US Car Buyers Love Pickup Trucks, But Less Than They Used To; To Combat The Trend, GM And Ford Are Focusing On Luxury Add Ons

Go to any North American auto show and you’ll find the pickup truck pavilions of the Detroit 3 crowded with more choices than a grocery store cereal aisle. Not surprising, considering America’s deep love affair with these workhorses, but a $40,000-plus full-sized pickup truck is also the most profitable non-luxury vehicle sold by U.S. automakers.

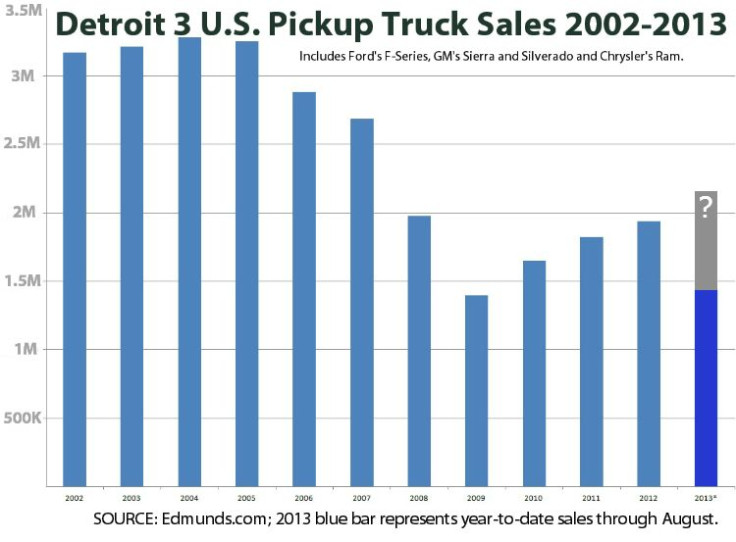

Times are changing, though. Perhaps in part because of stronger pickup truck choices from foreign brands, or because vehicles are lasting longer than they ever have, or because more Americans are living in cities, or a combination of all of these, the number of GM, Ford and Chrysler pickup truck sales appears to be declining even if sales are rebounding from the 2009 auto industry crisis.

As of the end of August, the Detroit 3 automakers were nearly 500,000 units shy of matching 2012 pickup truck sales. They sold a combined 134,545 units of Ford’s F-Series, GMC Sierra, Chevy Silverado and Dodge Ram pickups in September, a typically sluggish month, so it looks like pickup truck sales will break the previous year’s figure for the fourth year in a row.

But in 2002, Americans bought almost 3.2 million of these trucks, according to auto intelligence provider Edmunds.com. If consumers buy 2 million Detroit 3 pickup trucks this year, that’s still more than a million shy of pre-2006 annual sales figures topping 3 million. Between 2005 and the start of the subprime mortgage meltdown that sent the U.S. auto industry into a tailspin in 2008, pickup truck sales were falling. A year before the recession, these truck sales dropped below 2 million.

This isn’t good for the American auto giants. Last month, for example, one out of every four GM vehicles sold in the U.S., the world’s second-largest auto market, was either a Chevy Silverado or a GMC Sierra. Ford’s dependence on its line of pickup trucks is even stronger; in September nearly one in three Ford autos sold in the U.S. was an F-Series. Chrysler depends less on sales of its competing Dodge Ram, but still one in five of its U.S. sales comes from that brand.

This decline in truck sales even before the last recession could be part of a larger down cycle that will rebound in the coming years, but many analysts have said that the increased dependability of new cars means the replacement cycle – when car owners decide they need to replace their clunkers – will take longer to repeat.

Whatever the case may be, Ford Motor Co. (NYSE:F) is trying to maintain its over-three-decade-long lead in U.S. pickup truck sales by introducing still more members of its already crowded F-Series line. It’s unveiling eight – yes, eight – new versions, such as the F-150 Tremor half-ton sport truck. Already consumers have had a lot of F-Series choices: the XLT extended cab, the XL regular cab, the luxury King Ranch and Longhorn editions, the muscle-y Raptor, and even a Harley Davidson model. They currently come with four types of engines, including the efficient 3.5L V6 EcoBoost and the hungry 6.2L V8.

Meanwhile General Motors Co. (NYSE:GM) is taking a more conservative approach by focusing on luxury trim for its two top sellers: The Chevy Silverado will get the “High Country” fix, which starts the truck at $45,000, while the GMC Sierra and Denali trims are being overhauled to include more high-tech options to go after Ford’s luxury trucks. GM also recently announced it was raising the price for its pickups, by $2,100 for the base 2014 Chevy Silverado.

The move comes as GM is about to increase its incentive spending – it already spends more than other automakers encouraging customers to buy its products. Dealers like the rebates because they can be applied to the down payments when customers finance the vehicles – so essentially what GM is adding to the sticker price it’s removing from the incentives.

© Copyright IBTimes 2024. All rights reserved.