US Jobs Report: Hiring In December Expected To Have Weathered Global Storms

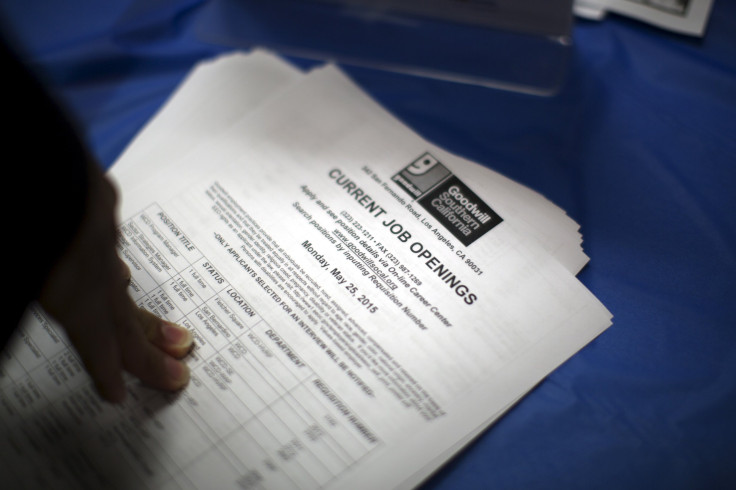

The U.S. jobs report for the month of December, due Friday, is widely expected to show that U.S. employers added a healthy 200,000 jobs and the unemployment rate remained at a record low of 5 percent for a third straight month. A solid report is likely to soothe fears over the impact of turmoil in emerging markets on domestic manufacturing and exports.

“The U.S. economy is a two-sided economy. The domestic sector continues to power job growth. There is a risk that the weakness in manufacturing could spread to services, but we don't see that right now,” Thomas Costerg, a senior economist at Standard Chartered Bank in New York, told Reuters.

Most analysts now expect that solid U.S. consumer spending will offset weakness overseas, especially in China. Strong domestic demand has given most American businesses the confidence to step up hiring even though some sectors — most notably manufacturing, and oil and gas drilling — continue to struggle.

As a result, employment gains in December are expected to remain concentrated in the services sector.

U.S. manufacturers, which added just 17,000 jobs last year through November — their worst performance since the recession ended in 2009 — are expected to continue their poor performance in December. Same is expected from the mining sector, which lost 124,000 jobs last year, about 14 percent of its total.

While a strong labor market would count in favor of another interest rate hike by the U.S. Federal Reserve in March, concerns over low inflation and the near-term adverse impact on exports is likely to weigh on the minds of policymakers seeking to do so.

In November 2015, exports fell to their lowest levels since 2012, as falling commodity prices and slowdowns in major economies such as China and Brazil, coupled with a strong dollar, hurt businesses.

“A stronger dollar means better terms of trade for U.S. consumers and businesses, which is a positive for a growing economy in the longer run,” Cleveland Fed President Loretta Mester reportedly said, during a speech earlier this week. “But in the near term, slower growth in our trading partners and the dollar appreciation are drags on U.S. export growth, and I expect net exports to be a negative influence on real GDP growth for somewhat longer.”

While low gas and oil prices may have had an adverse impact on several companies, it is believed to have helped consumers by cutting their gas bills. Additionally, if employers continue to hire steadily and raise wages — another aspect that would be closely watched in the report, which will be released at 8:30 a.m. EST Friday — consumers can be expected to keep spending and supporting U.S. economic growth despite the prevailing turmoil in global markets.

“The most important development in 2016 will be an acceleration in wage growth towards the 3 percent mark. If wages pick up, the hurdle for the Fed pausing or halting the policy normalization process would be raised,” Michelle Girard, chief economist at RBS in Stamford, Connecticut, told Reuters.

© Copyright IBTimes 2024. All rights reserved.