Marijuana Legalization Bill Introduced: 'The Current System Is Broken'

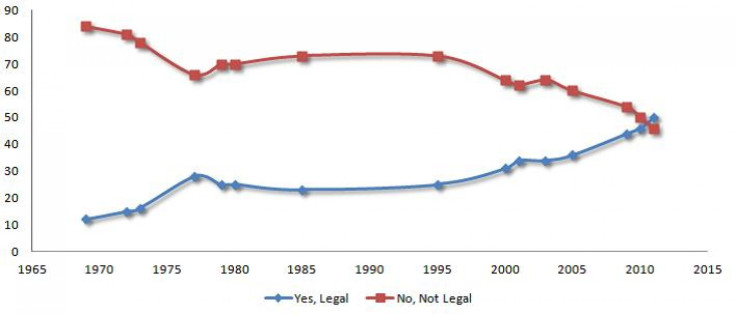

The federal Drug Enforcement Agency may still classify marijuana as a Schedule I narcotic, but public opinion -- along with 20 state laws -- suggests that a majority of Americans no longer believe that cannabis is a highly addictive substance with “no currently accepted medical use.”

In an effort to clarify state and federal jurisdiction of drug laws and combat the enormous costs associated with the arrest of and prosecution of marijuana users, two Democratic congressmen introduced legislation on Tuesday that would de-federalize marijuana policy and create a framework for the federal taxation of the substance.

“This legislation doesn't force any state to legalize marijuana, but Colorado and the 18 other jurisdictions that have chosen to allow marijuana for medical or recreational use deserve the certainty of knowing that federal agents won’t raid state-legal businesses,” U.S. Rep. Jared Polis, D-Colo., the sponsor of the Ending Federal Marijuana Prohibition Act, said in a statement. “Congress should simply allow states to regulate marijuana as they see fit and stop wasting federal tax dollars on the failed drug war.”

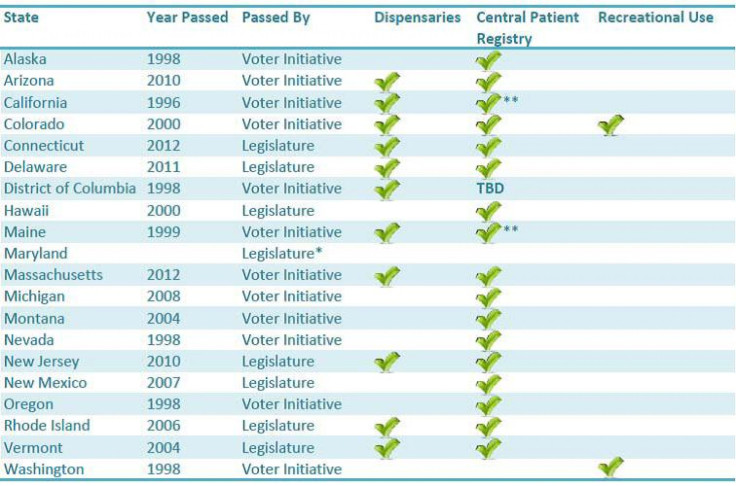

As of the November elections, 18 states and the District Columbia have legalized cannabis for medical purposes, while two -- Polis' home state of Colorado and Washington -- have legalized the recreational use of the drug. And while the DEA has classified marijuana as an illegal drug with no accepted medical use, putting it in the same group as heroin and PCP, research has shown that it is a highly effective treatment for nausea, chronic pain and insomnia and can be successfully administered to treat those symptoms in patients suffering from debilitating illnesses like cancer and AIDS.

It stands to note that cocaine, crystal meth, ketamine, opium and amphetamines are all classified as either Schedule II or lower, meaning the U.S. government believes those substances are less dangerous than pot or serve an accepted medical use. Several studies suggest marijuana is far less addictive than alcohol and tobacco, which together kill hundreds of thousands of Americans each year, according to the U.S. Centers for Disease Control and Prevention. There are no reported deaths from marijuana use.

