Latin America Received $174B Of Foreign Investment In 2012, A New Record High

As global Foreign Direct Investment saw a decrease in 2012, Latin America hit a record number. The region received $173.361 billion, its highest ever -– an increase of 6.7 percent from the previous year, as opposed to the general shrink by 14 percent in worldwide FDI flows.

The United Nations Economic Commission for Latin America and the Caribbean revealed the numbers in its annual report presentation last week in Santiago, Chile. Executive Secretary Alicia Bárcena said that these figures attest the current good performance of Latin American economy.

However, the report points out that FDI is mostly focused on the exploitation of natural resources, particularly mining, which attracted 51 percent of investments. Manufacturing and services accounted for 12 and 37 percent, respectively. These percentages show that FDI is not contributing to a significant change in the economic structures of the region, which Bárcena pointed was one of its main challenges.

The one exception to this general figures is Brazil, where services obtained a 38 percent of the investment last year, whereas natural resources were a 13 percent. Brazil also remains the main recipient of FDI, despite being one of the few countries that saw a slight decrease (2 percent) –- the next Olympic host received 41 percent of the regional inflows, $65.2 billion.

Maurizio Bussolo, a World Bank analyst, pointed at Brazil’s transparent economic policies and relative stability during the world financial crisis as cause for foreign interest in the country. According to the economist, this is only the beginning: “Investment is looking into the future, and developing economies, such as Brazil, are that future.”

Other countries in the region are following the example, with Peru and Chile seeing the biggest increases in investment in 2012 –- 49 and 32 percent, respectively. The Dominican Republic experienced the biggest increase, with inflows swelling by 59 percent.

Although the United States and the European Union remain by far the largest investors in the region, last year registered a significant rise in FDI from the region’s own countries –- 14 percent of the investments were neighbors helping neighbors. However, most transactions cannot be traced back to a country in particular because of the increasing practice of managing investment through third countries.

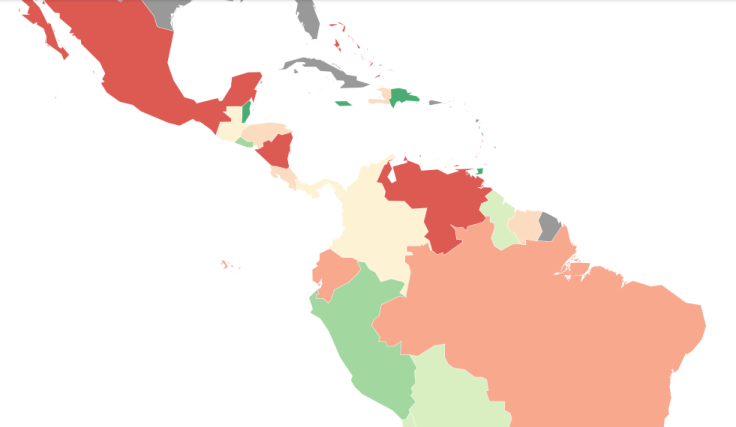

Check out this interactive map that charts out by how much FDIs grew or fell in Latin American and Caribbean countries. Green indicates that FDI grew in that country from 2011 to 2012, and red indicates that FDI fell during that period. A darker color indicates a higher-percentage increase or decrease. Click on any country to find out the exact percent change in FDI between 2011 and 2012, as well as the total dollar amount of FDI activity in 2012.

© Copyright IBTimes 2024. All rights reserved.