In The Shadow Of Ivanpah, Another Federally-Backed Solar Thermal Power Plant Gears Up

A shimmery new solar thermal power plant has risen in the Nevada desert, where it stands primed and nearly ready to pump power to as many as 75,000 homes at a time, beginning in mid-March. But the new plant will open just as some say an even larger federal investment in a giant solar thermal facility that was dedicated exactly one year ago, on Feb. 14, 2014, is failing to pay off.

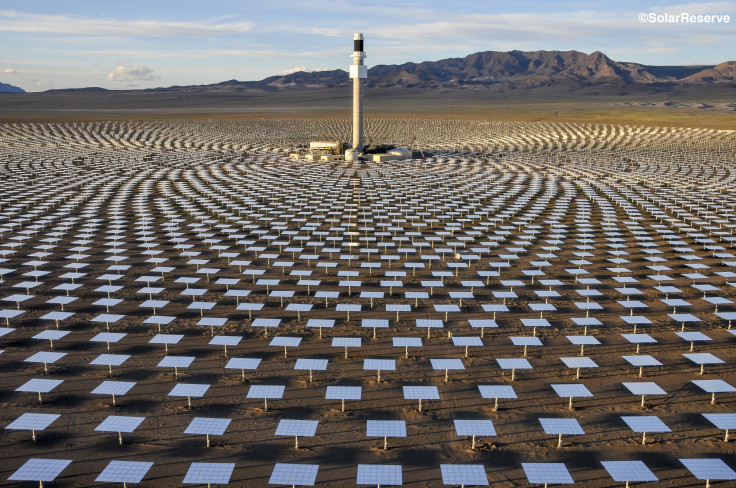

The new plant, known as the Crescent Dunes Solar Energy Project, looks very similar to its predecessor -- the Ivanpah Solar Electric Generating System in the desert of Southern California -- at least on the surface. Both facilities use fields of mirrors to reflect rays of sun at towers. The basic mechanics of each are the same: Heat from those rays is transferred to water and then made into steam, which spins turbines to generate electricity. Both plants also received hefty loan guarantees from the U.S. Energy Department, $737 million for Crescent Dunes and $1.6 billion for Ivanpah.

However, the operators of the Ivanpah plant have experienced a series of setbacks since opening, while the owners of the Crescent Dunes plant swear their prospects of success are far greater.

The $2.2 billion Ivanpah plant promised to deliver a million megawatt-hours of clean energy to customers, but generated just 411,000 megawatt-hours of electricity over the past year, according to Jeff Holland, communications director for NRG Energy Inc., a co-owner of the plant.

The owners of Ivanpah -- NRG, Google Inc. and BrightSource Energy Inc. -- have blamed cloudy weather for the plant’s poor performance and reminded the public their goals were for “mature year performance,” which they expect to reach in 2018. Last fall, they asked the federal government for a $539 million grant, dubbed a “bailout” by its critics, to repay part of their loan.

Sam Shelton, director of the Strategic Energy Institute at the Georgia Institute of Technology, says the plant posted lackluster results even when the sun did shine. “They were expecting what we call a load factor where, on average, the plant would convert about 25 to 30 percent of the available sun into electricity, which is an aggressive number, and they’re hitting less than half that,” he says.

With the Ivanpah plant still in its infancy, the Crescent Dunes plant will come online in mid-March. It is expected to operate at full capacity within months -- putting out 500,000 megawatt-hours of electricity per year. The owners say their ability to not just generate energy but also store it will enable them to provide a steady stream of electricity no matter what the weather, thus setting them apart from Ivanpah’s operators.

That’s because the tower at the Crescent Dunes plant will hold a mixture of molten salt instead of water, unlike the Ivanpah plant. This salt mixture can retain heat over time and be pumped into a storage tank to serve as a reservoir during nighttime or on cloudy days. “Our technology has always been focused on the storage aspect of solar thermal,” says Kevin Smith, CEO of SolarReserve LLC, which is building the plant. “Some of the [solar thermal plants] that don’t have storage are probably never going to get replicated.”

Smith says the storage tanks of heated molten salt at his plant can hold as much as a day’s worth of the sun’s energy at any given time, and provide about a 10-hour supply of electricity. This capability should allow the plant to generate excess electricity during times of peak sun and parcel it out as needed to ensure a comparatively reliable system.

“I think the molten salt energy storage system definitely differentiates it from Ivanpah and offers a technology advantage to eliminate the intermittency of the solar energy,” says Mark Barineau, a solar-energy analyst for Lux Research Inc. “There’s a lot of value in that, and the increased dispatchabilty of clean energy will be a large selling point moving forward for that technology.”

BrightSource, a co-owner and the developer of Ivanpah, appeared to admit that storing energy is a critical component of any solar thermal plant even before the turbine at the Ivanpah plant had completed its first rotation. “Changing dynamics in the California energy markets point to the need for more flexible resources, such as concentrating solar thermal power with storage,” the company said in April 2013 while suspending a project in California, as reported by Greentech Media.

Even with the ability to store energy, though, the Crescent Dunes plant will still run out of power after a few cloudy days in a row. And since NRG’s Holland estimates that the region around Ivanpah received 9 percent less sunlight than normal last year, with a deficit as great as 23 percent throughout July, that could still be a problem. Smith says the plant should perform better than Ivanpah, but how much better?

“Seeing the two, in a similar region, and comparing performance, will be enlightening as we move forward,” Barineau says. “We will have a clearer picture of those large-scale solar thermal plants over the next couple of years.”

No matter what the result, Barineau suspects the heyday of utility-scale solar thermal plants may have already passed. “I think you’re not going to see much utility-scale solar thermal in the U.S. in the next few years, at least,” he says. “I think overall solar thermal is not a dead technology -- I just think it’s going to have different applications and move away from utility-scale.”

Barineau says he still sees potential in the small-scale use of solar thermal technologies, such as generating steam for industrial processes, but doubts another giant plant will be built.

Meanwhile, the clock on any solar project is ticking -- a federal tax credit that covers 30 percent of a company’s cost of construction for a new solar facility is set to expire in 2016. Combined with the relatively weak performance of Ivanpah, this deadline may discourage investors and developers from pushing for another solar thermal power plant on U.S. soil.

That’s not to say that a strong performance at Crescent Dunes couldn’t pique their interest again, though. Smith and his team at SolarReserve are already moving forward with additional plants in Chile and South Africa, and they remain confident that solar thermal will see a resurgence in the U.S., as well.

“The only thing that could save it to any extent now is if Crescent Dunes came online and performed very well,” the Strategic Energy Institute’s Shelton says. “That would be the savior.”

© Copyright IBTimes 2024. All rights reserved.