New York City Public Pensions To Consider Gender And Ethnic Diversity In Investment Choices

It’s a truism among public pension managers that the key to safe investing is keeping a diverse portfolio. But New York City's pension custodian, Scott Stringer, is looking for more than a prudent mix of stocks and bonds. In an initiative announced Friday, Stringer said his office will now consider the firm's share of women and nonwhite employees when it picks investment managers.

“We’re going to ask the people who help us choose where to invest our money to show us that they walk the talk when it comes to diversity,” Stringer said in a release.

Stringer’s initiative is the first of its kind, according to the National Association of State Retirement Administrators. Pension boards already play a role in pushing corporate boards to be more diverse, but few, if any, have held their asset managers to the same standards.

The Wall Street firms that win a lion’s share of pension investments make up one of the whitest and most male-dominated sectors in the nation. In 2011, the financial services industry was 81 percent white, while 72 percent of upper-level managers were men, according to the Government Accountability Office.

But a wealth of evidence suggests that diversity doesn’t just make social sense: It makes financial sense.

Studies have found that women traders deliver higher returns, take fewer unwise risks and break fewer rules than men. Gender-diverse companies in all industries are 15 percent more likely to outperform competitors. That figure rises to 35 percent for ethnically diverse companies.

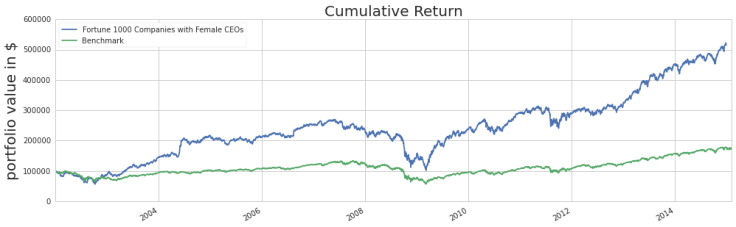

The trend is particularly striking for companies with female CEOs. Data compiled by Karen Rubin of the hedge fund Quantopian found that investments in Fortune 1000 companies headed by women delivered returns about three times better than investments in the overall S&P 500.

Researchers have even found that countries with racially homogenous financial sectors are more prone to stock-market bubbles and cataclysmic crashes, like the financial crisis of 2007-2008.

“Diversity is not merely a social value; it has strong economic value for our investments,” Stringer said.

The initiative, part of the comptroller’s larger effort to deliver greater returns for the $160 billion public employees pension fund, might also put pressure on an investment community that has resisted efforts to shine a light on its diversity issues.

One particularly homogeneous corner of the financial world is hedge funds and private equity firms, which Stringer’s office has singled out over excessive fees and underwhelming returns. For every hedge fund led by a woman, there are over 30 male-headed funds. In private equity, women make up a scant 11 percent of senior management, according to Bloomberg.

Stringer’s office plans to issue surveys to the roughly 300 money managers that control New York pension funds to gauge their gender and racial diversity. Though Stringer said he wouldn't sever contracts based on the surveys, the results would impact future investment decisions.

© Copyright IBTimes 2024. All rights reserved.