South Korea raises rates as focus shifts from hot money to inflation

The Bank of Korea raised a key policy rate by 25 basis points as the central bank's focus shifted from unchecked inflows of foreign funds to rising inflation.

South Korea's central bank held key interest rates steady in October as hot money inflows threatened to swamp the financial markets of the region.

The central bank, which had slashed rates by 325 basis points since the start of the global crisis, had returned to policy tightening in July when it raised the benchmark seven-day repurchase agreement rate to 2.25 percent a from a record low of 2 percent.

Consumer and producer inflation in the country raced to a two-year highs in October while consumer inflation rate breached the Bank of Korea's 2-4 percent target range.

The move was widely expected as South Korea was seen lagging other major Asia-Pacific economies like India and Australia which have tightened policy further.

In a Reuters poll, eleven of fourteen analysts had forecast a 25 basis point rise while a majority have seen chances of another rate rise early next year.

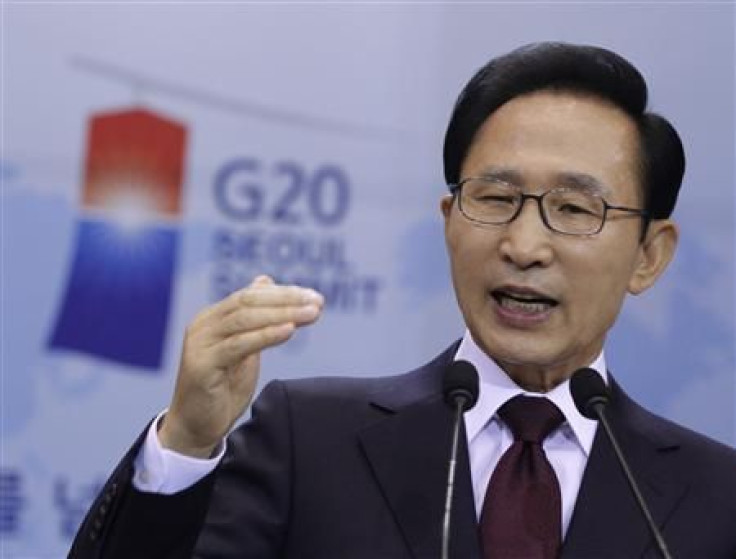

The G-20 summit in Seoul last week endorsed emerging Asian countries' worries over the influx of hot money, and Asia’s fourth largest economy is going ahead with new measures to curb volatility in cross-border capital inflows.

Traders believe South Korea has intervened repeatedly in the currency markets to rein in the won in recent times. The strength of the won, which has risen more than 14 percent against the U.S. dollar since May this year, has been a concern for the exporters.

Analysts' expectations of a further rate hike by the central bank early next year hinge on the strong performance of the economy.

The International Monetary Fund (IMF) recently upgraded its 2010 GDP forecast for the country to 6.1 percent from 5.75 percent, though GDP growth slowed in the third quarter to 0.7 percent from 1.4 percent in the previous quarter, as exports fell drastically in the wake of cooling global growth.

A marked reduction of exports to China in September to an 11-month low weighed on third-quarter growth figures. However the won, which had risen sharply this year has more or less stabilized, and this adds to positive sentiment over stronger exports and GDP growth going forward.

© Copyright IBTimes 2024. All rights reserved.