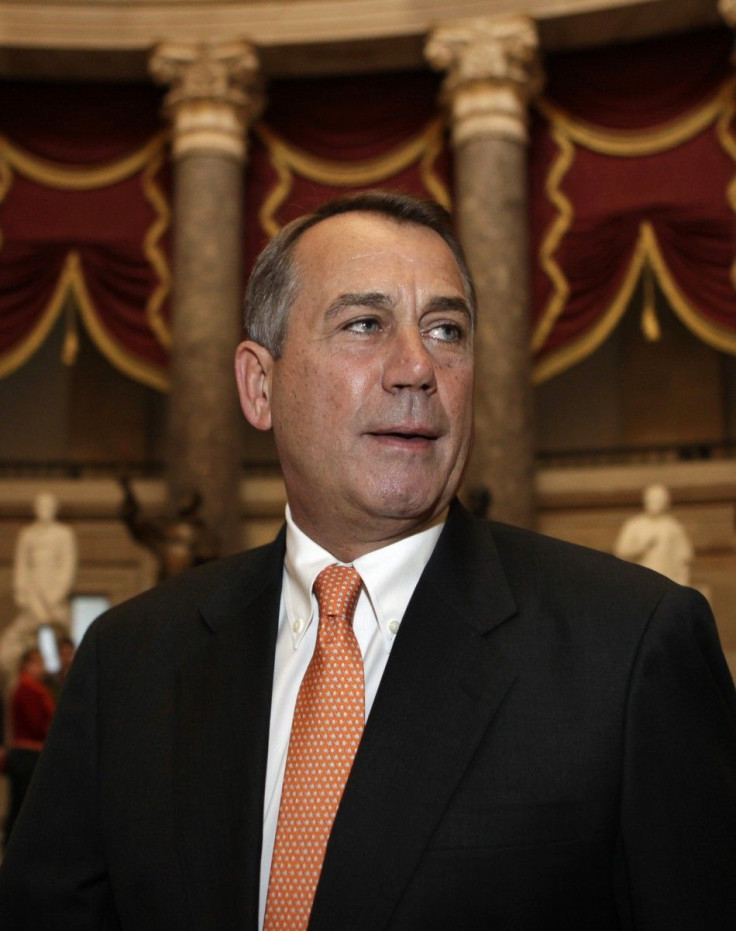

Republicans

House Speaker John Boehner's support was less than enthusiastic. Let's be honest, this is an economic relief package, not a bill that's going to grow the economy and create jobs, he said. For him and many Republicans in opposition, the biggest problem with the bill was its price tag. The $143 billion measure does not include provisions to cover its full cost, and the Congressional Budget Office reports that the bill will increase the federal deficit by $119.5 billion over the next five years.

Democrats

While the bill enjoyed the support of most Democrats, some objected to certain details. There were suggestions that the bill should have paid for itself by increasing taxes on the wealthy, or on corporations. As House Minority Whip Steny Hoyer put it, Nobody else in this bill, not a millionaire, not a billionaire, not a carried-interest beneficiary, not an oil company, nobody in this bill other than federal employees is asked to pay.

Federal Employees

Hoyer was arguing on behalf of his constituents in Maryland, where federal employees make up a relatively large chunk of the population. Existing workers won't see any changes, but new federal employees have reason to be angry--they'll have to give up more of their paycheck to cover pensions, and many feel that they are bearing the brunt of the financial burden for this bill.

Social Security Proponents

The payroll tax holiday extension is good news to most economists, but a few are calling it a short-term fix with long-term risks. Dean Baker, co-director of the Center for Economic and Policy Research in Washington, D.C., was opposed to the measure since it would cut directly into the revenue stream for Social Security. The bill includes a provision to credit the fund, which will offset the lost income. But in an op/ed published in Truthout, Baker explained that there is a serious political problem with tying the tax cut to Social Security...the question is what happens when the extension ends. Several Republicans in Congress have already publicly said that they would oppose restoring the payroll tax to its former level, since that would be a tax increase. In other words, Social Security may be permanently losing a portion of the revenue it has historically received from the payroll tax. If there was a commitment to permanently replace the program's shortfall with general revenue, continued Baker, the loss of the payroll tax revenue would not matter. However, there is no such commitment. Down the line, this could turn into an attack on the very institution of Social Security.

Objections notwithstanding, this bill was too hard to oppose. It is estimated to save the average American family around $1000, and will provide for a continuation of increased benefits for unemployed workers.

And although not all costs are covered, there are attempts to save. These include a plan to auction off public airwaves to private companies, which should generate at least $25 million and improve wireless communication across the country. There will also be small cuts to healthcare programs and efforts to streamline some small government programs. For most members of Congress, this was enough to send the Middle Class Tax Relief and Job Creation Act of 2012 to Obama's desk in time for Presidents' Day weekend.

© Copyright IBTimes 2025. All rights reserved.