JPMorgan’s Legal Troubles: How Many Legal Bombs Is Jamie Dimon Juggling? [Infographic]

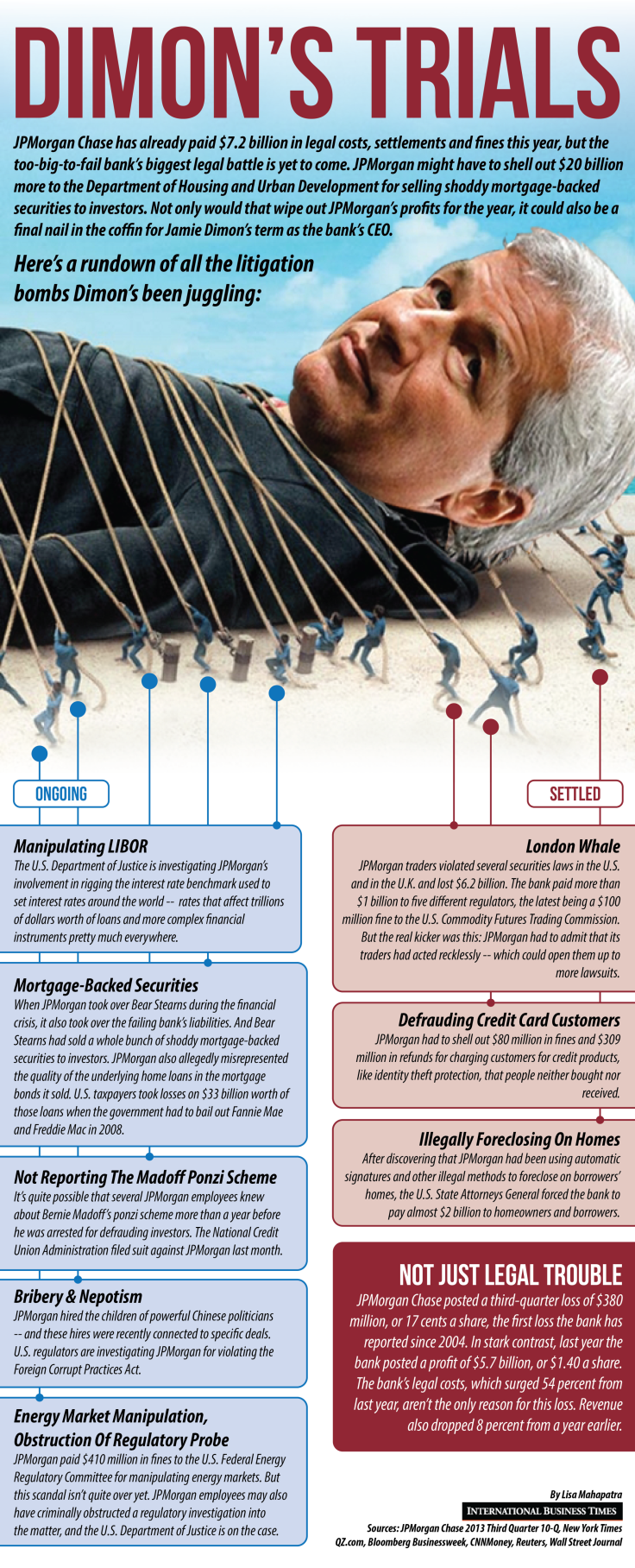

JPMorgan Chase (NYSE:JPM) CEO Jamie Dimon has been juggling lawsuits and regulatory probes all year, and it doesn’t look like there’s an end in sight.

Even though the too-big-to-fail bank shelled out more than $1 billion in fines and settlements last month, its biggest legal battle is yet to come. The Justice Department and the Department of Urban Development want JPMorgan to pay $20 billion in fines for selling shoddy mortgage-backed securities.

The details of this settlement have not been finalized, but if JPMorgan does have to pay the full $20 billion it would not only wipe out the bank’s profits for the year, it would likely put an end to Jamie Dimon’s regime as the company’s CEO.

These mounting legal costs have taken a toll on the company’s bottom line -- JPMorgan posted its first loss in almost 10 years in its third-quarter earnings statement. The bank lost $380 million in the three months ending in September, or 17 cents per share, a huge drop from the $5.7 billion it posted in the third quarter of 2012.

Here’s an infographic that details all the legal bombs Dimon’s been juggling of late:

© Copyright IBTimes 2024. All rights reserved.