IMF Worries That Chinese Slowdown Could Damage Sub-Saharan Economies

Africa’s rising economic star is in danger of burning out from even a modest contraction in China’s economy as that country’s demand for natural resources decreases, warns the International Monetary Fund.

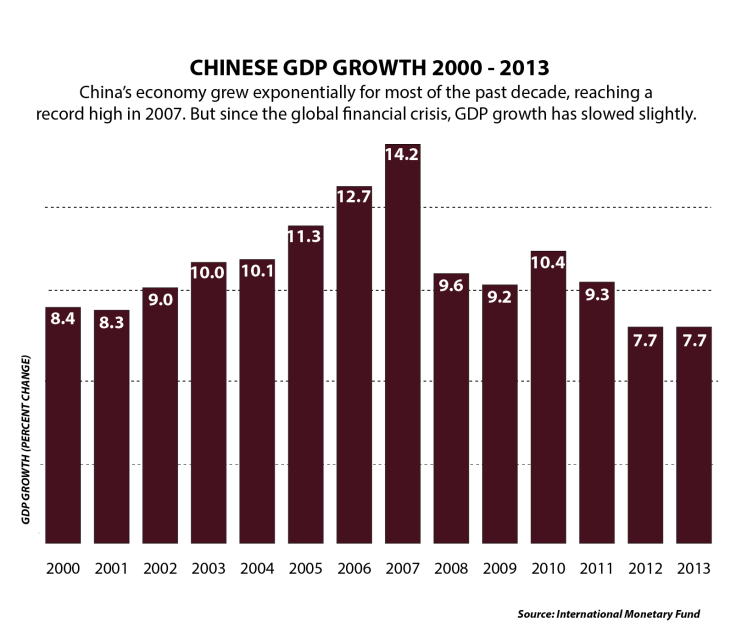

After a meteoric rise for most of the past decade, China’s economic growth rate has cooled off to a modest 7.4 percent in the first quarter of this year and officials have tightened fiscal policy, which could make investments abroad less appealing.

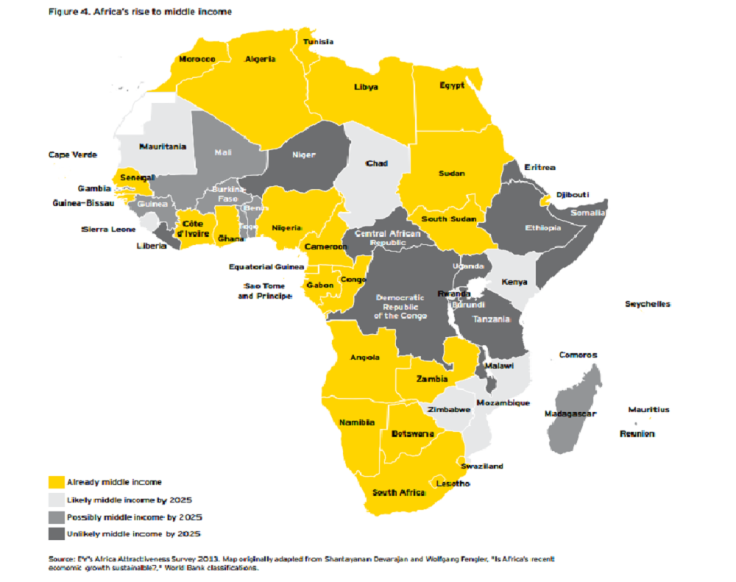

The economies of many sub-Saharan countries are expected to rise, but their dependence on Chinese trade could be a stumbling block in the future, notes the IMF in its Regional Economic Outlook for Sub-Saharan Africa, which was released on Thursday.

“Growth in the BRICs, notably China, has fueled growth in sub-Saharan Africa through high commodity prices and investment inflows,” the report reads, adding that “the rebalancing of China’s growth toward relatively more reliance on consumption and less on investment are likely to reduce demand and lower prices for commodities, especially for industrial inputs such as copper and iron ore.”

