Thanksgiving 2013 Deep Discounting Is Myth Among Retailers, As Black Friday & Cyber Monday Show Little Broad Promotional Pricing: Report

Deep storewide discounts on Black Friday and Cyber Monday may be a popular myth propagated by big U.S. retailers, according to detailed pricing data from specialist price tracker 360pi.

The Ottawa company, which makes software to monitor retail pricing, watched more than 8,000 Amazon products in eight popular categories, like video games, televisions and tablets, tracking prices over the recent holiday season.

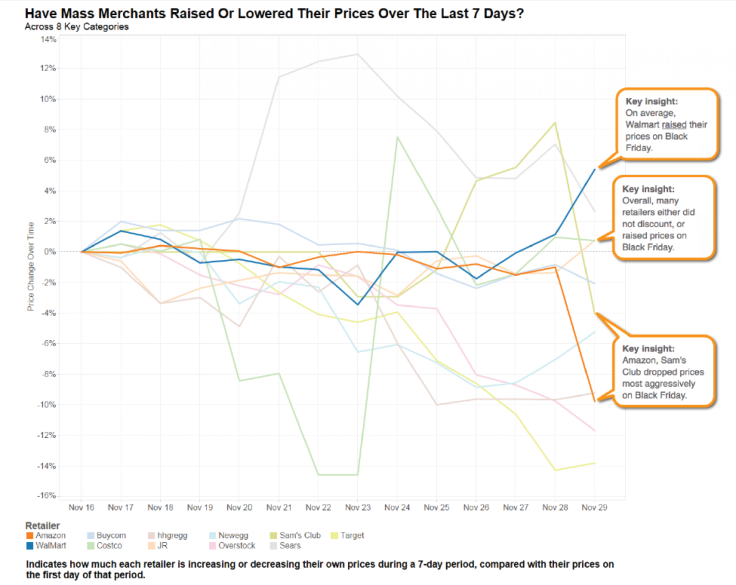

360pi found that the world’s biggest retailer Wal-Mart Stores, Inc. (NYSE:WMT) actually raised its average prices across these categories by about 5 percent on Black Friday, and increased prices steadily in the days leading up to the anticipated shopping event.

“360pi observed some interesting pricing strategies on Black Friday and Cyber Monday,” a spokeswoman said in an email to International Business Times. These strategies “point to the idea that Black Friday deep discounts could be a myth, with only a few retailers dropping prices on only a few categories.”

A majority of retailers didn’t lower prices or even raised prices slightly on Black Friday itself, the research found.

Retailers also often hike initial prices higher, to net similar profits when an apparent percentage discount is offered. That leaves shoppers paying pretty much the same as they have years ago, despite apparent promotions, the Wall Street Journal reported.

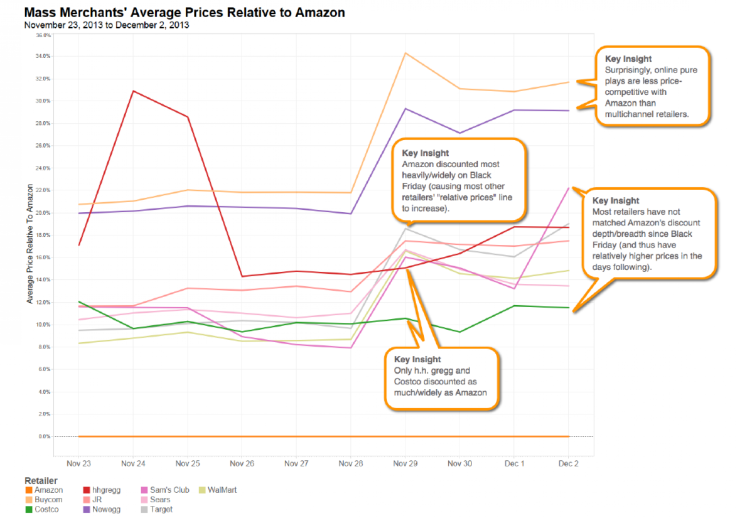

360pi’s data is benchmarked to Amazon.com, Inc’s (NASDAQ:AMZN) products, so it doesn’t cover all products or prices offered by all major retailers. But it examines a telling cross section of popular products, including major items like Apple Inc.’s (NASDAQ:APPL) iPads.

“With the exception of Amazon, largely prices stayed constant the week of Black Friday and into Black Friday,” Jenn Markey, a 360pi marketing vice president, said. “In certain cases, some retailers, including Wal-Mart, actually increased their prices.”

She added, “Amazon on Black Friday changed prices on a third of their assortment on that day alone. By comparison, most other retailers didn’t even change 10 percent of their pricing.”

Notably, Wal-Mart unit Sam’s Club, a discount warehouse, was one of the few significant discounters on Black Friday, alongside Amazon. Earlier 360pi research showed that brick-and-mortar retailers beat Amazon’s prices, on Amazon’s own selected products, one-fifth of the time this holiday season.

“It’s surprising to discover that other retailers were winning on Amazon’s own turf 20 percent of the time,” Markey said, referring to the earlier research. “You’d figure they’d be higher, that’s really Amazon’s game. These are the products they’ve chosen to cover.”

Surprisingly, purely online retailers like Buy.com Inc. and Newegg Inc. kept higher price tags for many items, compared to traditional retailers, on Cyber Monday, for these products.

“It’s clear that in this holiday season the traditional retailers are sharpening their pencils and trying to become more competitive,” relative to Amazon and other e-commerce players, Markey said.

Target Corp. (NYSE:TGT) scored well on pricing, as the mass merchant with the most-significant price cuts for this product range, compared to its prices from two weeks before Black Friday.

In contrast, Wal-Mart has picked some key items and categories where it has adopted very aggressive discounts, Barclays PLC (LON:BARC) retail analyst Meredith Adler said at a New York retail panel on Nov. 25.

“For most of the past year, what other retailers were saying about Wal-Mart was that they were getting louder,” she continued. “They were being more visible generally, but the absolute price pint was not particularly going down.”

That’s not Wal-Mart’s side of the story, of course. The company offered 200 online specials from Cyber Monday onward and much free shipping, according to a news release. It also scored its best online sales day ever on Cyber Monday 2013, after 22 million shoppers ventured into U.S. Wal-Marts on Black Friday itself.

The company offered to match prices at retail rivals even before Black Friday, a move Adler described as somewhat “nasty,” since other retailers couldn’t react by tweaking prices again.

ShopperTrak retail data showed that sales rose during Thanksgiving weekend 2013, though in-store traffic fell, on a yearly basis. U.S. shoppers spent about $22 billion over four days, data showed.

Retailers may be relying on a few “door crasher” deals, which tempt shoppers into stores, as they hope that consumers don’t recognize the normal pricing elsewhere in the store, especially as Christmas looms, Markey said.

Here are the detailed pricing reports for Black Friday and Cyber Monday.

© Copyright IBTimes 2025. All rights reserved.