In a report released alongside the legislation, the congressmen laid out a five-part agenda: Removing the federal ban on marijuana and taxing it the same way Congress regulates and taxes alcohol in states where it is legal; allowing states with medical marijuana laws to offer the substance without federal interference; ending the ban on industrial hemp; eliminating tax and banking restrictions that prevent medical marijuana dispensaries from operating legally; and creating a “Sensible Drug Policy Working Group” in Congress to push those initiatives.

According to Polis and U.S. Rep. Earl Blumenauer, D-Ore., the sponsor of the Marijuana Tax Equity Act, implementing those policies would have several benefits, including the following:

Lowering Massive Costs Associated With The "War on Marijuana’"

More than 660,000 Americans were arrested for marijuana possession in 2011, with a disproportionate number of those arrests occurring in communities of color (the National Association for the Advancement of Colored People estimates that African-Americans are 13 times more likely to go to jail for a drug-related offense than whites, even though statistically they are no more likely to use illicit substances). As a partial result of an uptick in marijuana arrests, drug offenders are the fastest-growing portion of the federal prison population, outnumbering prisoners locked up for violent crimes by a huge margin.

According to a 2010 Congressional Research Report cited by Polis and Blumenauer, the enforcement of marijuana laws (including incarceration) costs a minimum of $5.5 billion each year.

Marijuana legalization would also undercut the amount of cannabis imported to the U.S. via Mexico, which comprises between 40 to 70 percent of pot consumed in the nation.

“While marijuana only comprises a small fraction of the overall drug trade coming from Mexico, legalization in the United States will directly undercut these cartels. It could bring greater stability to the region and reduce the violence that has resulted in 60,000 drug trade-related deaths since 2006. It should be noted that U.S. taxpayers have given Mexico $1.3 billion in military and judicial aid over the past seven years to combat drug cartels,” states the Blumenauer-Polis report.

Clarifying The Role of State/Federal Authorities

While the federal government continues to regard cannabis as an illegal controlled substance, 19 jurisdictions now permit medical marijuana, while two states have legalized its recreational use.

But, as seen by the frequent raids of medical pot dispensaries in California, the line between federal and state jurisdiction on this issue is vague to the point of being nonexistent.

“Strict enforcement will become increasingly difficult and costly as more states legalize marijuana,” states the report, adding that officially legalizing the use of the substance, while providing no legal framework for its sale or cultivation, will strengthen the black market and “create barriers to entry for those who seek to grow and sell marijuana legally.”

The confusing state of marijuana law enforcement also makes it nearly impossible for cannabis businesses to operate legally, since the federal tax code currently does not allow businesses to deduct expenses associated with the trade on their federal taxes. Federal banking provisions also make it difficult for marijuana businesses to obtain a bank loan, register an account with a bank or obtain insurance coverage.

Economic Benefits

An estimated 40 percent of Americans over the age of 12 have used marijuana at some point of their lives; marijuana is the most popular recreational drug in the U.S. after alcohol and tobacco. Research indicates that this number isn’t going to decline anytime soon.

The Congressional Research Service estimates that the revenue from taxing marijuana at approximately $50 per ounce could generate $20 billion a year. That doesn’t include the savings generated by reduced expenditures on enforcement and incarceration.

“This represents a unique opportunity to save ruined lives, wasted enforcement and prison costs, while simultaneously creating a new industry, with new jobs and revenues that will improve the federal budget outlook,” the report states.

Hemp production could also benefit the economy. Current federal marijuana laws make hemp, which is cultivated from the cannabis plant and contains negligible amounts of the psychoactive ingredient THC, illegal to grow industrially in the U.S. And yet, more hemp is exported to the U.S. than any other country.

The sales of hemp food and body-care products took in $43 million in 2011, according to the report. Some advocacy groups estimate that the total American retail market for hemp is valued at more than $400 million.

© Copyright IBTimes 2024. All rights reserved.