Trade between China and Africa has increased 5.6 percent year over year to hit $201 billion in 2013, according to figures released from the Chinese Ministry of Commerce, reported Xinhua. And on Wednesday executives from Standard Chartered Bank told Chinese and African officials that they expect China-Africa trade volume to hit $280 billion by 2015.

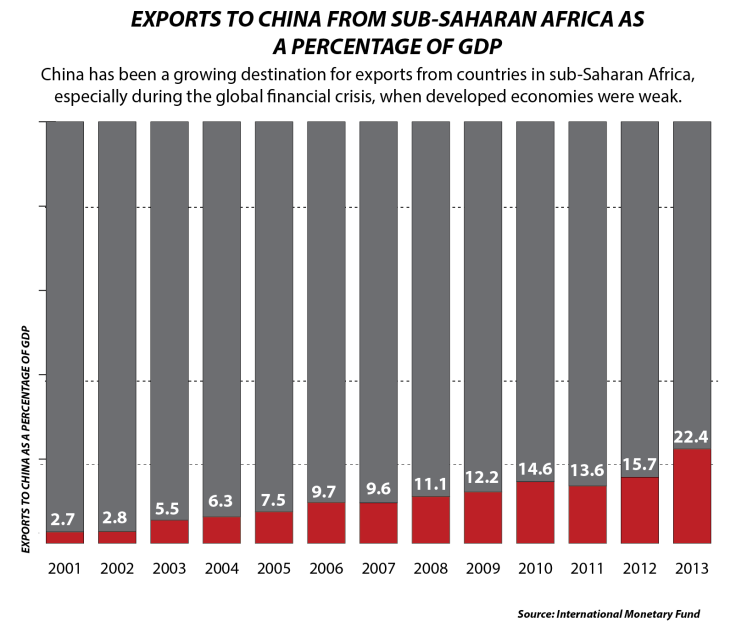

In 2012, exports to China accounted for 15 percent of all global exports from sub-Saharan Africa, up from just 2.6 percent in 2001, according to IMF data. By the end of last year there were more than 2,000 Chinese companies based in Africa, ranging in sector from agriculture to manufacturing, resources to finance.

But that depth of integration, with high levels of infrastructure and mining investment, could be a double-edged sword.

“Too much of Africa’s recent prosperity depends on China’s own continued prosperity and rapid growth,” wrote Robert Rotberg, a senior fellow at the Center for International Governance, in an April 4 blog post. “If China goes, so goes Africa,” he added.

That has some economists urging low-income, resource-rich countries to diversify and decrease their dependence on China, especially given a commodities market that has whipsawed over the last year.

The IMF predicts that iron ore and coal prices will have the largest downward adjustment this year but cocoa and coffee prices will be much higher, which should benefit Cote d’Ivoire, Ghana, Rwanda and Uganda.

“The greater exposure countries have to China today is the result of larger exports from sub-Saharan African countries to China, which has helped drive economic growth in the region, especially at a time when their exports to advanced economies were being hit by the slowdown,” said Drummond.

“Chinese investment has had an impact on global growth and commodity prices, and for countries that are resource rich there will be an impact through commodities,” said Drummond. During the boom, countries that exported resources such as ore and metal, cotton or timber did well.

Zambia is one example. As one of the largest copper producers in the world, its economy has been steadily increasing to meet demand for the metal from China. Nearly a fifth of the country’s total exports went to China in 2012, up from 0.03 percent in 2001.

Today, more than 30 percent of the country’s tax revenue comes from its mines, up from just 16 percent in 2008, according to a study from the International Council on Mining and Metals.

However, the price of copper has fallen more than 50 percent since it hit its zenith in 2011. In a report last year, the IMF listed “trade and commodity implications of a slowdown in emerging markets, such as China,” as one of the primary risk factors to the country’s economy.

© Copyright IBTimes 2024. All rights reserved.