Goldman Predicts Corporate Spending In 2016 To Lean Toward Shareholders

Of the $2.2 trillion in cash corporate America is poised to spend next year, roughly half will go directly to shareholders. Between stock buybacks and dividend increases, Goldman Sachs estimates that just over $1 trillion will end up flowing to shareholders, a 7 percent increase over 2015.

“Despite weak activity during the first half of 2015, buyback activity will remain robust,” wrote Goldman’s chief U.S. equity strategist David Kostin in a note to clients Monday.

The projections show that although increasing in absolute terms, spending in the Standard and Poor’s 500 on research, development and capital expenditures will fall as a percent of overall budgets. Kostin sees R&D increasing 5 percent over 2015 to $256 billion, while capital expenditures -- spending on infrastructure upgrades and new facilities -- increase just 1 percent, held back by a sagging energy market.

Meanwhile, the accelerating spending on shareholder returns come even as analysts see returns on share repurchases diminishing in an expensive equities market. The $1.5 trillion spent on buybacks over the last three years has helped companies firm up earnings figures and keep their stock prices moving upward. More than 80 percent of S&P 500 companies now buy back their stock, double the share two decades ago.

But returns on indexes that bundle high-buyback stocks have dragged in recent months. The S&P 500 Buyback Index is down -0.6 percent year-to-date, compared with a 1.3 percent rise in the broader S&P 500, after years of buyback-heavy stocks outperforming the wider market. Analysts at Oppenheimer have warned that buyback index underperformance could be a harbinger for a stock-market crash.

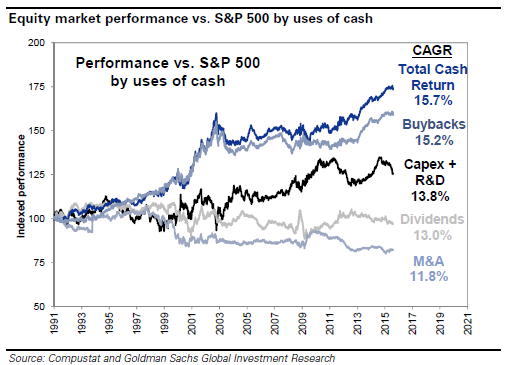

Still, Goldman saw companies returning cash to shareholders delivering better returns than those investing in research and equipment. Since 1991, the companies with the highest cash-return strategies have far outpaced those investing in research and development or pursuing mergers and acquisitions, according to Goldman's figures.

“We expect high cash return strategies to outperform given modest GDP growth, low rates, and slim equity returns,” Kostin wrote.

© Copyright IBTimes 2025. All rights reserved.