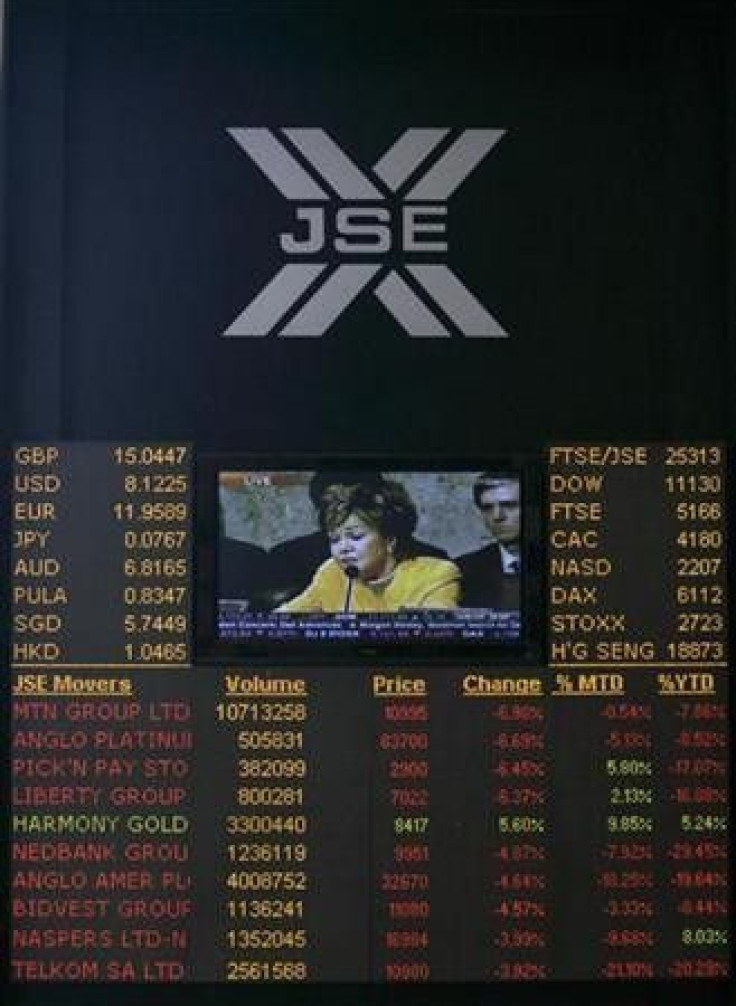

S.Africa stocks hit month low on China data

Johannesburg stocks fell to their lowest close in a month on Wednesday, as weak Chinese factory data sparked concerns about demand from the world's second-largest economy, hitting miner Assore and luxury good maker Richemont.

Johannesburg-traded shares of global miner BHP Billiton were also squeezed by news that Australia's lower house of parliament approved plans to impose a 30 percent tax on the iron ore and coal sectors.

Manufacturing in China shrank at is sharpest pace in 32 months in November, data showed, reviving fears that a slowdown in the country would curb demand for South African resources.

I don't know if one piece of manufacturing data is going to make you very, very scared but it does prove the point that everyone is banking on the massive growth, said Nic Norman-Smith of Lentus Asset Management.

If it doesn't pay off, you could see a lot pain in some of the share prices that are heavily geared to (China).

Johannesburg's Top-40 index shed 1.4 percent, or 393.42 points, to 27,608.68, its lowest close since October 20. The broader All-Share index was down 1.3 percent to 30,956.19.

Shares of iron ore miner Assore tumbled 3.8 percent to 200.98 rand, becoming the biggest percentage decliner on the Top-40. The company more than doubled its full-year profit in August, as stong demand from China drove the price of the steel-making ingredient higher.

Johannesburg-listed shares of Swiss luxury goods maker Richemont slid 3.1 percent to 40.57 rand.

The maker of Cartier watches and Mont Blanc pens saw its Asia Pacific sales surge 60 percent in the first half of this year, buoyed by robust demand from Chinese consumers.

News of an undersubscribed bond auction in Germany also weighed on sentiment.

It's just a lot of bad news following yesterday's weak data and that has hit the market, said Nick Kunze, head of dealing at BJM Private Clients, referring to a downward revision of U.S. GDP growth on Tuesday.

Petrochemicals group Sasol was a ray of sunshine in an otherwise grey Johannesburg Stock Exchange, rising 0.8 percent to 368 rand after flagging that its half-year profits would rise by at least 45 percent.

It gained the most ground among blue chips. Only one other Top-40 member, brewer SABMiller, finished in positive territory, with a 0.45 percent rise to 276.25 rand.

Only 66 companies saw their share price rise, another 202 firms fell and 63 were unchanged. Trade was relatively busy with 210.5 million shares changing hands.

BJM's Kunze said he expected trade to slow down for the rest of the week as U.S. markets take a break on Thursday.

We can expect a weak close and very small volume as tomorrow is Thanksgiving in America and most traders I imagine will take Friday off as well, he said.

© Copyright Thomson Reuters 2024. All rights reserved.