Top-Five Investor Concerns Over HP

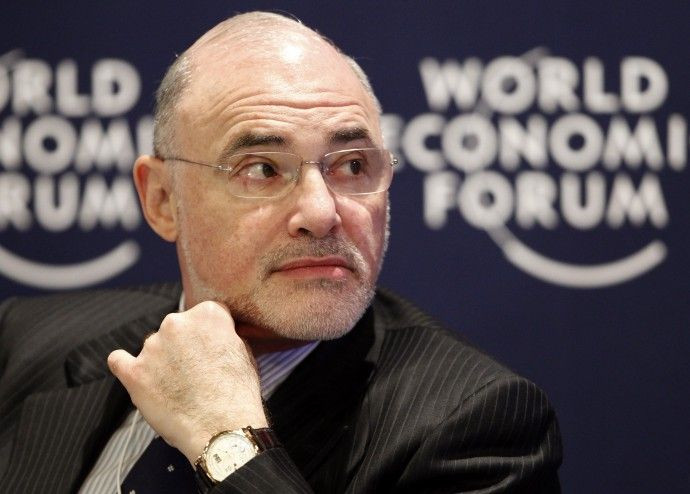

Léo Apotheker, the Chief Executive Officer of PC giant Hewlett-Packard (NYSE: HPQ), is expected to hold an investor briefing on March 14 in San Francisco where he may unveil his much anticipated vision for HP.

Meanwhile, Analyst Amit Daryanani of RBC Capital Markets lists out the five concerns for Apotheker to address. The concerns that HP ought to address are around cost controls and margin dynamics.

In addition, investors will look to understand how HP plans to compete and measure themselves against IBM (NYSE: IBM), Cisco (NASDAQ: CSCO), Oracle (NASDAQ: ORCL) and Dell (NASDAQ: DELL) on enterprise side, and Apple (NASDAQ:AAPL) and the Asian PC manufacturers on the consumer front.

The analyst said he has consistently heard these concerns from investors regarding Hewlett Packard. Following are those concerns:

What Is HP's EPS Potential? Given the multiple concerns around HP, the analyst said investors are trying to gauge what is HP's true earnings power.

We are uncertain if Mr. Apotheker will provide a roadmap for EPS growth, given he has been at the job for more than 100 days and HP has historically provided annual guide during their Sept analyst day, Daryanani wrote in a note to clients.

Nonetheless, the detailed analysis of all the levers suggests HP has the ability to provide visibility into $6.00 EPS in fiscal 2012 and sustain 15 percent plus EPS growth to fiscal 2015, implying EPS of more than $9.00.

Commitment to Cost Control: A hallmark of HP for several years has been an unwavering focus on cost control, which has resulted in impressive consistency in margins and EPS. There is concern that a new CEO could result in HP retreating from this paradigm.

While some of this may be positive, such as increasing R&D, a bloated selling, general and administrative line would make investors nervous. Investors need clarity on the magnitude of increased spending and where these dollars will be focused from a multi-year perspective.

Strategic Value of PCs: Daryanani noted that investors have started debating if PCs are a strategic asset. Concerns center on growing prominence of multiple portable devices that could cannibalize PCs along with competition from Asian vendors that could pressure margins.

Investors will seek clarity if PCs are perceived as strategic assets and balance between advantages of supply-chain scale that PCs provide and increased volatility added to the portfolio.

Software Acquisitions: While HP has made few software acquisitions, software still accounts for only about 3 percent of revenues compared to IBM at 20 percent and Oracle at 65 percent.

Given Mr. Apotheker's background in software, there is an expectation that we could see material uptick in software deals, the analyst said.

Meanwhile Investors will look for clarity around nature and segments of software deals, valuation discipline around deals and targeted revenues from software.

Competitive Dynamics on Multiple Fronts: HP is facing competition on multiple fronts. On consumer side, there is competition from Apple, Dell, Lenovo etc. and on enterprise side, with growing focus on convergence historical allies have become competitors.

Daryanani believes that investors would like to understand 1) who does Apotheker perceive as key competitors, 2) can HP successfully compete with Apple and others on consumer front and 3) while simultaneously competing with IBM and others on the enterprise front.

© Copyright IBTimes 2025. All rights reserved.