US Risks Losing Status As World’s Top Exporter Of Corn Due To The Ethanol Mandate

The United States, the world's longstanding top corn exporter, is slipping. And fast.

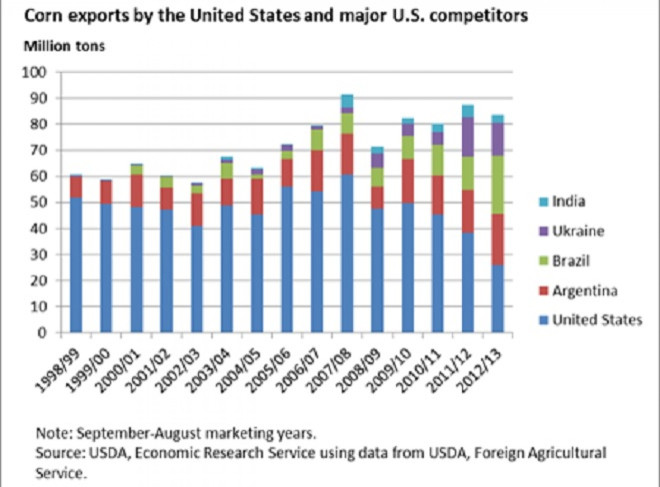

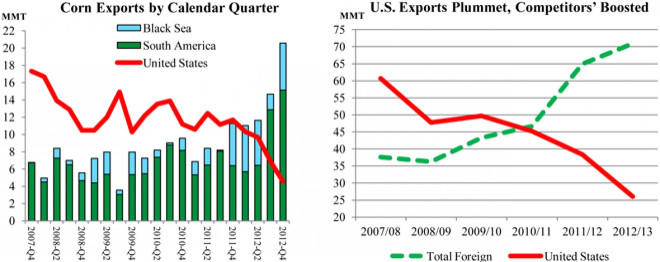

Commanding 60 percent of the global market five years ago, the U.S. now sells less than 30 percent of the corn on the international market. Exports by major competitors have gained increasing shares of the world market since the mid-2000s.

American corn exports for the year are poised to drop to the lowest level in over 40 years, falling below wheat exports, according to the Department of Agriculture.

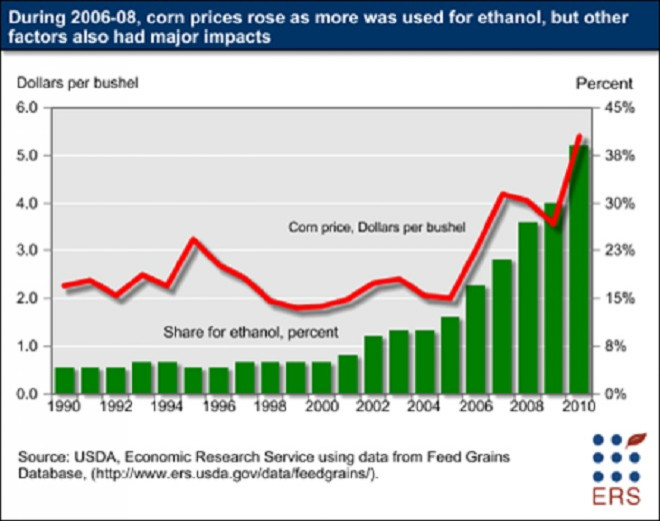

The decline in U.S. corn market share has correlated with the increased use of corn to produce ethanol in the U.S.

Relatively strong corn prices have sparked more production in competitor countries. Twelve years ago, Argentina was the only other major corn exporter, but now Brazil, Ukraine and India have joined the race.

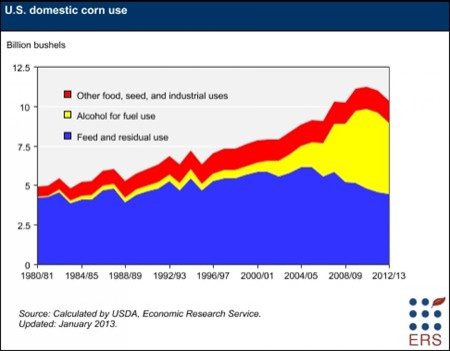

Since 2005, the U.S. government has mandated that gasoline contain ethanol, almost all of it derived from corn. The policy is aimed at reducing the country’s dependence on foreign oil and at improving the environment. Corn acreage soared by a fourth after Congress passed the Energy Independence and Security Act of 2007, which required that gasoline producers blend 15 billion gallons of ethanol into the nation’s gasoline supply by 2015.

The Environmental Protection Agency on Jan. 31 proposed a 9 percent increase in the so-called renewable fuels standard from 2012, in line with a 2007 law. Half of the 1.35 billion-gallon increase would go to corn ethanol and half to "advanced" biofuels that produce half the greenhouse gases of first-generation ethanol.

Last fall, the administration denied a request from several governors from livestock and oil-producing states for a partial or total waiver of the requirement to use ethanol.

The corn ethanol mandate, which creates demand for 40 percent of the U.S. corn crop, makes American corn less competitive on the global market because increased domestic demand drives up the price at home. And last year’s drought, the worst in more than 50 years, only made things worse as ethanol makers, livestock producers and grain exporters competed for a smaller supply.

Drought-reduced production drove up U.S. prices at the same time that key competitors had record or near-record supplies. While U.S. corn exports dropped to the lowest level in at least two decades, South American shipments, Brazilian in particular, have tripled.

In contrast to the slow pace of U.S. corn exports, Brazil has been exporting at a record pace, approaching 4 million tons per month in the final months of 2012. While Brazil’s corn exports will slow as its soybean harvest and exports ramp up, corn exports are likely to pick up again after June 2013 as second-crop corn gets harvested.

Meanwhile, Argentina’s corn exports are expected to increase, with the corn harvest starting in March.

Forecasting a harvest of at least 26 million tons, Argentina’s Agriculture Secretary Lorenzo Basso told Reuters last month the country will approve at least 3 million tons more in 2012-13 corn exports.

The government in Argentina - the world's No. 3 corn exporter - controls wheat and corn exports through a quota system designed to guarantee ample and affordable local food supplies.

Meanwhile, Black Sea (mostly Ukrainian) corn has been competitively priced, making its way to traditional U.S. markets such as South Korea and Japan.

Tight U.S. corn supplies are reflected in high prices that limit export sales.

As of Jan. 3, U.S. corn outstanding sales were only 6.1 million tons, down 42 percent from the previous year. Moreover, the pace of corn export shipments in the early months of 2012-13 has been very slow, with Census export data for October and November (3.2 million tons) showing exports at less than half the previous year’s pace. Moreover, grain inspections put corn exports for December at less than 1.3 million tons, down more than 70 percent from a year ago.

© Copyright IBTimes 2025. All rights reserved.