Icahn's Stake In Texas Refiner CVR Now 80%

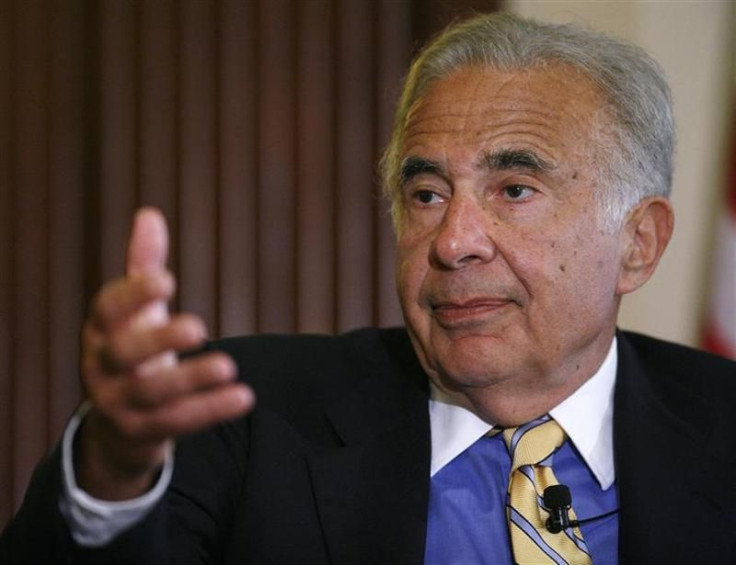

Billionaire magnate Carl Icahn has raised his share in CVR Energy Inc. (NYSE: CVI) to 80 percent and is completing the replacement of the incumbent nine-member board of directors after winning the support of shareholders in the refiner and marketer of transportation fuels.

The billionaire activist investor replaced seven board members last month after winning a $30-a-share tender offer that raised his stake in the company by about 48 million shares to approximately 69 percent.The replacement of the last two board members of the Sugar Land, Tex., company was announced Monday.

CVR shares rose 88 cents to close Monday at $31.35. The share value has risen more than 15 percent since April 2. Icahn, 76, first announced his hostile bid for all outstanding shares on Feb. 16. Icahn is seeking to sell the company for $37 per share.

On Friday, additional shareholders agreed to accept the offer to sell about 9.5 million shares of stock to Icahn that includes a contingent cash payment if Icahn can sell the company for more than the tender offer share price. The New York activist is seeking to move CVR Energy's annual meeting to May or June so that he can formally acquire all the shares he bid for in his $2.6 billion tender offer. The previous board adopted a resolution that would bar that on a technicality.

In an April letter, the board urged shareholders not to sell, encouraging them to consider that the long-term value exceeds $30 a share. Billionaire hedge fund manager John Paulson predicted the company could be sold for as much as $36 a share, Bloomberg News reported.

CVR Energy which has 950 employees, previously reported net income soared last year to $345.8 million, or $3.94 a share, from $14.3 million, or 16 cents, a year earlier. Revenue rose 23 percent to $5 billion. Earnings gained because the company bought cheaper oil in high inventory in Cushing, Okla., rather than higher priced fuel located at the Gulf Coast.

However, the reverse flow of the 670-mile Seaway pipeline connecting Freeport, Tex.,with Cushing is expected to ease some of that advantage,lowering CVR's current competitive advantage, analysts told Reuters.

CVR also owns fertilizer maker CVR Partners LP (NYSE: UAN), whose share price rose 75 cents to close Monday at $21.57.

© Copyright IBTimes 2024. All rights reserved.