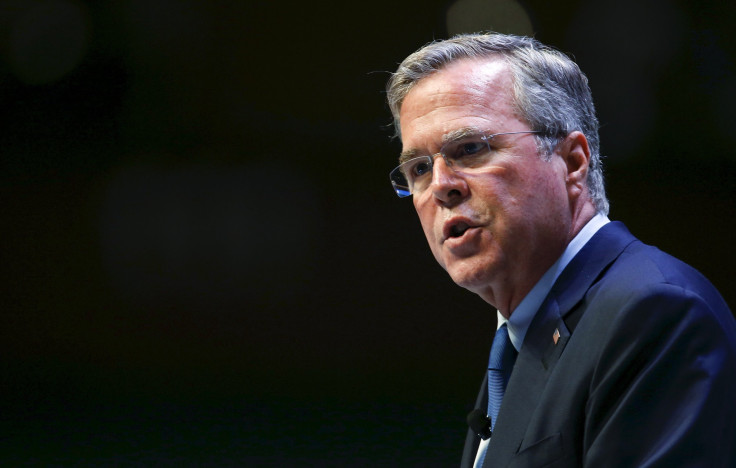

Jeb Bush Criticized 'Ridiculous' Wall Street Payouts; Now Is Backed By Big Banks

With a $114 million campaign war chest filled with dollars from corporate executives, Jeb Bush is not generally thought of as a populist. But a decade before mounting his presidential bid, he sought to rein in “excessive” Wall Street pay, using language expected more from Elizabeth Warren than the former Florida governor.

In 2005, Bush expressed disgust when he received an email about Morgan Stanley’s plan to send off a top executive with a $32 million pay package. "It is ridiculous, the payouts,” Bush wrote. “Don't you think shareholders can rebel against that kind of action?"

Bush then asked the director of the state’s pension agency, “How do we deal with excessive-pay issues?" Months later, Bush requested that the agency study whether executives at firms in which it had invested were being overpaid in comparison with their companies’ performance, and potentially use its powers as a shareholder to try to oppose unreasonable compensation plans.

The following year, Bush called exorbitant compensation for financial executives “a threat to capitalism.” He said: “If the rewards for CEOs and their teams become extraordinarily high, with no link to performance -- and shareholders are left holding the bag -- then it undermines people's confidence in capitalism itself.”

After Bush left the governor’s mansion, he joined Lehman Brothers on Wall Street, where he collected a $1.3 million salary. As he campaigns for president now, he relies extensively on support from financial executives, including those working for firms that were bailed out by the U.S. government in 2008 and 2009 during the recession. Bush's campaign has been silent on the topic of CEO pay, even as his opponents -- from Donald Trump to Hillary Clinton -- have raised the issue.

The reforms Bush has recently proposed to make the government more accountable to the public consist primarily of tax cuts that would benefit the wealthy and promises to roll back regulations on the private sector, including the financial services industry.

Bush has pledged to “work with Congress to repeal significant portions of the 2010 Dodd-Frank financial law.” Dodd-Frank, passed in the wake of the financial crisis, includes a rule requiring companies to give shareholders the opportunity to vote on executive pay packages. Bush’s campaign did not respond to questions from International Business Times about whether he intends to keep that provision.

Before Lehman Brothers’ collapse, Bush worked for the investment bank as a consultant. Trump, his Republican primary opponent, has called that Lehman gig “a no-show job” and suggested it was a reward for sending the state’s pension dollars to the firm as governor.

Bush moved from Lehman to Barclays, where he earned $2 million annually. The British banking giant, which absorbed parts of Lehman after its collapse, borrowed hundreds of billions of dollars from the U.S. Federal Reserve during the financial crisis.

© Copyright IBTimes 2025. All rights reserved.