India’s Flipkart Acquires Sequoia-Backed Startup AdIQuity In Foray Into Online Advertising

India’s top online shopping company Flipkart has entered into the digital advertising business with the acquisition of AdIQuity, a Sequoia Capital-backed startup based in Bangalore.

Terms weren't disclosed.

AdIQuity’s technology will help Flipkart provide online marketing services to the sellers on its site, an online marketplace, helping them improve their chances of reaching a wider and more relevant audience, including that are served up with searches and social networking posts.

Flipkart, has raised nearly $2 billion as it competes with Amazon.com Inc. and Indian rival Snapdeal, which is backed by eBay Inc. and SoftBank Corp., for India’s rapidly growing base of smartphone-toting online shoppers.

"M&A is a key focus for us this year. And given our concentration on mobile, companies that have made a mark in this space will be on our radar,” Flipkart said in an emailed statement to International Business Times.

“AdIQuity has a history of mobile innovations, extremely valuable experience in the ad space and a talented tech team - all of which are a great strategic fit for Flipkart.”

Spending on digital advertising in Asia Pacific will more than double from about $21.9 billion in 2013 to about $48.6 billion in 2016, research firm eMarketer estimates. China will continue to dominate the coming growth in digital advertising spending in the region in absolute value, accounting for nearly half of all spending.

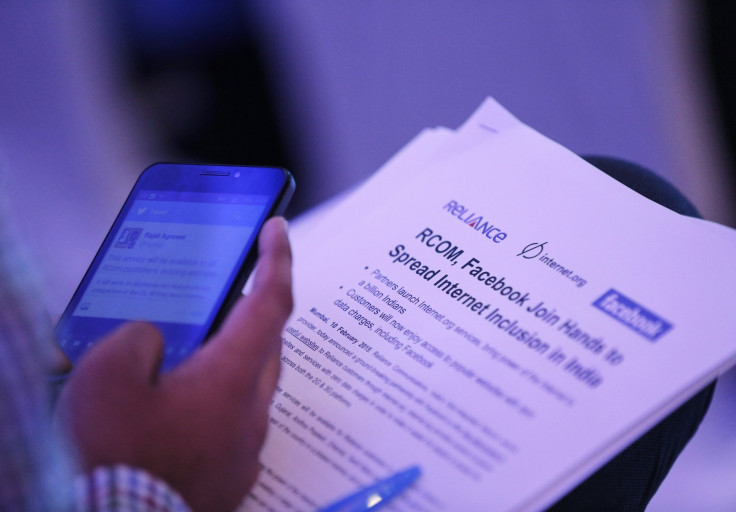

India and Indonesia -- the largest bases for Facebook outside the U.S. -- will see the fastest growth while accounting for 1.9 percent and 1 percent of the spending in APac, with traditionally strong digital markets of Japan and South Korea accounting for much of the rest, according to eMarketer.

With AdIQuity, Flipkart can help its vendors by taking the burden of effective online marketing off of their shoulders, for a fee. It would also ensure the vendors are tied to Flipkart’s ecosystem more firmly at a time of intense competition.

Adiquity’s technology currently reaches 150 million active users, and it serves up 25 billion ad impressions a month in 200 countries, according to its website. An impression roughly translates to every time an ad is displayed on a website.

Flipkart is recently said to have carved out a new business unit, led by senior vice president Ravi Vora, formerly the company’s marketing head, to build in-house brands. AdIQuity’s acquisition could be seen as a complementary move, the advertising industry executive said.

Bangalore-based Flipkart is also adding top talent from Silicon Valley to deepen its technological capabilities and raise its profile in the U.S. as a likely public listing may not be too far away.

© Copyright IBTimes 2024. All rights reserved.