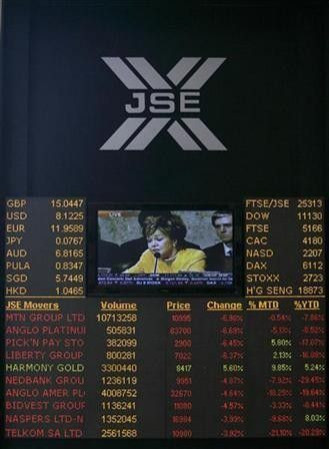

S.African stocks fall for 2nd day led by miners

South African stocks ended sharply lower on Tuesday, extending the decline to two days as investors worldwide offloaded risky assets after Greece's shock move to hold a referendum on a rescue deal.

Miners featured on the losers' list, as data showing both the U.S. and China's manufacturing growth grew slower than expected added to the sell-off on metal prices.

African Rainbow Minerals gave up 4.63 percent to 174.93 rand, Impala Platinum lost 4.61 percent to 175.01 rand and Anglo Platinum retreated 3.21 percent to 556 rand.

Doubts began creeping in on Greece's ability to head off a default after the debt-laden European country called a referendum on the 130 billion euro bailout plan, traders said.

It was never going to be smooth sailing. You're never going to be able to sort out an eight year old problem in eight days, said Nilan Morar, head of trading at Global Trader.

The other thing is, if we get through Greece problems, what about Italy and the rest of the guys?

The JSE Top-40 blue-chip index dropped 2.23 percent to 28,372.84 and the broader All-share index fell 1.93 percent to 31,724.22.

Other decliners included Allied Technologies, falling 1.88 percent to 51.70 rand, after a source told Reuters that the technology firm is plotting an up to $60 million takeover of Kenyan IT firm Symphony.

On the flipside, AVI Limited rose 1.40 percent to 36.10 rand after the consumer food maker said quarterly sales rose almost 11 percent.

Retailers also inched higher after data showed that the South African jobless rate eased in the third quarter. Shoprite added 0.56 percent to 116.96 rand and Massmart gained by the same margin to 159.69 rand.

© Copyright Thomson Reuters {{Year}}. All rights reserved.