Sports TV Ratings Are 'Flatlining' As Costs Keep Going Up, Spelling Trouble For ESPN, Fox Sports And CBS

We have reached a peak in sports, and the biggest broadcasters on the field could see profits shrink considerably as they pay off ever more expensive packages. Research highlighted by Bloomberg finds that ratings are “flatlining” across North American sports, just as costs for the right to air live broadcasts of the games continue to go up and increasing numbers of people abandon their cable packages.

“Everyone thought sports rights were the holy grail,” BTIG Research analyst Brandon Ross told Bloomberg. “But if your revenues are not as high as you expected and you’ve signed long-term, high-priced agreements, that makes things tough.”

Broadcasts of live sporting events remain an unmatched opportunity in television. The NFL, for instance, has crushed everything in the ratings department for most of the past decade. And while Major League Baseball no longer draws huge ratings at a national level, regional sports networks like Comcast SportsNet New England dominate ratings in their markets during baseball season. Meanwhile, the NBA’s regular-season ratings may be up-and-down, but its lengthy postseason draws lots of viewers: An average of more than 19 million people tuned in to each game of the 2015 NBA Finals. This unparalleled ability to attract audiences is expected to push the already high price for sports rights up about 10 percent a year for the next several years.

But the reality is, in an era of cord-cutting and increasing choices for on-demand content, sports programming alone is not enough to get people to hold on to their cable packages. ESPN has lost more than 7 percent of its subscriber base since 2011, and virtually every single sports-centric cable channel has experienced similar declines over the past few years as more and more people cut the cord, either in favor of skinny bundles like Dish Network’s Sling TV or a smattering of on-demand options like Hulu and Netflix.

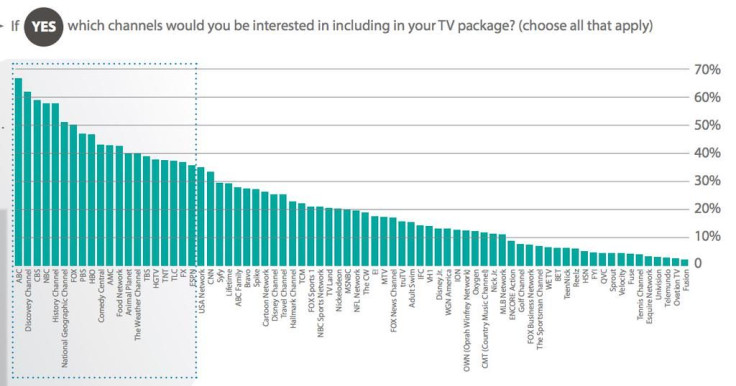

Those bundles might not be enough to retain subscribers, either. According to research conducted by Variety, fewer than 25 percent of people would want sports-centric channels like Fox Sports 1 or NBC Sports Network to be part of a paid package of TV channels.

If these trends continue, an ugly start to the year could get still bleaker for these channels' parent companies, which have been struggling to contain advertising losses as ratings continue to drop. Since the start of 2015, CBS’ stock is down 20 percent, to $44.14. Disney, which owns ESPN, has seen its shares up more than 6 percent, to $99.98. Shares of 21st Century Fox, Fox Sports’ parent company, have slid nearly 29 percent this year, to $26.79.

© Copyright IBTimes 2024. All rights reserved.