Money-Saving Apps: Can Americans’ Financial Problems Be Fixed By The Power Of Automation?

Americans are a pretty conservative bunch. Given the choice, most wouldn’t swim in shark-infested waters, and bungee jumping isn’t a common hobby.

Yet nearly half of Americans are living on the edge when it comes to their finances.

According to the Federal Reserve Board, 46 percent of Americans would not be able to come up with $400 to cover an emergency or an unexpected expense. For some, low wages and heavy debt loads make living paycheck to paycheck the only option. But a lack of savings isn’t always a result of limited resources. Many people wouldn’t think twice about shelling out $400 or more for a flat-screen television or a monthly car payment.

For those who struggle to save money, a new category of apps might provide a solution. Since launching in 2015, automated savings apps like Digit and Qapital have shown early success at improving saving behaviors. While the apps may not work for everybody, for a certain type of consumer they could mean the difference between financial vulnerability and financial security.

“If you really want the majority of people to have good financial health, you need to make financial health effortless,” said Ethan Bloch, founder and CEO of Digit.

The easiest way to make money management effortless, of course, is to take the human factor out of financial decision-making. Few industries are as well suited to innovation as personal finance, and as is true elsewhere, young adults between the ages of 18 and 35 are leading the charge. At least 80 percent are using the internet to manage their finances and pay bills, according to a recent Gallup report.

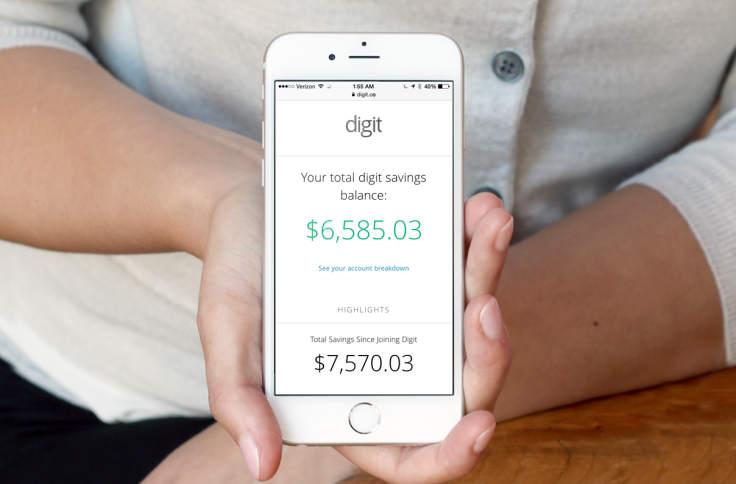

Of the money-saving apps now available, Digit takes an "out of sight, out of mind" approach, while Qapital focuses on goal-based savings. Digit’s algorithm analyzes your income and expenses to determine how much you can afford to save, and then sweeps a small amount of money from your checking account every few days, reimbursing any overdraft fees that may be triggered. Qapital requires users to specify their goals and set a visual reminder to help encourage better spending decisions throughout the month. Both apps are currently free to download and use. They make money by earning interest on the cash you save.

