Ukraine's Post-Civil Crisis Financial Position In 5 Simple Charts

Analysts at UBS, the Swiss banking giant, on Monday post a research report on the precarious position Ukraine now finds itself in after civil unrest has led the president to flee.

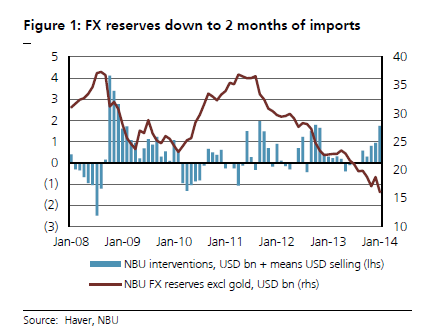

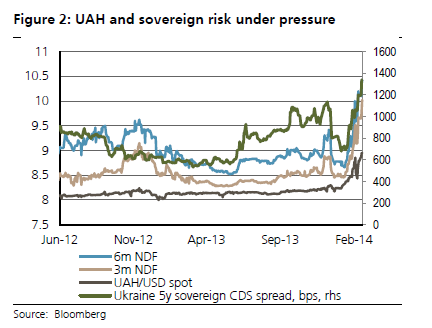

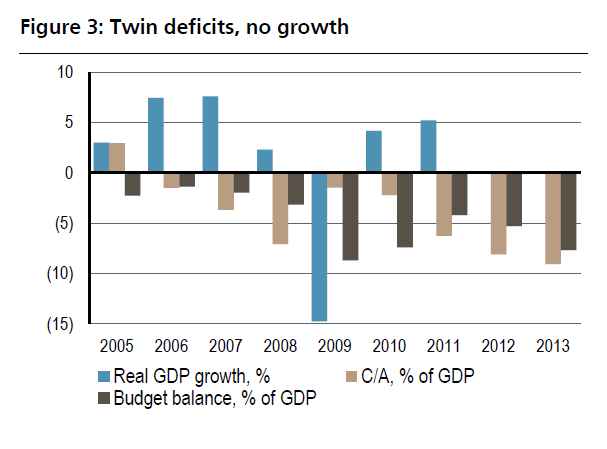

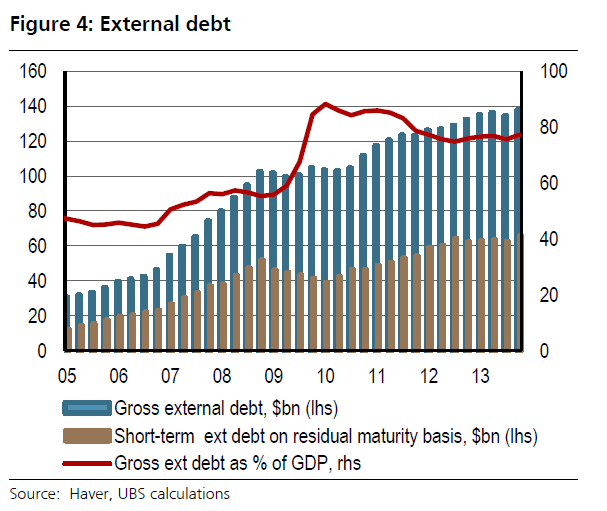

"Public unrest and a more violent escalation of Ukraine's political crisis have again called into question the sustainability of Ukraine's external funding position, and thus even the short-term reduction in the country risk premium after the December deal with Russia proved fleeting," the analysts concluded.

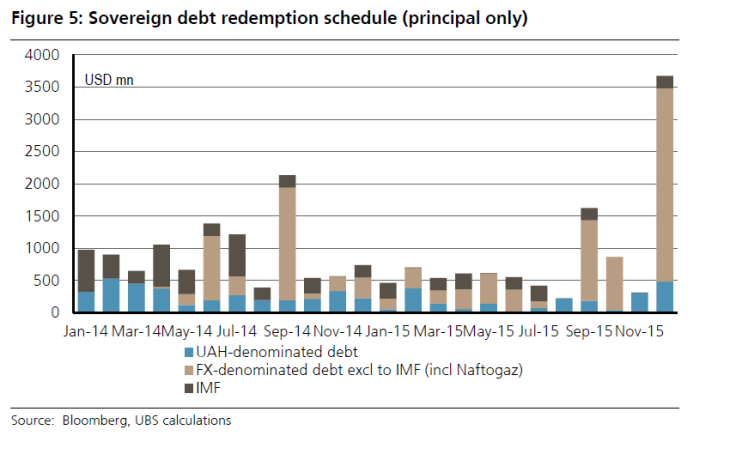

"The longer the political turmoil persists, the higher the risk that the worst case scenario of a full-blown balance of payments and sovereign debt crisis materialises" they said, adding that, "We think that even if a solution is reached, most scenarios would still involve a lot of uncertainty over 2014-15 – and thus keep the sovereign risk premium volatile and business conditions highly uncertain."

The following five charts highlight the difficulties the nation faces over the short term.

© Copyright IBTimes 2025. All rights reserved.

Join the Discussion