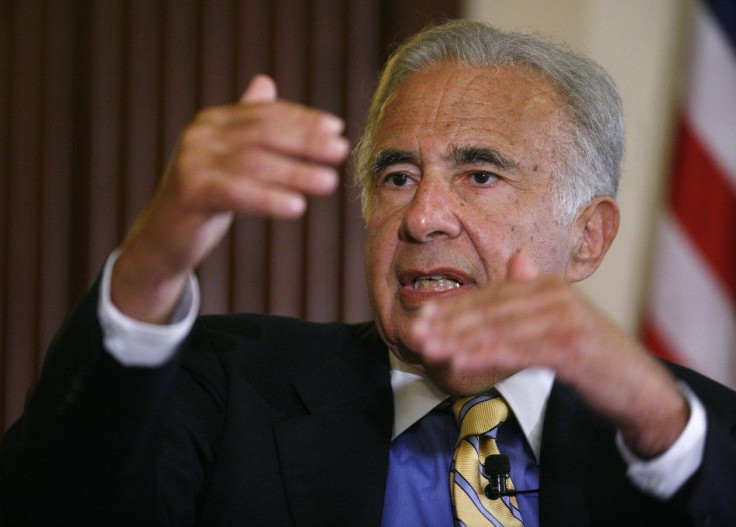

Icahn, Motorola Gadfly, Gets Big Payoff: Other Tech Plays?

One of the most happy investors Monday is clearly Carl Icahn, the corporate raider or "value investor" who first started buying into the old Motorola Inc. in 2007 with an initial $1.78 billion.

That was right after Motorola's so-called "turnaround" CEO, Ed Zander, who'd been president of Sun Microsystems, quit after the fabled developer of smartphones, communications equipment and military electronics posted a loss for 2006.

Icahn, usually known for targeting companies that invested in railroad cars and real estate, as well as Time Warner, kept buying. Then he mounted a failed effort to seat his own slate on the Motorola board of directors. The slate failed but Zander invited him to advise the board on strategy.

Icahn pushed for Motorola to become more valuable. He helped push out Zander and replace him with insider Greg Brown, later helping to snare Sanjay Jha from Qualcomm. By last year, Icahn had prompted Motorola to split in two, spinning off the mobile phone and set-top box lines as Motorola Mobility, in Libertyville, Il., and the defense and high-end businesses as Motorola Solutions, based in the former headquarters in Schaumburg, Il.

Icahn kept stakes in both Motorola companies. His Motorola Mobility shares are valued around $600 million, based on the price Google set for them Monday; he also retains about nine percent of Motorola Solutions, valued around $1.25 billion.

It's not clear if Icahn's Motorola investment has made any money, especially since he didn't seem to sell any of his shares. He issued a statement Monday terming the Motorola Mobility sale to Google "activism at its best."

Icahn also has some other big tech holdings.

One is an 11 percent stake in Mentor Graphics, the Wilsonville, Ore., developer of electronic computer aided-design software. He has pushed for an auction of Mentor.

Another is Lawson Software, the St. Paul-based developer of enterprise software particularly for the health sector, which never recovered after a merger with Sweden's Intentia International. Lawson last quarter agreed to be acquired by Golden Gate Capital and Infor, a software company controlled by Golden Gate, for about $2 billion. When the deal closes, Icahn could take away about $160 million.

Then there's the entertainment business, where Icahn bought a nearly 12 percent holding in Take-Two Interactive Software of New York, which publishes Rockstar Games and 2K. The company has had a troubled history and Icahn might be trying to force a sale to another games maker such as Electronic Arts or Nintendo.

The Icahn stake in Take-Two is valued around $100 million.

In the past, Icahn, now 75, has toyed with other tech investments including Yahoo, where he was elected a director after forcing a shakeup that brought in CEO Carol Bartz from Autodesk. As with Motorola, it's not clear if Icahn made any money on the deal since he started buying Yahoo shares at $25 and sold a large stake at $17.

Icahn, who's made plenty of money over the years, studied philosophy as a Princeton undergraduate. His senior thesis was "The Problem of Formulating an Adequate Explication of the Empiricist Criterion of Meaning."

Since he graduated in 1957, the Wall Street investor has been teaching CEOs a lot more about the meaning of shareholder value.

© Copyright IBTimes 2025. All rights reserved.