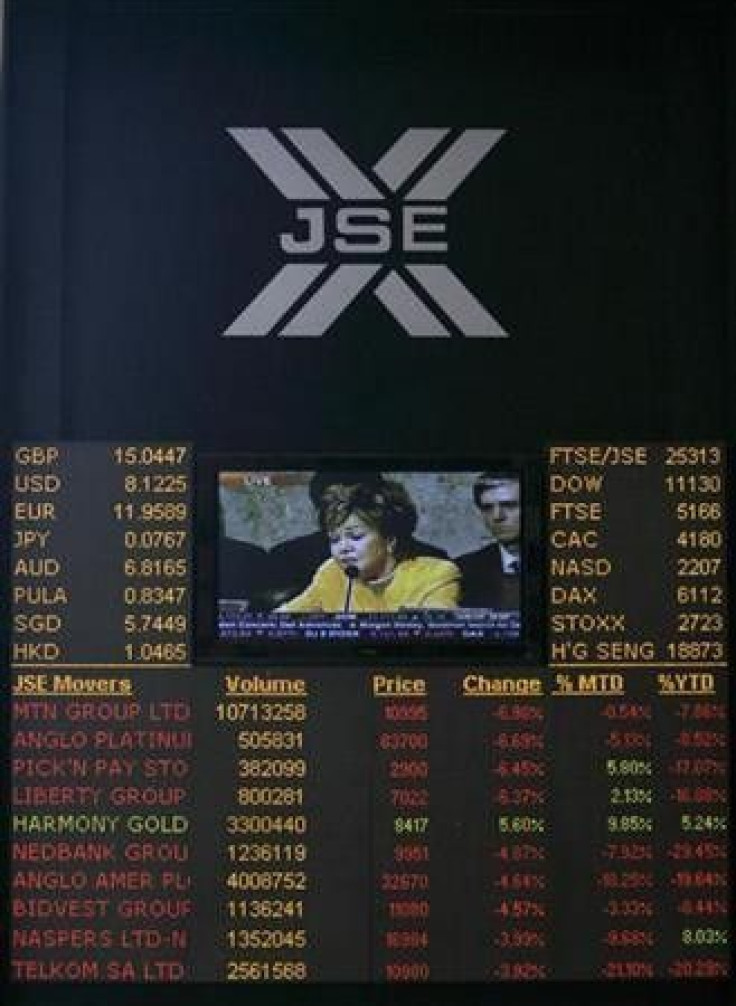

S.African stocks rebound, gold miners rise

South African stocks rose to their highest level in more than six weeks on Tuesday, bouncing back from the previous session's decline, with gold miners among the top gainers as the domestic currency falters and bullion prices cruise higher.

Grindrod also featured on the gainers' list after Africa's top shipping company said it would sell a stake to Remgro in exchange for a 2 billion randcapital injection.

The JSE Top-40 blue-chip index was up 1.41 percent at 28,043.66, a level last seen on August1, 2011. The broader All-share index added 1.24 percent to 31,343.9.

Volumes were low as some investors stayed on the sidelines ahead of the U.S. central banking meeting, which some expect will result in additional measures to boost the flagging U.S. economy.

We have a very weak rand and that is supporting the market on the resource side of things, which is largely keeping our market up, said Michael Carlsson, a trader at Consilium Capital.

Although the rand currency recovered some lost ground during the session, it was still largely at weakened levels.

There are still concerns out there but the market is expecting something positive to come out of the Fed's meeting.

Gold miners were among the top gainers, tracking higher bullion prices and weaker rand, with Gold Fields up 1.85 percent at 135 rand and rival Harmony up 1.39 percent at 101.39 rand.

Grindrod rallied 4.28 percent to 15.58 rand after the company said it would sell 133 million shares, or a 22 percent stake, at 15 rand each to investment group Remgro to help fund an expansion project.

Remgro inched down 0.18 percent at 114.10 rand.

A total of 170 million shares, worth 97 billion rand changed hands, according to Reuters data, compared with 380 million the previous session.

© Copyright Thomson Reuters 2024. All rights reserved.