Angry Protesters Confront Spain's Foreclosure Policies

A Spanish activist group fighting against bank-ordered evictions has stepped up its protest activity and embraced law-breaking -- and sometimes violent -- methods to stop the physical removal of families from their homes.

To Shame Banks, Flash Mobs Reward Depositors Who Close Accounts With Gifts, Drama

In long forgotten days, before most bank profits came from risky speculation and taxpayer bailouts and those institutions still lived or died by their ability to attract depositors, customers who opened new checking accounts were often given toasters as tokens of appreciation.

US Economy Is In Recession Right Now: Business Cycle Expert

The U.S. is currently in a recessionary cycle and, no matter what they say, there's nothing policymakers can do to stop that. That's according to Lakshman Achuthan, co-founder of the Economic Cycle Research Institute.

Monti Says Italy Might End Up Tapping Bailout

Italian Prime Minister Mario Monti told reporters Tuesday that Italy won't need a Greek-style bailout, but said the country may need to tap into the European Stability Mechanism (ESM), Europe's all-purpose bailout bucket, asking the fund to subsidize sovereign borrowing by buying Italian government bonds.

With New Jets Flying Off the Shelves, Aerospace Giants Push Suppliers To Ramp Up

Airbus and Boeing are ramping up their global supply chain efficiency to meet a huge number of orders.

World Economies Slowed In May, Even White-Hot Brazil Disappoints: OECD

The world's major economies extended their slowdown in May, with conditions deteriorating significantly in India and Italy, according to a statistical indicator released by the Organisation for Economic Co-operation and Development on Monday. Even in Brazil, one of the few economies surveyed that is expanding, the pace of growth slowed.

Boeing Announces Big 737 Sale In Europe

Boeing Company (NYSE: BA) has extended its lead in 2012 orders over European rival Airbus SAS with a multibillion-dollar commitment from a leasing company that the Chicago-based company revealed this week in Airbus' backyard.

America: Number One In Wealth, Richer Than The Next Four Nations Combined

The U.S.A. remains the world's richest country, with more wealth than the combined treasures of the next four richest nations -- Japan, China, Germany and the UK. And most of its wealth comes from the potential of its people.

Ex- Barclays CEO Blames Bank of England for Libor Debacle

The British Parliament, might not be the place one would expect to see fireworks lit on July 4. But that's what's likely to happen Wednesday, when the former CEO of Barclays plc (NYSE:BCS), who resigned Tuesday, is expected to tell the House of Commons its fraud was partly done at the bequest of the Bank of England.

Why Exactly Are Heads Rolling At Barclays? Libor Scandal Explained

Following the revelation last week that British banking giant Barclays was engaging in massive fraud meant to distort the Libor, the interest rate underpinning hundreds of trillions of dollars in credit transactions, politicians and regulators the world over are taking a sober look at the system. What they find may prove to be shocking.

Crisis in Europe Finally Dragging America Down: Economists

The whirlpool created by the European financial crisis is finally dragging American down. That?s the conclusion of some economists, after disappointing manufacturing activity data showed a slight contraction in June.

In Slight To Occupy Wall Street, New Yorkers Say Cage Around Iconic Wall Street Statue No Longer Needed

Manhattan community leaders began pressing Sunday for the cage around the iconic Charging Bull statue in the middle of New York's financial district to be removed.

Egyptian President, First Democratically Elected Civilian In Nation's History, Sworn In During Defiant Ceremony

Mohammed Morsi, the new Egyptian president, was formally sworn into office on Saturday and then spirited away to Cairo University, where he delivered a speech that both praised and condemned the nation's military, as he showed he had no fear of it.

John Roberts Flip-Flopped On Health-Care Law Decision: CBS

U.S. Chief Justice John Roberts was originally set to vote with the Supreme Court's conservative justices to strike down the Affordable Care Act, CBS News reported. However, he changed his mind about a month ago to join the court's liberal justices in mostly upholding the constitutionality of the law.

As US Fries In Heat Wave, Half A World Away, Eggheads Wonder If Global Warming Is Real

Thousands of miles away, a cadre of international Nobel laureates assembled to discuss global warming were having a, er, heated debate, arguing over data that the vast majority of scientists the world over say shows clear evidence of manmade climate change. But in the steaming streets of Brooklyn, the crowded public pools of Atlanta and the power outage-hit suburbs of Washington, D.C., the discussion was unanimous: It was hot.

Obamacare 'Tax Increase' Debate Heats Up Sunday Morning News Shows

It's not a tax. It's a penalty. President Barack Obama's administration and its allies in Congress carpet-bombed the morning news talk show Sunday with those seven words, holding the line in a PR counter-offensive the White House has been engaging on since Friday.

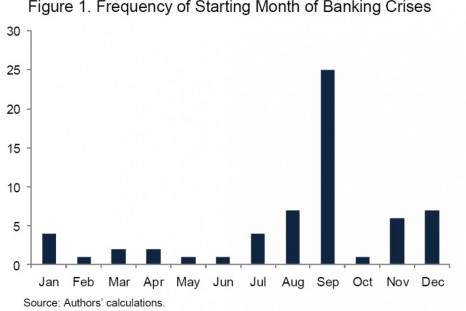

Collapse Of Financial System Will Come In August, Maybe September: Market-Watchers

Disappointed by the lack of aggressive action by the U.S. Federal Reserve during the meeting of its powerful rate-setting committee last week, and expecting little more than rehashed promises from the leaders of Europe this week, pessimistic market-watchers are turning to once again guessing when the clock atop the Eurozone time-bomb will finally run to 0.

