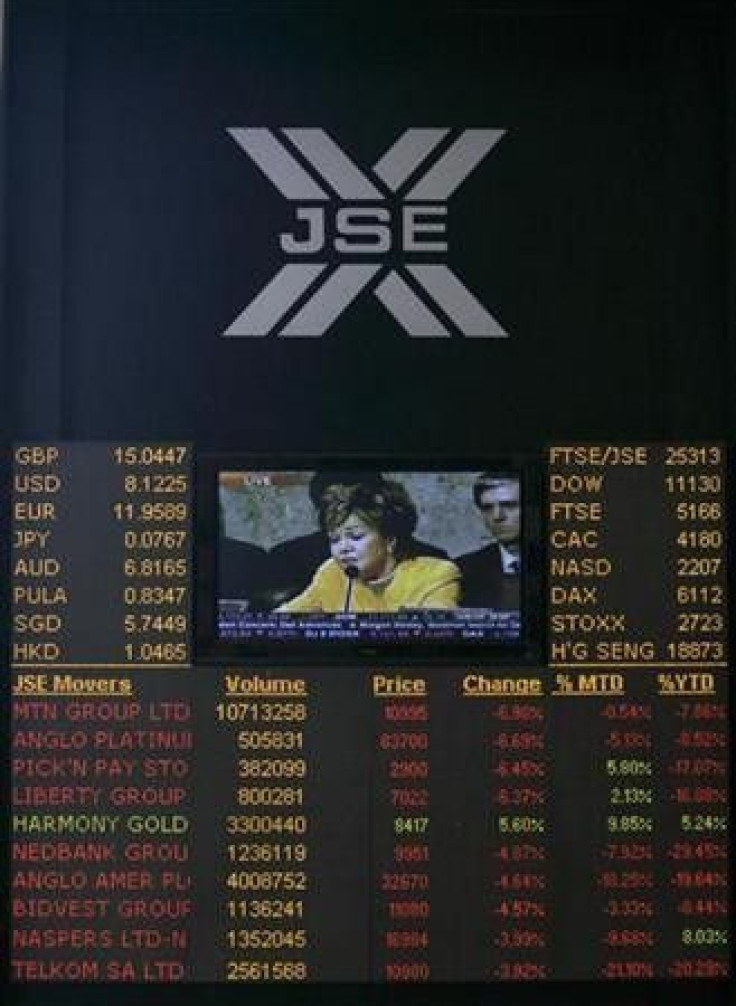

S.Africa stocks rebound, track global equities

South African share prices rose on Wednesday with investors snapping up stocks they felt had been over-sold and as positive sentiment seeped back into global markets after Europe said it would protect the region's lenders from the euro zone crisis.

Miners and banks led the rebound at Johannesburg's bourse, which has taken a beating in recent weeks. As of Wednesday's close, the Top-40 index of blue chips had fallen over 5 percent from the end of August.

Some of these valuations are looking a little bit juicy and giving investors waiting on the sidelines with a bit of cash an opportunity to buy, said Sasha Naryshkine, an asset manager at Vestact.

The Europeans are still flipping and flopping. That's not helping anyone, (but) we've been comfortably buying at these levels. There will ultimately be a resolution in Europe.

The Top-40 index finished up 1.2 percent, or 314.22 points, at 26,233.80. The broader All-Share index gained 1 percent, or 290.29 points, to 29,468.56.

Markets were bolstered by news that European finance ministers had agreed to safeguard their banks, hours after Franco-Belgian municipal lender Dexia became the first bank in the region to be bailed out due to the debt crisis.

Better than expected U.S. private sector payrolls data has also reinforced investors' appetite for riskier assets in emerging markets such as South Africa.

Johannesburg's banking index rose 1.2 percent with RMB Holdings gaining over 4 percent to 25.70 rand -- the highest climber among blue chips.

FirstRand ended 2.6 percent higher at 19.81 rand as Goldman Sachs raised its target price for the stock to 24.50 rand from 24.10 rand, while keeping a neutral rating.

FirstRand, South Africa's second-largest bank, has a dividend yield of around 4.2 percent, putting it in the top third of the Top-40 index. Its price-to-earnings ratio currently stands at 8 times, making it one of the cheapest stocks on the index.

Most miners were buoyed by the positive sentiment but gold producers bucked the trend to fall more than 1 percent as previously risk-averse investors dumped the safe-haven sector.

Johannesburg-listed shares of top global miner BHP Billiton were up 3.5 percent to 220.66 rand.

Retailer Pick N Pay slid nearly 3 percent to 35.60 rand after issuing a profit warning that its first-half performance would likely fall by as much as 45 percent, due to the start-up costs for its newly-launched shopper reward programme and investments in its distribution system.

A total of 137 shares advanced while 135 declined and 73 were unchanged. Total traded volume was 194.6 million shares, according to the latest exchange data available at 1526 GMT, from 295.9 million in the previous session.

© Copyright Thomson Reuters 2024. All rights reserved.