LinkedIn Revenue Up 45 Percent Thanks To International Expansion And Increased Hiring

When more companies hire more people, LinkedIn stands to be there to profit. The company reported a huge 45 percent increase in its revenue to $568 million this past quarter, with earnings per share of $0.52, soundly beating expectations of $557.49 million on $0.47 EPS.

LinkedIn basically makes money in three ways. Companies pay to set up their own page on the site and get access to LinkedIn's hefty collection of resumes. LinkedIn sells ads to be displayed to users browsing the site. And it also sells premium subscriptions to the users themselves, granting them much more robust access and capabilities within the site, such as the ability to message someone you aren't connected to.

It's this first arm of the business, Talent Solutions, that seems to be particularly paying off. As it grows alongside LinkedIn's expansion to international markets like China (where it currently offers a beta version of the site), analysts suggest it'll be driving the company's growth for quarters to come.

Investors cited member growth as a key metric to look at for gauging this quarter's success. LinkedIn reports 332 million registered members, making for 28.18 percent year over year growth. This number is up just 6 percent from the previous quarter, though unique visitors reached a new all-time high -- LinkedIn has 90 million of them, responsible for 28 billion pageviews.

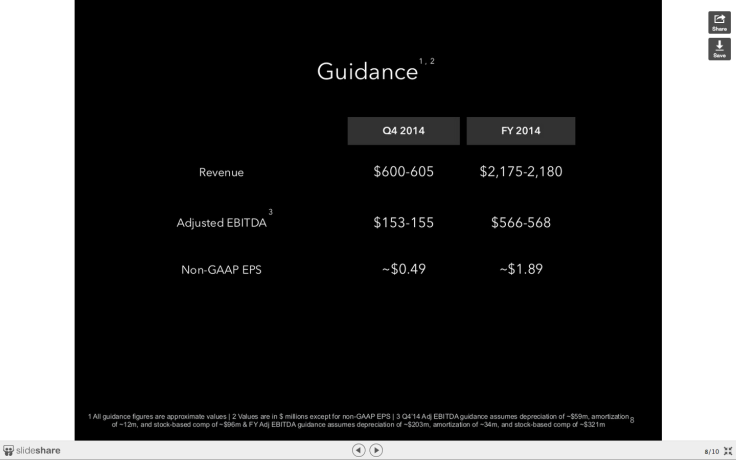

Guidance for the fourth quarter left investors dismayed at first, sending shares tumbling down as much as ten percent, though it ultimately bounced back into the positive. It expects Q4 revenue to land between $600 million and $605 million, though the numbers from Thomson Reuters call for $612 million on average. The company predicts earnings per share of $0.49, short of analyst estimates of $0.52.

© Copyright IBTimes 2024. All rights reserved.