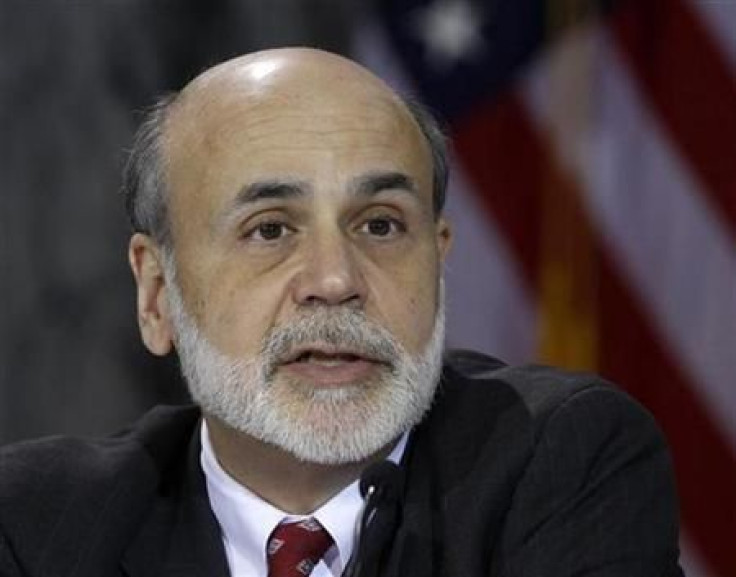

We see evidence of “self-sustaining recovery”: Bernanke

“We have seen increased evidence that a self-sustaining recovery in consumer and business spending may be taking hold,” said Federal Reserve Chairman Ben Bernanke in a testimony to Congress.

The phrase “self-sustaining recovery” is key. Previously, as Bernanke acknowledged in the testimony, the US economy has largely expanded because of government support and businesses rebuilding their inventories. In other words, it’s not a sustainable recovery driven by genuine private sector demand.

However, now, consumer spending is growing at a “solid pace” and business investment in new equipment and software has continued to expand, said Bernanke.

Meanwhile, global demand continues to support the US manufacturing sector.

The chairman credits rising consumer and business confidence, accommodative monetary policy (i.e. his program of quantitative easing, aka QE2), and better lending conditions to the strength of the economy in 2011.

In response to the better conditions, the Federal Reserve raised its projection for real GDP growth for 2011 to 3.5 to 4 percent, which is 0.5 percentage points higher its previous estimate.

© Copyright IBTimes 2024. All rights reserved.