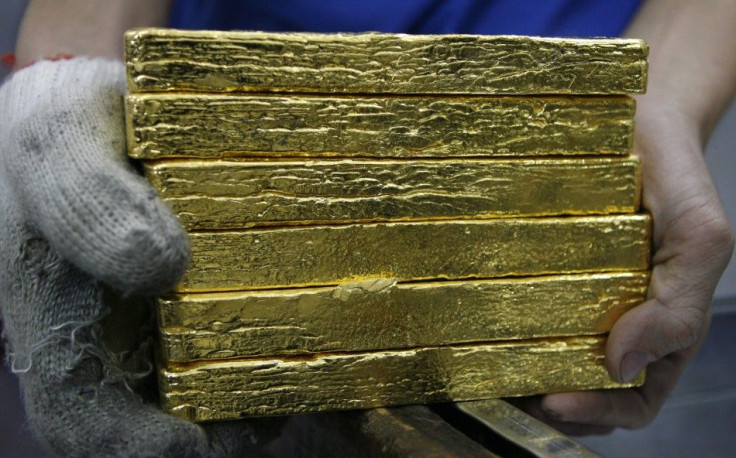

Gold Prices Rebound on Bargain Hunting

Gold prices began the final trading day of 2011 higher as bargain hunters took advantage of a recent downdraft that has left the metal with its first fourth-quarter loss in more than three years.

The approach of the Lunar New Year next month increased physical demand in China, a trend that is expected to continue into next week.

A broad-based commodity rally also helped precious metals prices, all of which were higher, with oil in London rising over $108 per barrel and oil in the U.S. above $99. Tensions between Iran and the U.S., as well as its Persian Gulf allies, helped boost the price of oil.

Currency moves were insignificant. In thin volume, the dollar was off a half a percentage point against a basket of major currencies, and the euro remained under $1.30.

Stocks, which have tended in recent months to move in the same direction as gold, were mixed. Asian equities were mostly higher but European shares trended lower. U.S. futures were mixed.

Gold for February delivery was up $31.50 to $1,572.40, while spot gold rose $39.11 to $1,572.33.

Silver for March delivery increased 65 cents to $27.97, while spot silver added $1.13 to $27.92.

© Copyright IBTimes 2025. All rights reserved.