British, US Banks Fall Hard On News of Barclays Fraud

Investors in Barclays PLC (NYSE: BCS) (London: BARC) lost over £4 billion Thursday as the British bank lost one-sixth of its market capitalization a day after international regulators announced the bank would have to pay hundreds of millions as a fine for an audacious price-fixing fraud some of its traders were found to have engaged in.

Profits at State-Owned Chinese Companies Decline

Higher costs and a spike in taxes are squeezing the bottom line at China's state-owned companies, the Xinhua news agency reported on June 15, driving down profits and slowing down the rate of growth in operating income.

Morgan Stanley Getting Hit From All Sides

It's not turning out to be a good week for Morgan Stanley (NYSE: MS). Over the past few days, the bank has been embroiled in two international scandals and cut by analysts at Goldman Sachs. That follows a month that saw a major credit downgrade, participation in the fumbled IPO of Facebook Inc. and behind-the-scenes grumbling by the FDIC. The bank has lost more than one-third of its market capitalization since late March.

Italy To Bail Out Old, Broke and Crooked Bank

Banca Monte dei Paschi di Siena SpA, a 540-year-old financial institution commonly called Europe's oldest bank, was the newest Continental house of finance to receive a government bailout, after the Italian Treasury granted the bank a ?3.9 billion ($4.87 billion) credit lifeline Tuesday. The rescue came even though Monte dei Paschi is seen as basically insolvent by the markets and is led by a banker currently under criminal indictment.

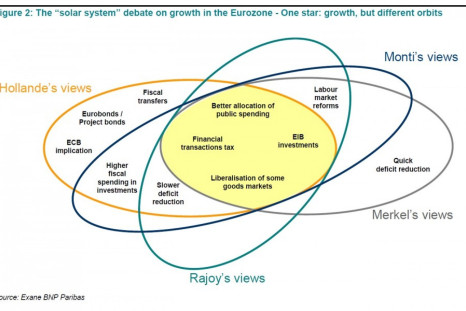

Why Can't Europe's Leaders Figure Out How To Solve the Crisis? BNP Paribas Explains

An eye-catching illustration included in a report by BNP Paribas Exane explains why the Continent's leader seem unable to solve the ever-worsening eurozone crisis: in spite of being ostensibly committed to the same goals, top policy-makers disagree on the more aggressive policies most experts believe are needed. It's almost like they're on different planets.

Job-Killing Austerity Is Making Contagion In Europe More Pronounced, Economists Find

Spikes in unemployment might be a necessary evil to austerity reform measures meant to control the European financial crisis. But, when push comes to shove, those high levels of joblessness are actually making contagion of the crisis amongst countries worse.

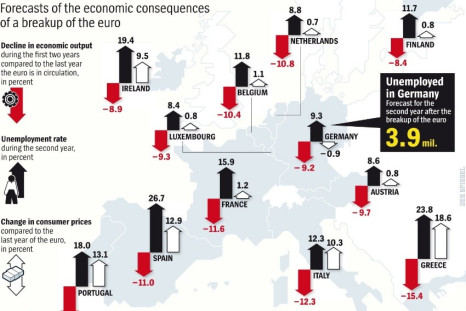

Horrific Unemployment, Stagnation, Inflation Seen In Euro Zone Collapse

A graphic published by Der Spiegel, Germany's top newsweekly, is making the rounds among global financial blogs and Facebook walls, succinctly putting into numbers the horrific economic carnage a collapse of the common currency union would entail.

Europe Has Three Days, Not Three Months, to Avoid 'Fiasco': Soros

Multibillionaire financier George Soros, who is quickly becoming an éminence grise on the topic of the euro zone financial crisis, said in a televised interview Monday that the leaders of Europe had three days to resolve their disagreements on the appropriate way to move forward in anticipation of a summit Thursday.

Moody's to Global Leaders: Stop Threatening Your Banks With Capitalism

Thursday's downgrade contained a veiled threat that pointed at politicians in Germany, the United Kingdom, France and the United States and plainly stated, Stop talking about making the banks responsible for their own follies -- or else.

ECB Eases Lending Standards

The European Central Bank said Friday it was easing the collateral rules on certain asset-backed securities currently pledged by banks as backing for ECB loans. Specifically, the bank will accept lower-quality securities as collateral for loans made to banks without demanding higher cash collateral, as had been the case in the past.

'Sugar High' Is Only Fleeting in Skeptical Markets: Economist

Markets are losing the power to ride high after positive political developments, a worrying trend that might rain chaos on the best laid plans of central bankers and politicians looking to buy time to solve the financial crisis in Europe with grandiose statements.

ECB May Toss Rule Book On Bond Collateral: Report

The European Central Bank may soon ease its lending standards in what appears to be an effort to prevent Spain's sovereign debt crisis from worsening, according to reports published Thursday. But the move could also impair the credibility of ECB.

China To Lower Standards For Foreign Investors In National Markets

Chinese market regulators announced Thursday they could be easing the rules that currently allow only a small group of foreign banks to invest in the national equity and bond markets, a move that is seen as part of a wider campaign to open the country's financial system to global competition. Whether by design or by coincidence, however, the move also takes a tremendous amount of pressure off the country's central bankers, who are between a rock and a hard place in deciding whether or n......