January FOMC Meeting Statement: Fed Tapers $10 Billion To $65 Billion

As expected, the U.S. Federal Reserve on Wednesday voted unanimously to reduce asset purchases on Feb. 1 by another $10 billion a month to $65 billion. The reduction was evenly split, with the Treasury purchases cut by $5 billion to $35 billion and the mortgage-backed securities purchases trimmed by $5 billion to $30 billion.

The Fed said information received since the Federal Open Market Committee met in December indicates that growth in economic activity picked up in recent quarters, while labor market indicators were mixed but on balance showed further improvement, according to the statement from the Jan. 28-29 FOMC meeting.

The recent volatility in emerging markets was not mentioned in the statement.

The Fed emphasized again that bond-buying is not on a preset course, and the Committee's decisions about their pace will remain contingent on policymakers’ outlook for the labor market and inflation as well as its assessment of the likely efficacy and costs of such purchases.

The Fed did not change its targets for inflation, short-term interest rates or its desired unemployment rate. Economists predict the Fed will wind down its bond-buying program by the end of the year.

"We expect the committee to continue reducing the pace of asset purchases by $10 billion at each upcoming FOMC meeting through September, and then take a final $15 billion reduction in October to conclude QE3," Barclays' Michael Gapen wrote in a note.

The 2014 Lineup

The January FOMC meeting offers the first glimpse of a new lineup of policymakers.

Janet Yellen, Bernanke’s close policy ally and current vice chair, is due to succeed him on Feb. 1. She will also be leading a rather different group than the one that backed Bernanke’s aggressive stimulus measures last year.

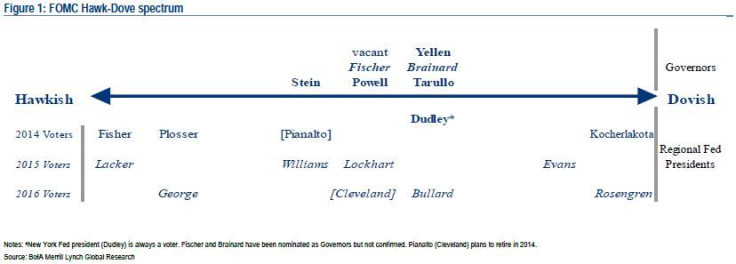

Outside of all of the changes on the Board of Governors, four new regional Fed presidents rotated into voting positions, joining the New York Fed president who has a permanent voting position on the FOMC. The remaining four seats rotate among the remaining 11 regional Feds in a regular three-year cycle; thus the voters in 2014 are mostly the same as those in 2011 and 2008.

“Yellen’s first year as Fed chair has the potential to be volatile, and the changing cast of voters does introduce some modest uncertainty into the markets,” Bank of America Merrill Lynch economist Michael Hanson wrote in a note.

Last year’s voting regional presidents were fairly more co-operative. This year’s group seems to be a little more volatile. The dispersion of views among the voting Fed presidents is particularly wide, with Dallas’s Richard Fisher and Philadelphia’s Charles Plosser on the hawkish end, Cleveland’s Sandra Pianalto in the middle, and Minneapolis’s Narayana Kockerlakota on the far dovish side, according to Hanson.

That said, Hanson predicts Yellen will aim to stay the course.

Yellen’s Challenges

Refinements to the Summary of Economic Projections and a press conference after each FOMC meeting are likely high on Yellen’s agenda.

But while the Fed’s move to transparency is a good thing, “a Fed that reacts to the markets and holds press conferences to talk about how it’s reacting to the markets is a bad thing,” said Sam Wardwell, investment strategist at Pioneer Investments.

“I think people have become too short-sighted.” Wardwell said. “Monetary policies take 12 months to work, so you really don’t need a press conference eight times a year.”

In terms of the biggest challenge facing Yellen, Wardwell believes it is to rebuild the Fed’s balance sheet.

The Fed's third round of quantitative easing began in late 2011 when its balance sheet was less than $3 trillion. Data released by the central bank showed the Fed’s balance sheet crossed the $4 trillion mark earlier this month.

“I wouldn’t call it a bubble, but they [the Fed] have to figure out how to get that balance sheet back to normal,” Wardwell said. “If you look at the European Central bank, Europe is a mess, but the ECB has got a lot of dry powder. The Fed really doesn’t.”

“The Fed needs to rebuild its reserve situation, it needs to get rates up so they can lower them again and shrink its balance sheet, so if necessary, they can expand it again,” Wardwell added.

© Copyright IBTimes 2024. All rights reserved.