Horrific Unemployment, Stagnation, Inflation Seen In Euro Zone Collapse

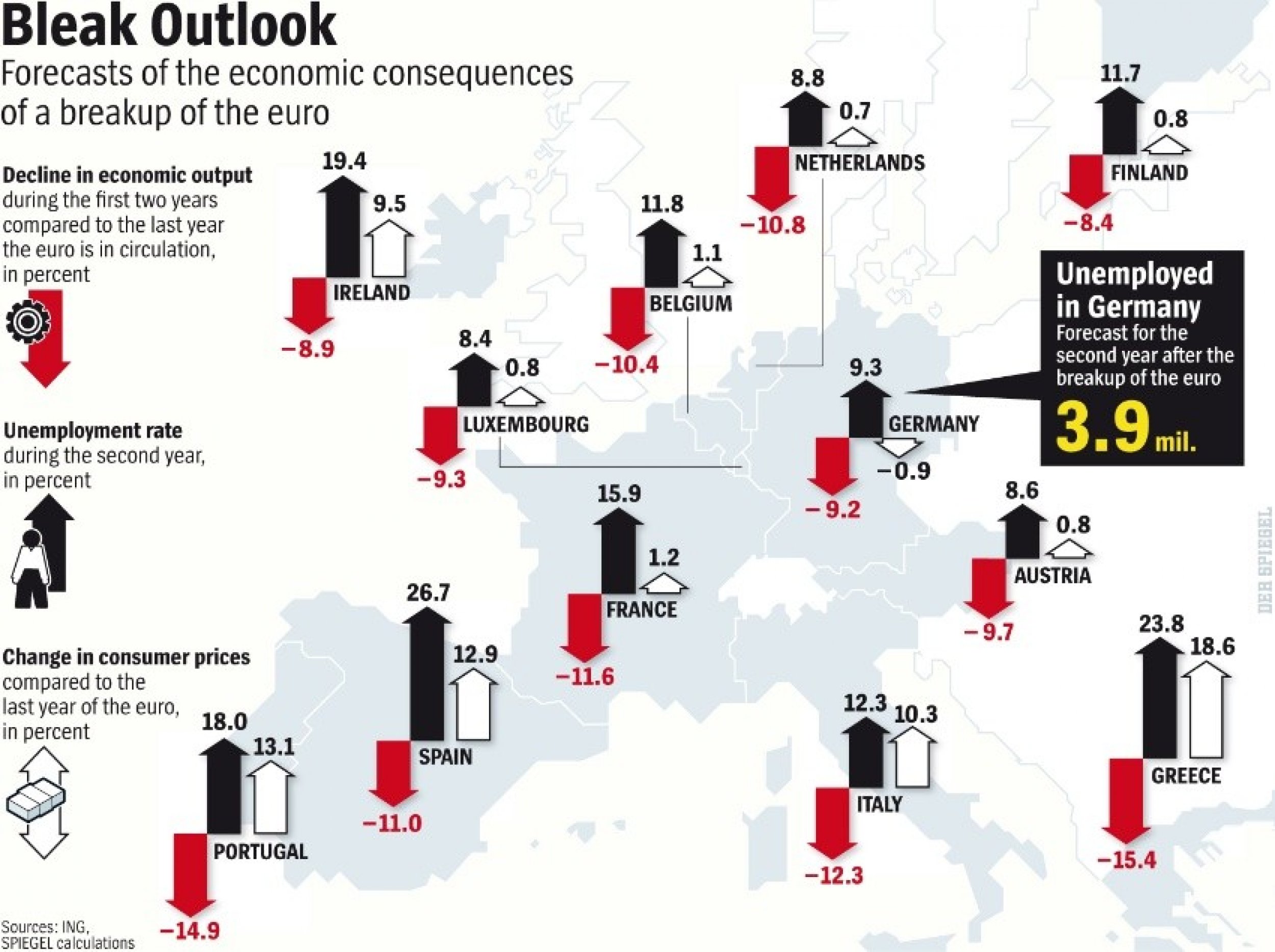

A graphic published by Der Spiegel, Germany's top newsweekly, is making the rounds among global financial blogs and Facebook walls, succinctly putting into numbers the horrific economic carnage a collapse of the common currency union would entail.

The image, based on calculations commissioned by the magazine and Dutch financial giant ING, suggests, as the article accompanying it states, that if the euro collapses a monetary disaster would spread across the entire economy like a tidal wave.

According to Der Spiegel, ING believes the first two years after the collapse of the euro zone would spur a contraction of one-eighth of the total economic activity in the union, making the recession that followed the bankruptcy of investment bank Lehman Brothers seem like a minor industrial accident by comparison. The economies of Europe would remain depressed for over five years.

According to the newsmagazine, internal projections at the German Finance Ministry were even more dire. The officials were so horrified by their conclusions that they kept all of their analyses under lock and key, the publication states, citing an unidentified Finance Ministry official.

Indeed, the graphic shows how, ironically, the richer, healthier economies of Europe might be the ones that suffer the most from a collapse of the euro zone.

Unemployment would rise 2 to 3 percentage points in countries like Portugal, Spain and Greece, of course, but Germany, Finland and France would see unemployment soar more than 4 percentage points. That's because a devaluation of the currency in southern European countries would kill a huge amount of the exports of consumer goods from northern Europe, destroying industrial bases in Stuttgart, Helsinki and Reims.

© Copyright IBTimes 2025. All rights reserved.