Merck's $9.5 Billion Cubist Deal Is Really About The Global War On Drug-Resistant Bacteria

Merck & Co. is paying $8.4 billion in cash and assume $1.1 billion in net debt to acquire Cubist Pharmaceuticals Inc. and join the fight against drug-resistant bacteria — a growing global threat that's slowly fueling a lucrative pharma business.

On Monday, the New Jersey-based pharma giant announced plans to buy the biotech company, which has been developing medicines to fight so-called superbugs, or diseases that no longer respond to traditional antibiotics. Lexington, Mass.-based Cubist’s chosen area of research was once deemed unprofitable, but in recent years the spread of drug-resistant bacteria has become a significant focus for health officials and economists around the world.

In a report earlier this year, the World Health Organization (WHO) called drug-resistant bacteria “a problem so serious that it threatens the achievements of modern medicine.” The WHO warned that in many parts of the world certain strains of bacteria are developing a resistance to common medicines used against them, rendering the drugs useless.

“In some settings, few if any of the available treatment options remain effective for common infections,” the WHO stated.

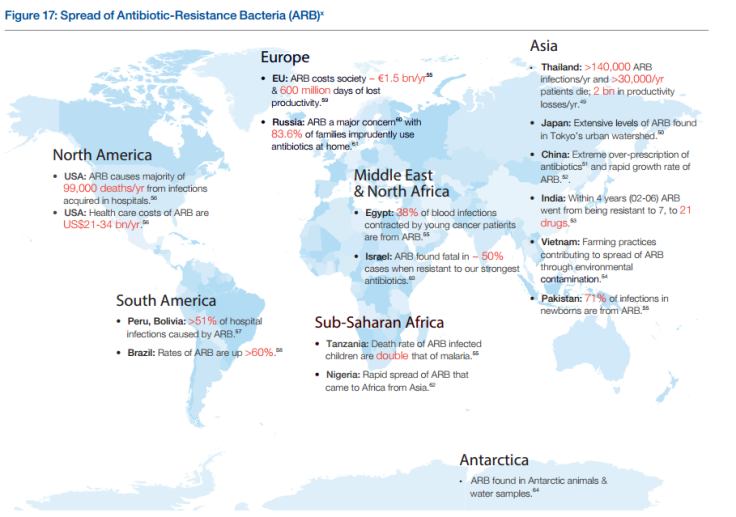

A recent Princeton study noted that between 2000 and 2010, consumption of antibiotic drugs increased 36 percent, with Brazil, Russia, India, China and South Africa accounting for 76 percent of the increase. Some research shows the rising demand could be due to fewer restrictions on antibiotic use. A study in China found, for instance, that 98 percent of patients in a Beijing children’s hospital were given antibiotics for a common cold. In India, where antibiotics do not require a prescription, pharmacy sales of the drugs increased six times between 2005 and 2010.

But despite the increase in use, new research has been lacking, according to the U.S. Centers for Disease Control and Prevention.

“The problem is defined by challenges on both demand and supply sides of the equation,” the CDC said in a joint statement with 25 other national health organizations. “Just as antibiotics are frequently overused, there are few new drugs in the development pipeline.”

One reason: economics. Large pharmaceutical companies tend to pursue a wide variety of other health issues, such as cancer, which generate more reliable revenue. The World Economic Forum (WEF) identified the problem in its 2013 “Global Risks Report.”

“Drugs to treat chronic illnesses such as diabetes and hypertension increasingly offer a greater potential return on investment for pharmaceutical companies,” the report says. “They have the potential to rapidly achieve wide market penetration, whereas any new antibiotic is likely to be kept as a last-resort treatment, which will be used for only a few weeks even in that setting, resulting in low sales for companies.”

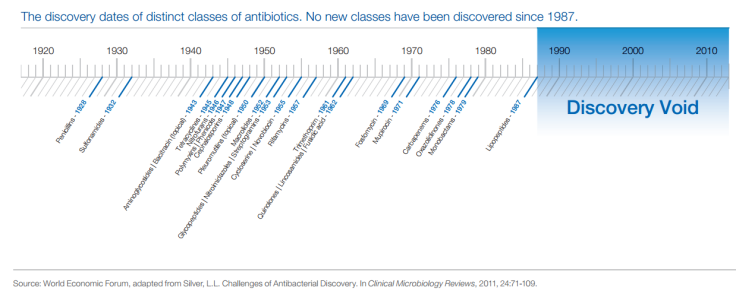

The lack of economic incentive, according to the WEF, has created a “discovery void” for antibiotics in recent decades.

Even so, the WEF reports that the problem is getting expensive. It estimates that antibiotic-resistant bacteria costs Europe $1.84 billion every year in lost productivity, while Americans pay more than $21 billion every year in health costs fighting this problem.

With increased interest in the problem, smaller companies are coming to the forefront. Cubist, for its part, has been focusing on fighting “superbugs” for decades.

“The danger is real, and growing,” its website reads. Roughly 80 percent of the company’s revenue comes from Cubicin, a drug designed in 2003 to treat skin infections and later (in 2006) approved for use on bloodstream infections.

As concern over drug-resistant bugs grows, Cubist and other companies will benefit from increased demand, especially as problems associated with drug-resistant bacteria become more costly.

Cubist isn’t the only antibiotics researcher getting attention. In 2013, GlaxoSmithKline PLC solidified a partnership with the U.S. Department of Health and Human Services, in a $200 million agreement meant to help develop drugs that can fight antibiotic resistance. And this past February, the Swiss pharmaceutical company Debiopharm Group announced plans to work with Canadian firm Affinium to develop new, stronger antibiotics.

“We are convinced that it is crucial to develop innovative targeted antibiotics which preserve indigenous gut microbiota and overcome resistance to broad-spectrum antibiotics,” Debiopharm said in a public statement at the time.

On Sunday, the U.S. Food and Drug Administration approved the use of Actavis Antibiotic, a joint-venture between AstraZeneca and Actavis, for the treatment of certain infections caused by drug-resistant pathogens.

© Copyright IBTimes 2025. All rights reserved.