Treasury Default Could Crash US, Global Economy: Bank Analyst Richard Bove, Leading To A Depression Lasting Decades

A default by the U.S. government would collapse the global economy, plunging the world into a depression so severe it would take decades to recover, Richard Bove of Rafferty Capital Markets LLC, warned Thursday.

“God spare us from the fools who lead us,” Bove, one of the most influential bank analysts in the United States, wrote in a note to clients about prospects that Congress may not raise the debt ceiling on Oct. 17 and, thus, force the nation to default on its sovereign debt.

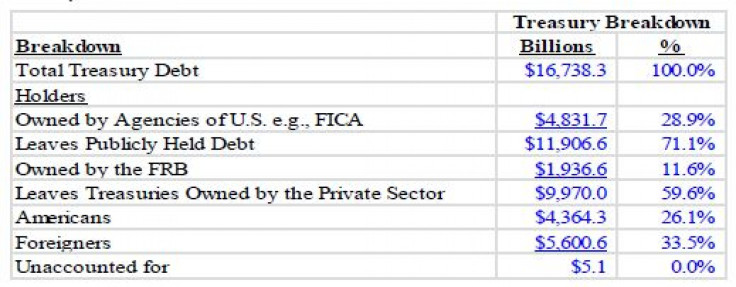

His warning stems from an analysis of U.S. Treasury debt, nominally at $16.74 trillion. However, that figure does not include $7.6 trillion in debt and guarantees of government-sponsored enterprises like Fannie Mae and Freddie Mac.

Because the Social Security fund and other government agencies and pension funds are, taken together, the largest holders of Treasury debt, at 29 percent, a default would hurt everyone on Social Security and those who are on government-backed pensions.

Besides the 29 percent held by Social Security and other government agencies and pension funds, the Federal Reserve holds 11.6 percent of the total $16.74 trillion debt. Because Treasurys amount to 54.5 percent of the Fed’s balance sheet, a default could wipe out the central bank’s equity.

Add to that 54.5 percent, the Fed’s agency and mortgage-backed securities and the total amount the Fed owns that is guaranteed by the Treasury rises to 91.1 percent.

A default could wipe out the Fed’s equity and raises “the question of what is behind the value of the dollar,” Bove wrote.

Besides destroying Social Security and other government-guaranteed pensions and wiping out the Fed’s equity, the knock-on effect of a default would not be limited to the United States.

“The devastation to the United States would be so severe that it would take decades to recover from the Depression caused by a default and the attendant dumping of trillions of dollars of U.S. Treasury securities on the global financial markets,” Bove wrote.

“What is not theoretical is that the discussion of the possibility that the U.S. would actually default has a real impact on every country in the world that holds Treasurys. It tells them as clear as can be that they are at risk. The reserves in their central banks are not based on a nation with a stable and secure economy. The value of their reserves is based on an erratic and politically charged government that may destabilize their central banks and they cannot stop it.”

Bove says his outlook may actually understate the risks of a default.

"Please be aware that the numbers in this comment grossly understate the actual obligations of the United States government. For example, the GSE debt and guarantees is believed to equal $7.6 trillion on top of the $16.7 trillion the U.S. owes. Moreover, there is no number provided for all of the debt guaranteed by the U.S. outside the mortgage sector. It is also in the trillions. God spare us from the fools who lead us."

© Copyright IBTimes 2024. All rights reserved.