Oil Price Outlook Is Still Uncertain As Global Demand And Supplies Both Surge, Energy Agency Says

Oil demand is likely to surge this year as the global economy steadily improves. But whether the world’s thirst for crude will be enough to prop up sluggish oil prices is still unclear, the International Energy Agency said Wednesday.

Oil prices have plunged 50 percent since last year amid waning global demand and an unprecedented boost in supplies. Given that drop, “one might be hoping for more clarity on supply and demand,” the agency, based in Paris, said in its monthly Oil Market Report. “Yet in some ways, the outlook is only getting murkier.”

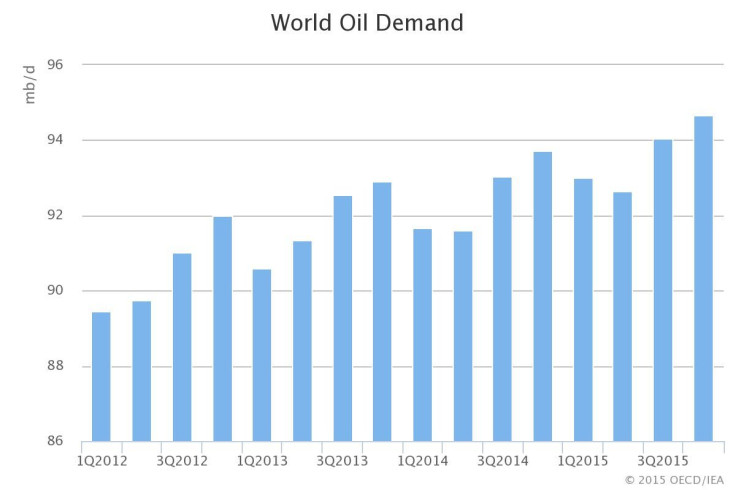

The IEA raised its forecast of global oil demand to 93.6 million barrels per day in 2015, a gain of 1.1 million barrels a day on the year. The agency called the jump a “notable acceleration” from 2014’s growth levels of 0.7 million barrels per day, attributing the rise to growing demand in China, India and Europe and a spate of colder temperatures in the first quarter, which prompted homes and factories to burn more energy for heat.

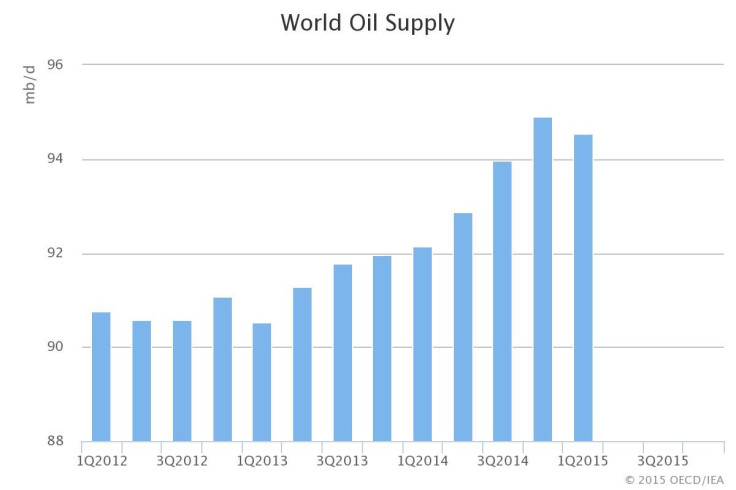

Crude oil output is likewise on the rise. Oil supplies surged by 1 million barrels a day in March, to a monthly total of 95.2 million barrels a day, thanks largely to soaring production in Saudi Arabia, Iraq and Libya. Year-on-year gains in oil output, which totaled 3.5 million barrels a day, were split between OPEC nations and non-OPEC nations, such as the United States.

The IEA said it remains to be seen if the boost in global oil consumption will stimulate higher prices, or whether the growth is merely a temporary blip. “The demand response has taken the market by surprise. Unexpected pockets of demand strength have emerged,” the report said. “Should those be seen as a sign that the demand response to lower prices will prove more robust than expected, or rather as a temporary aberration that will lead back to renewed weakness later on?”

A decline in output, however, could alternately boost prices, as evidenced by the price hike Wednesday on news of falling U.S. production.

Brent crude futures, an international benchmark, jumped more than a dollar to $59.78 in afternoon trading in Europe after the U.S. Energy Information Administration reported lower-than-expected builds in U.S. crude stocks. The agency said crude stocks rose 1.29 million barrels to nearly 484 million barrels in the week of April 6-10. Earlier forecasts put the crude-stock gains at 4.1 million barrels, a Reuters survey of analysts found. U.S. crude futures rose $1.60 to hit $54.89 a barrel Wednesday.

The U.S. agency, based in Washington, this week forecast that U.S. shale production would drop by 45,000 barrels per day to 4.98 million barrels per day in May, marking the first monthly decline in four years. In North Dakota, one of the states leading America’s shale boom, oil production fell by 15,000 barrels per day in February from the previous month.

The IEA said “considerable uncertainty” remains about production in other oil-rich nations, particularly in Iran. Western sanctions against Tehran’s nuclear program have significantly hampered Iran’s output and exports of oil in recent years. If the U.S. and Europe finalize details of a tentative nuclear deal with Tehran this summer, Iran could sharply expand its production and further strain a market that’s grappling with oversupply.

“Recent developments thus may call into question past expectations that supply-and-demand responses would tighten the market from mid-year on,” the global agency said in its report. “Advances in talks on Tehran's nuclear program … may already have encouraged other producers to hike supply and stake out market share ahead of Iran's potential return. All in all, that suggests the market rebalancing may still be in its early stage.”

© Copyright IBTimes 2025. All rights reserved.