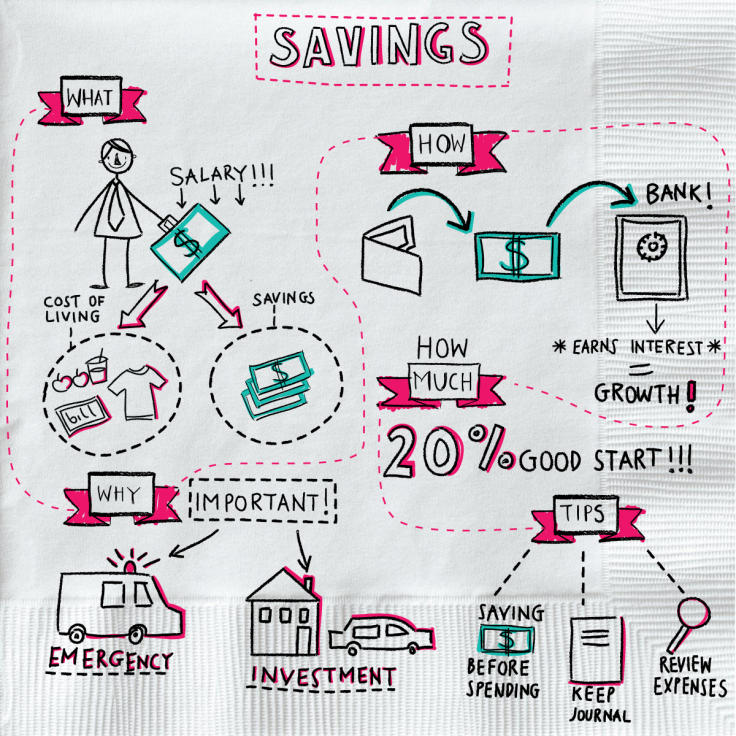

These new technologies may be particularly helpful for consumers who don’t respond well to traditional financial literacy programs, according to Tina Hay, the founder of Napkin Finance, which takes a fresh approach to educating Americans about money. A visual learner, Hay found herself struggling to learn finance while in business school. That’s a problem that extends beyond college classrooms, to banks and financial institutions as well. Hay is on a mission to simplify complex financial topics into small visual lessons, something she says the user experience of automated savings apps helps with as well.

“A lot of people don’t think in numbers, especially when it comes to money. It’s much easier to understand things when they’re illustrated, quirky and fun,” Hay said. “The apps are much more user-friendly, and the interfaces are much more inviting. A lot of tools involve behavioral economics, making them more personalized to people’s needs versus just being more general. The problem is there’s no one-size-fits-all model.”

Testing out a few different apps may be necessary in order to find the option that's most effective for you. Keeping track of the new accounts you create in these apps is essential, so your private financial data isn’t floating around too many different places. Although these apps say they'll keep your data private, they do use it to guide product development.

Early data from users indicates that automated savings apps have potential. The typical behavior for Digit users, according to Bloch, is to let their account grow for three months, and then withdraw some of the money to cover something like credit card debt, student loans or a financial emergency. While goals like travel are commonly cited at signup, most people are using the app as a way to manage their short-term liquidity challenges.

By helping people save without thinking about it, Digit may have stumbled upon a solution to the $400 problem that has long eluded other organizations. Qapital's goal-based approach to savings, on the other hand, resonates with a different type of saver.

“It has to be emotional,” said George Friedman, CEO of Qapital, who aims to give users a dose of reality with their savings accounts. Having some money set aside for travel might be a great idea, he said, but if you spend the entire amount on a big trip, then you could find yourself in a dire situation if an emergency comes up. “Two or three bad decisions and then you're just playing catch-up for 10 or 15 years and you’re one of the 'can’t raise 400 bucks' people.”

Digital solutions offer something else that financial literacy programs rarely have: accountability. Tracking whether financial education actually works — or whether consumers change their behaviors after the program — isn’t easy to do. An app, on the other hand, will fail or succeed based on its merits as a tool. Digit has been growing exponentially, having saved more than $125 million for users, it says, since it launched in February 2015. Its expansion is likely to continue with a new $22.5 million B-round led by Ribbit Capital. Qapital is growing as well, and more apps are likely to pop up in the future.

In a race to acquire new users, savings apps are hoping to establish themselves as a more effective bank of the future, and a one-stop shop for all things financial. “There is an optimal answer for every financial question you have as an individual,” said Bloch. “It’s not even complex math. We’re literally saying: Here is your debt, here is your income, here is your other spending, subtract subtract subtract, control for interest ... OK this is what you should do.”

As anyone who has ever relied on a calculator knows, machines are pretty great at math. And if they make our lives a little easier, and a little more financially secure, then all the better.

The thing is, if you’re already good at saving, you’re probably better off with an online savings account that will pay you more in interest. But for the 46 percent of Americans who don’t have $400 to spare and have trouble saving, it’s worth seeing if an app can help.

© Copyright IBTimes 2025. All rights reserved.