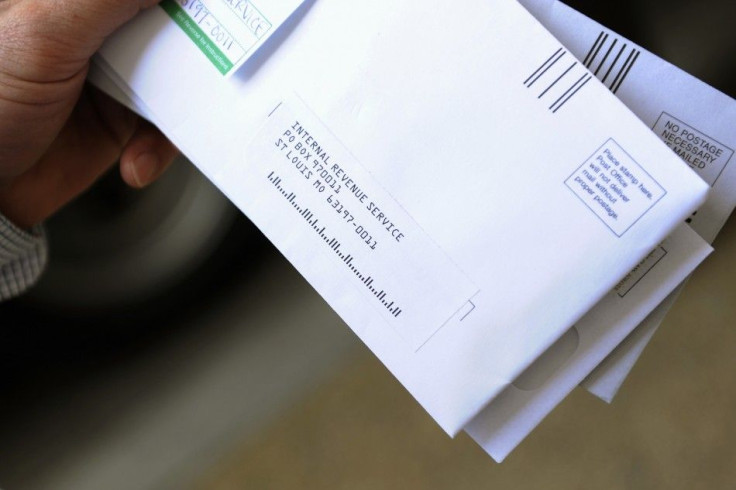

IRS Seeks to Return $153 Million in Undelivered Checks to Taxpayers

The Internal Revenue Service is holding onto $153 million worth of tax refund checks that failed to be delivered to taxpayers. In all, 99,123 taxpayers who should receive refund checks this year did not get them due to mailing address errors.

While only a small percentage of checks mailed out this year by the IRS are returned as undelivered, these undelivered refunds are valued at $1,547 each.

To avoid lost, stolen or undelivered checks, IRS suggests taxpayers choose direct deposit when filing either paper or electronic returns. The IRS, however, recommends the latter, which can eliminate the risk of lost paper returns, reduce errors on tax returns and speed up refunds.

Last year, eight out of 10 taxpayers filed for their refunds electronically and more than 78.4 million chose to receive their refund through direct deposit. Taxpayers can receive refunds directly into their bank account, split a tax refund into two or three financial accounts or buy a savings bond.

© Copyright IBTimes 2024. All rights reserved.